The Impact of Transitional Climate Risks on Exports: Empirical Evidence from Russian Regions

[Чтобы прочитать русскую версию статьи, выберите русский в языковом меню сайта.]

Yulia Sokolova — research engineer at the Laboratory of Natural Resources Policy, assistant and postgraduate student at the Department of Economics, Graduate School of Economics and Management of the Ural Federal University named after the First President of Russia B.N. Yeltsin (UrFU).

ORCID: 0000-0002-5991-3061

Scopus Author ID: 58172689100

For citation: Sokolova, Yu., 2024. The Impact of Transitional Climate Risks on Exports: Empirical Evidence from Russian Regions. Contemporary World Economy, Vol. 2, No 1.

Keywords: exports, global energy transition, transitional climate risks, renewable energy, Russian regions.

The research was carried out with the financial support of the Ministry of Science and Higher Education of the Russian Federation under the Development Program of the Ural Federal University named after the First President of Russia B.N. Yeltsin in accordance with the Strategic Academic Leadership Program “Priority-2030.”

Abstract

In the face of the government’s exclusive attention to the issues of export development, the investigation of the determinants of export operations of Russian regions comes to the forefront. Exporting companies face the following limiting factors: technological backwardness, inconsistency of goods quality with international demand, complexity of customs procedures. In the context of the modern climate agenda, there is a new type of economic risks for exporters – transitional climate risks. This group of risks is emerging as a result of states’ intentions to achieve the environmental goals set out in the Paris Agreement and move towards low-carbon development. Transition risks for exporters can appear in the form of trade restrictions, environmental requirements for goods, and the willingness of importing countries to substitute less environmentally friendly exported products. Evaluating the export development of Russian regions in the context of transitional climate risks is a nontrivial task. The global energy transition can generate both risks and opportunities for Russian exports. The purpose of this paper is to model the impact of transitional climate risks on the dynamics of Russian regional exports based on data for the period 2013-2021 using an extended gravity model of international trade. The study has two distinctive features: a comprehensive analysis is conducted, introducing transition risks from three different aspects; regional factors determining the sign of the impact of transitional climate risks on export volumes are identified. The study reveals that the impact of transitional climate risks on the export performance of Russian regions is diverse. Firstly, environmental regulation of trading partners poses risks for many Russian regions, but promotes exports from regions with the most favorable socio-economic conditions for innovation and active regional environmental policies. Secondly, the production of alternative energy sources in partner countries reduces reliance on Russian energy imports, which jeopardizes the sustainability of the economies of regions specializing in the extraction of traditional energy resources. Meanwhile, Russian mineral-rich regions are making a significant contribution to global energy transition trends as suppliers of critical mineral resources and are increasing their exports.

Introduction

Export development represents a critical challenge for the Russian economy. In 2018, the government unveiled the ambitious “International Cooperation and Export” initiative, which aims to significantly boost exports by 2030.1 It is widely acknowledged that the intensification of a country’s export activity is associated with the strengthening of its economic position in the international arena. This is achieved by building long-term relationships and providing unique products to the foreign market. Furthermore, export activity contributes to the growth of the national economy by expanding production, increasing labor productivity, creating new jobs, as well as the inflow and redistribution of budgetary funds and foreign currency [Kadochnikov & Fedyunina 2013; Islam et al. 2022; Fedyunina et al. 2023]. In light of the ongoing economic crisis in Russia, an examination of potential factors influencing export growth in different regions is a crucial area of research.

Exporters and companies in Russia that are planning to enter international markets are confronted with a number of internal and external constraints. The group of internal constraints includes high production costs, technological backwardness, limited assortment, inconsistency of goods quality with international demand, complexity of national customs procedures, ineffective national trade policy, and an unfavorable institutional environment.2 Conversely, the list of external constraints includes the requirements of host markets, trade restrictions, and geopolitical risks [Volchkova 2013; Glazatova and Daniltsev 2020]. The aforementioned factors have been extensively examined in the existing literature, and strategies to overcome them have been partially incorporated into export development strategies.

Additionally, the global climate agenda and the energy transition process can be considered international challenges faced by Russian companies when exporting. Consequently, the intentions of countries to achieve the goals of the Paris Agreement give rise to a novel category of economic risks: transitional climate risks. The primary distinction between transitional climate risks and physical risks is that companies’ financial losses are not a direct consequence of climate change per se, but rather the result of public and private sector initiatives aimed at mitigating these changes.

The relevance of transitional climate risks for exporters, especially those countries that have not adapted to the new low-carbon paradigm, is determined by the following facts. First, export flows may become subject to regulation due to the peculiarities of the GHG accounting system, which does not distinguish between producers and consumers, exporters and importers. Countries tend to shift responsibility to exporters, as they are direct emitters of greenhouse gases [Makarov and Sokolova 2014]. Secondly, the international community holds the view that it is impossible to resolve the issue of global climate change without the involvement of all countries worldwide in the climate agenda, achieved through the comprehensive dissemination of carbon regulation and the unification of standards. In light of the current challenges to establishing a unified global regulatory framework, the most viable approach for activating national climate policies is through the utilization of carbon regulatory instruments in international trade [Nordhaus 2015]. Thirdly, the utilization of trade mechanisms to attain carbon neutrality is also substantiated by the fact that the absence of national climate regulation serves as a means of sustaining competitive advantages in the international market. It is postulated that exporters of states with weak climate regulation do not incur supplementary costs associated with environmental protection and are thus able to maintain prices at a low level [Makarov and Shuranova 2023]. In other words, the phenomenon of “environmental protectionism” or “benevolent protectionism” is becoming increasingly prevalent [Kutyrev et al. 2021; Makarov 2023].

In light of the structure of export supplies and the specific characteristics of national climate regulation, the transitional climate risks facing Russian exporters can be broadly classified into three key components: carbon regulation, the development of alternative energy sources, and the electrification of transportation. Consequently, the implementation of carbon regulation gives rise to the emergence of trade barriers, which impose partial or complete restrictions on export flows. Additionally, the introduction of requirements for Russian products directly impacts the capacity of goods to compete in international markets [Shirov and Kolpakov 2016; Porfir’ev et al. 2020]. The development of renewable energy and the transition to electric vehicles, in turn, affects the demand for Russian traditional energy, which accounts for the majority of the country’s exports [Saenko and Kolpakov 2021; Albert 2021]. Conversely, recent literature indicates that the global energy transition presents novel opportunities for export growth for countries endowed with mineral resources.3 It is well established that the production of renewable energy capacity, including solar panels and wind turbines, is dependent on the availability of rare earth elements and base metals [Elshkaki et al. 2016; Valero et al. 2018; Islam et al. 2022; Islam and Sohag 2023; Andersen et al. 2024; Harpprecht et al. 2024]. Russia plays a pivotal role in the global energy transition, given its status as the leading producer of numerous critical minerals, including cobalt, nickel, lithium, iridium, palladium, platinum, zinc, copper, and uranium. In light of Russia’s substantial resource endowments, a number of regions stand to considerably augment their export revenues [Chupina 2022].

Since the Paris Agreement was signed, the vulnerability of the Russian economy and exports to the global energy transition has begun to emerge. This is due to the significant share of the fuel and energy sector in GDP and the high carbon footprint of exports [Makarov et al. 2020]. However, in the wake of the political upheaval that unfolded in February 2022, there has been a notable intensification of transitional climate risks for the Russian economy. Western states have accelerated their plans to restrict Russia’s carbon-intensive exports and reduce their reliance on Russian energy imports.4

Furthermore, the redirection of export flows from unfriendly to friendly states will not fully mitigate the aforementioned transitional climate risks. Firstly, in states with which Russia has friendly relations, there has been an intensification of climate policy and the introduction of carbon regulation instruments (a case in point being China, Kazakhstan, and Turkey5) [Makarov and Shuranova 2023]. Secondly, the conclusion of export contracts, for example those pertaining to the supply of Russian energy, may prove challenging due to the absence of the requisite infrastructure. Third, the markets of friendly states are relatively limited in capacity, and their solvency may be affected by the imposition of sanctions by Western states. Fourth, the calculation of emissions across the entire value chain will result in direct purchasers of Russian goods demanding a carbon footprint if they are to enter global markets with their products.

In light of the prevailing geopolitical circumstances, the question of how to effectively oversee the export activities of Russian regions, with due consideration for the transitional climate risks, has become a pressing concern. The objective of this study is to examine the impact of various aspects of transitional climate risks on the export volumes of Russian regions using econometric tools. Furthermore, the study seeks to elucidate the regional characteristics that determine the direction of the impact of the global energy transition on export performance.

In order to address the aforementioned objectives, the study considers three groups of variables related to the global energy transition. These are: the stringency of environmental regulation (which can be considered a proxy variable for carbon regulation), alternative energy production, and countries’ readiness for energy transition. Secondly, given that regional characteristics may potentially exert an influence on the impact of the global energy transition on territories, the Russian regions are divided into subsamples based on their mineral endowment, an index of socio-economic conditions for innovation, and an index of the region’s openness to the Green Deal.

To the best of our knowledge, no previous study has examined the intricate relationship between the global energy transition and export performance for Russian regions in sufficient detail. This paper addresses this gap in the literature and contributes to the existing body of knowledge by investigating the relationship between the global energy transition and export performance using the gravity model of international trade and estimating it using the FE PPML method based on data for regions and partner countries for the period 2013-2021. Furthermore, while previous studies have tended to generalize the findings on exports of the Russian economy, this study focuses on the heterogeneity of the impact of transition risks on export volumes by dividing regions into subsamples.

This paper is comprised of four sections. The first section provides an overview of the concept of transitional climate risks. The second section offers an analysis of Russia’s economic and export development in the context of the global energy transition. The third section presents the empirical model utilized in the study. The fourth section analyzes the empirical results obtained. The conclusion follows.

1. Transitional climate risks: classification and impact on foreign economic activity

The concept of climate risk gained prominence on the international stage between 2017 and 2019, largely due to the efforts of the Task Force on Climate-Related Financial Disclosures (TCFD), an initiative spearheaded by the G20.6

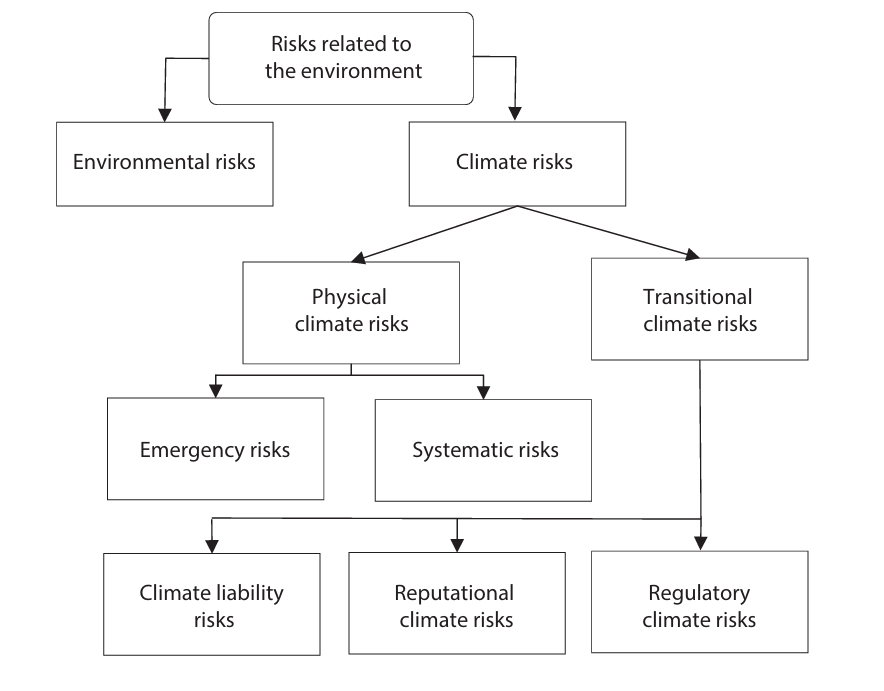

Risks pertaining to the environment are classified into two categories: environmental and climate (see Figure 1). Environmental risks pertain to the consequences of environmental degradation, depletion of natural resources, increased emissions of pollutants, reduction of biodiversity, and inefficient waste management. Climate risks, in contrast, refer to losses resulting from climate change and measures undertaken by states to mitigate its effects.

The conventional presentation of climate risks is in the form of physical climate risks, which may be the consequence of abrupt extreme climate conditions (emergency risks) or gradual alterations in the climate system (systematic risks). A salient characteristic of physical climate risks is their direct impact on the tangible assets of companies and the state, as well as the quality of life of the population [Weezel 2020; Buhaug et al. 2023].

A relatively novel category of climate risks pertains to the financial implications of societal and governmental efforts to mitigate alterations in the Earth’s climate system. These risks may manifest in various ways, including lawsuits and fines against companies that fail to implement active measures to achieve carbon neutrality (climate liability risks), or the “boycotting” of firms that emit significant amounts of greenhouse gases by state entities, investors, and the public (reputational climate risks), or the need to bear additional costs associated with the tightening of national climate regulations (regulatory climate risks) [Sanderson and Stridsland 2022].

This is inextricably linked to the plans of states to shift to low-carbon development. This involves actively producing alternative energy sources and limiting the consumption of traditional energy resources, both at the national and global levels. It also involves integrating “green” technologies into the daily practices of businesses. This is especially the case through climate regulation and government support for manufacturers. It further involves shifting preferences towards electric power and reducing the use of alternative energy sources. Those countries, sectors, and enterprises that are associated with fossil fuels or dirty production are most vulnerable to the risks inherent in the transition process.

Figure 1. Classification of climate risks

Source: compiled by the author from Task Force on Climate-related Financial Disclosures (URL: https://www.fsb-tcfd.org/, accessed December 2023), Bank of Russia (URL: https://cbr.ru/Content/Document/File/143643/Consultation_Paper_21122022.pdf, accessed December 2023).

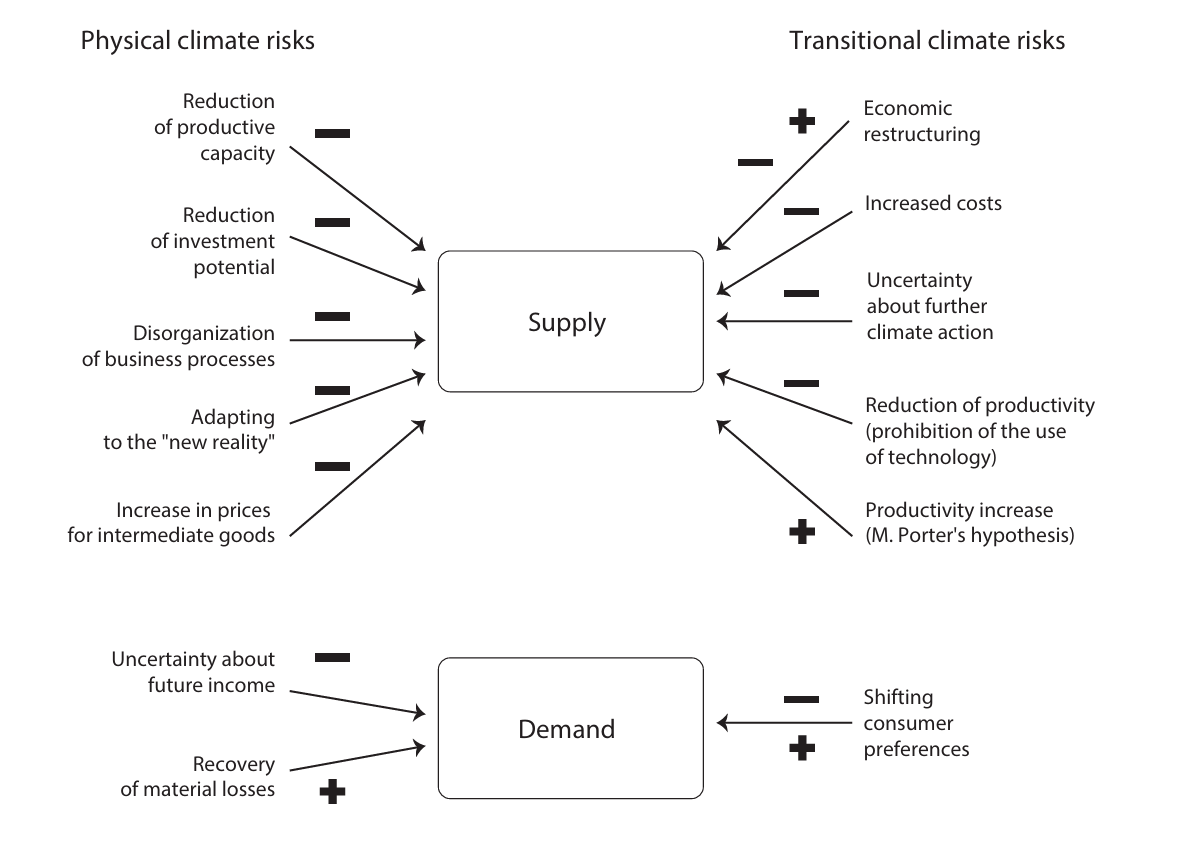

The impact of climate risks on foreign economic activity can be effectively analyzed in terms of the impact of these risks on supply and demand (see Figure 2). A negative impact on exports is a possibility due to the reduction of the country’s export potential, which is driven by cost increases, higher prices for intermediate goods, disorganization of business processes, reduced demand from host markets, logistical problems, and the emergence of trade barriers [Sheng et al. 2022; Carattini et al. 2023]. An increase in exports is also a possibility, due to the rise in productivity (as postulated by Michael Porter) and the recovery of material losses in importing countries, which will lead to an increase in demand. Furthermore, diversification of exports is likely to occur [Porter 1995; Gong et al. 2020; Wang et al. 2021; Chen et al. 2022; Hamaguchi 2023; Yu and Zheng 2024].

Figure 2. Channels of climate risk impact on supply and demand

Source: compiled by the author from Task Force on Climate-related Financial Disclosures (URL: https://www.fsb-tcfd.org/, accessed December 2023), Bank of Russia (URL: https://cbr.ru/Content/Document/File/143643/Consultation_Paper_21122022.pdf, accessed December 2023).

2. Russian and regional exports under transitional climate risks: constraints and opportunities

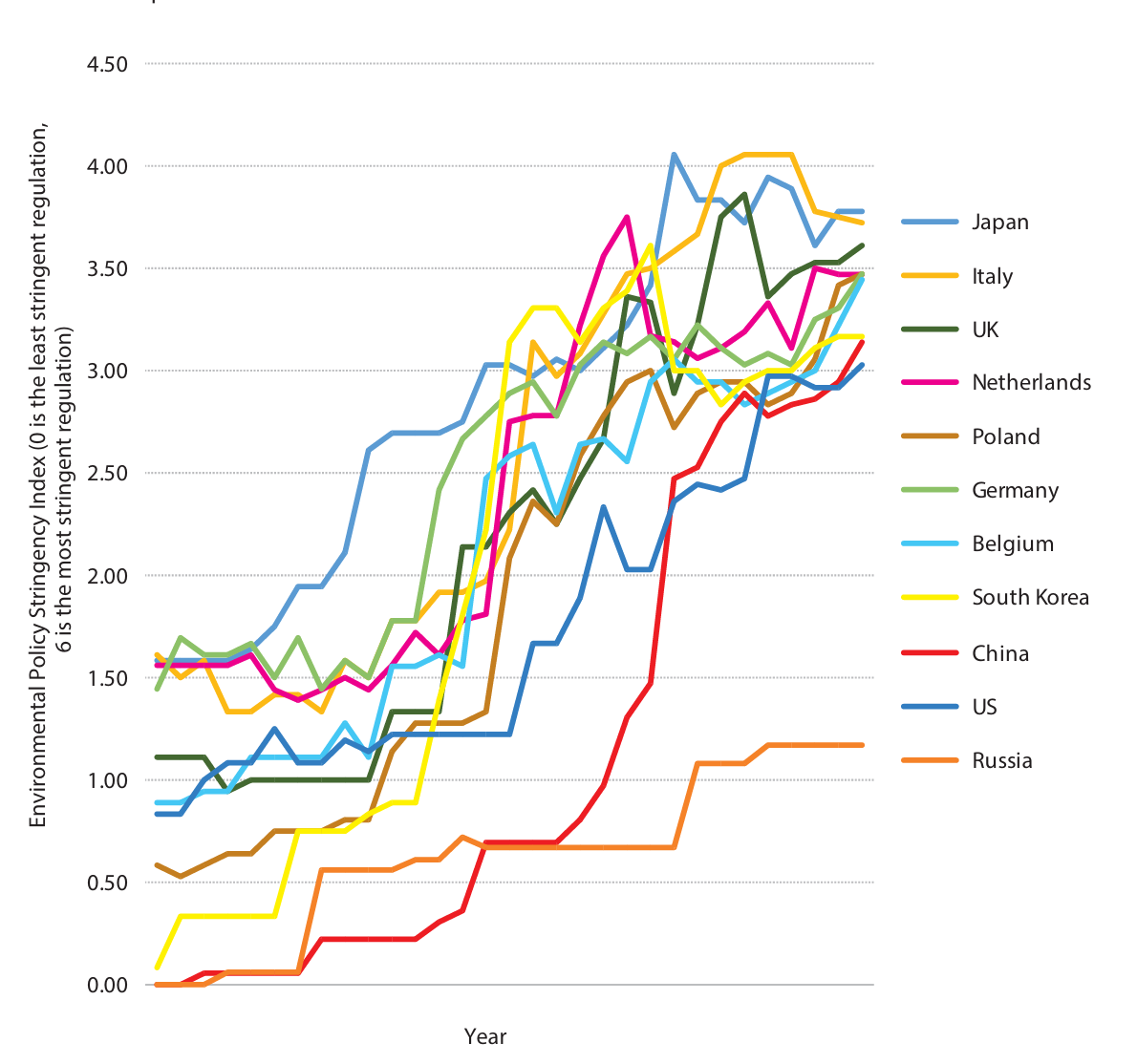

The assessment of export potential in Russian regions, taking into account the impact of transitional climate risks, represents a significant challenge. Russia is among the world’s leading emitters of carbon dioxide on an annual basis. Up to 20% of the country’s emissions are attributable to the production of export goods. The geographical structure of Russian CO₂ exports is characterized by the prevalence of groups of countries that have adopted an active stance on environmental issues and climate policy: the G20 countries, the Organization for Economic Co-operation and Development (OECD), and the European Union (see Figure 3). However, Russia’s national climate policy is lagging behind, prompting trading partners to intensify efforts to achieve global climate goals, including through carbon trading mechanisms [Makarov and Stepanov 2017].

Figure 3. Dynamics of the Environmental Policy Stringency Index of Russia’s trading partner countries in 1990-2020

Source: compiled by the author on the basis of OECDstat (URL: https://stats.oecd.org/Index.aspx?DataSetCode=EPS, accessed December 2023).

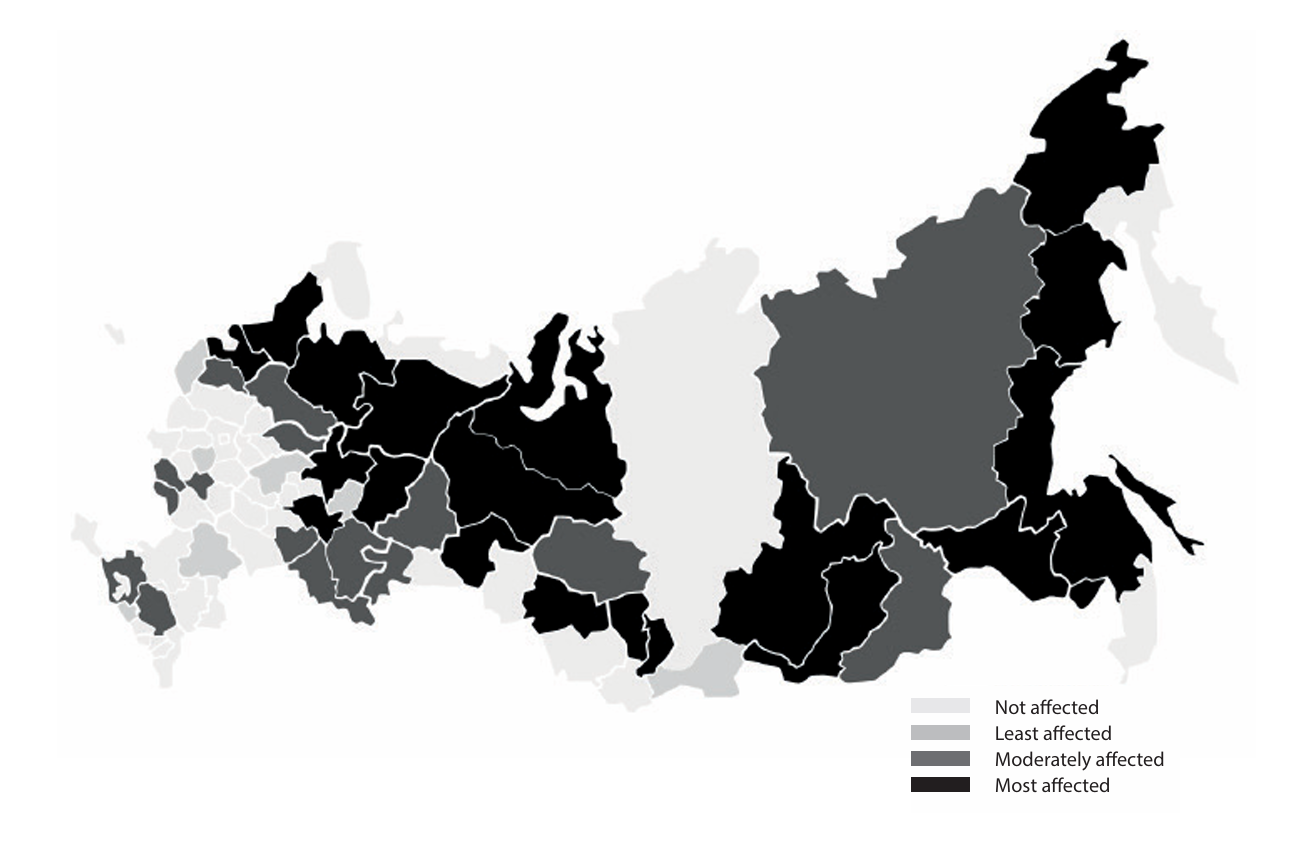

In consideration of the commodity and geographical structure of exports, the vulnerability of exports of Russian regions to carbon regulation of trading partner countries can be defined as follows, as illustrated in Figure 4. Conversely, as postulated by Porter, trade restrictions and regulations may serve as a catalyst for the growth of exports from Russian regions, particularly those specializing in the production of environmentally sensitive goods.

Figure 4. Vulnerability of Russian regions to climate regulation of trading partner countries: statistical analysis of commodity and geographical structure of exports of the regions

Note: the figure was constructed as follows. First, having identified environmentally “sensitive” export industries and analyzed the commodity structure of exports of Russian regions in 2013-2020, three groups of regions were identified: regions with absolute dominance of “sensitive” industries, subjects where the share is in the average range, and those where the share is minimal. It turned out that, according to the analysis of the export structure, the environmental agenda is not a challenge for 37 regions. The remaining groups included 22 regions each. In the “red zone” were those regions whose exports are not diversified and are represented by fuel, ferrous and non-ferrous metals. Secondly, the 44 “sensitive” regions were given an additional criterion—the share of trading partners with “strict” environmental policies, and we obtained three groups. We observe that 20 Russian regions are in the most vulnerable position—they supply environmentally “unsafe” products to countries that actively implement environmental measures. Hence, we conclude that for 38 Russian regions the environmental agenda may be a challenge and an export-limiting factor.

The map of Russia is shown in the borders as of September 2022.

Source: compiled by the author on the basis of Customs Statistics of Federal Districts of the Russian Federation (URL: https://customs.gov.ru/structure/regionalstructure/regional, accessed December 2023).

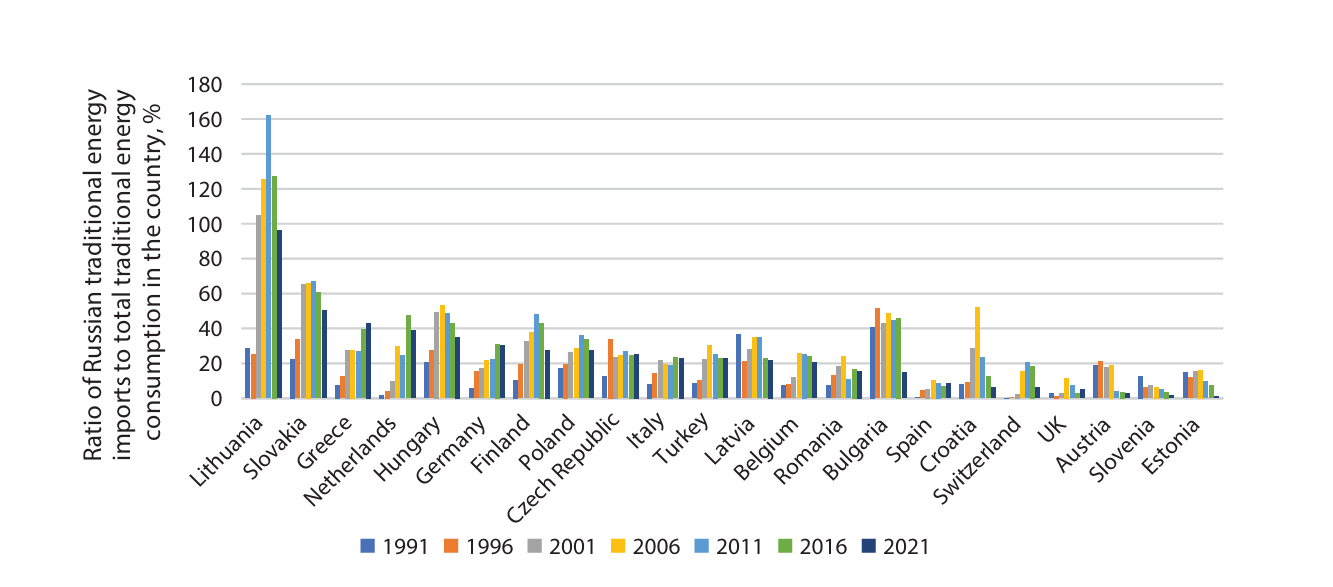

Secondly, in 2021, Russia was the third largest exporter of fossil fuels, with a market share of 8.3%. Over the past two decades, developed countries have constituted the largest proportion of the geographic structure of Russia’s energy exports. The high dependence on Russian energy imports has been a significant concern for numerous governments (see Figure 5). The current policy makers’ intentions to shift away from Russian imports are driven by a number of factors, including the pursuit of zero emissions, extreme economic conditions such as shocks in oil and gas markets or the impact of the global pandemic, and geopolitical considerations that have become increasingly prominent in 2022 [Perdana et al. (2022), Arndt (2023), Crowley-Vigneau et al. (2023), Chepeliev et al. (2024), Shang et al. (2024)]. The advancement of alternative energy sources is regarded as an effective strategy for curbing reliance on imports of Russian energy carriers. In light of these considerations, the global energy transition process presents a number of risks for regions that have developed a specialization in the production of fossil fuels [Sokhanvar and Sohag 2022].

Figure 5. Dependence of trading partner countries on Russian traditional energy imports in 1991-2021, %

Source: compiled by the author based on International Energy Agency (IEA) (URL: https://www.iea.org/reports/national-reliance-on-russian-fossil-fuel-imports/which-countries-are-most-reliant-on-russian-energy, accessed December 2023).

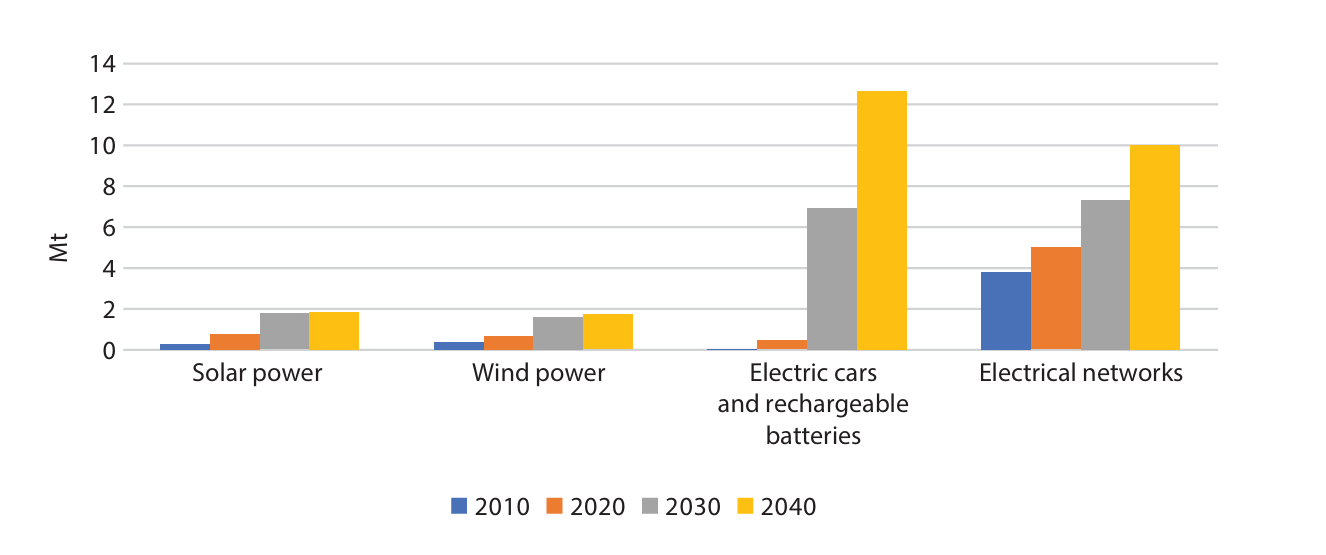

Third, while energy exporters are at risk, the global energy transition opens up new growth opportunities for mineral producers in Russian regions. Mineral resources such as cobalt, nickel, lithium, iridium, palladium, platinum, zinc, copper and uranium in Russian regions are in demand in the context of alternative energy capacity production in trading partner countries (see Figure 6). Thus, given Russia’s resource potential, a number of regions can make a significant contribution to the global energy transition trends and increase their exports [Cherepovitsyn and Solovyova 2022; Chupina 2022; Cherepovitsyn et al. 2023].

Figure 6. Dynamics of demand for mineral raw materials for the production of clean energy technologies in 2010-2040

Source: compiled by the author according to IEA (URL: https://www.iea.org/reports/the-role-of-critical-minerals-in-clean-energy-transitions/mineral-requirements-for-clean-energy-transitions, accessed December 2023).

The determinants of transitional climate risks for exports of Russian regions can be summarized as follows—see Figure 7.

Figure 7. Determinants of transitional climate risks for Russian exporters

Source: compiled by the author.

3. Research methodology

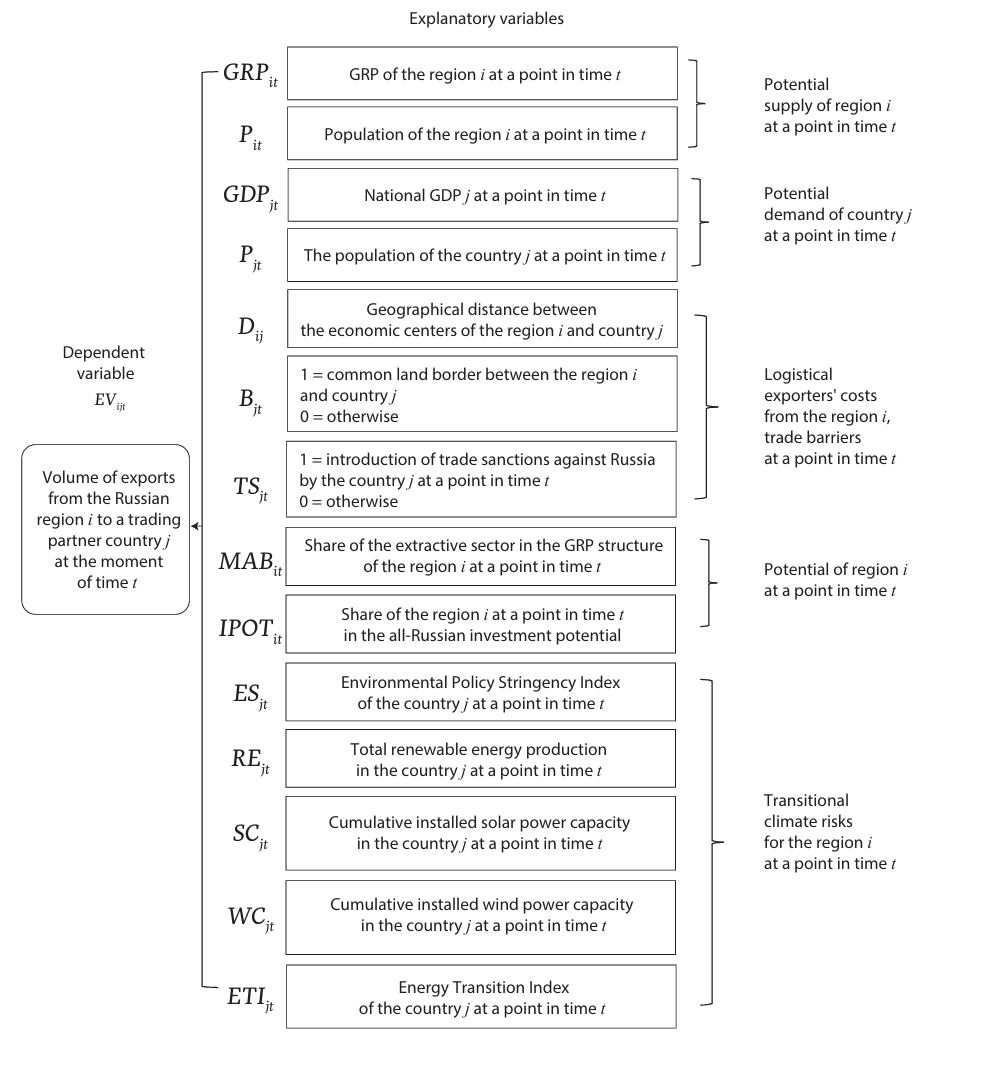

The paper answers the research question about the impact of transitional climate risks on the exports of Russian regions using econometric modeling tools. The theoretical basis of the study is the gravity model of international trade. For the purposes of the study, the traditional gravity equation is modified as follows—see Figure 8.

Figure 8. Empirical model

Note: i =1, …, 84 (Russian exporting regions), j =1,…, 204 (foreign trading partner countries), t =2013, …, 2021 (period of analysis). Data sources for dependent and explanatory variables: EVijt (Federal Customs Service: Regional Customs Departments, https://customs.gov.ru/structure/regional), GRPit , Pit , MABit (Rosstat, https://rosstat.gov.ru/folder/210/document/13204/), Pjt (WDI, https://data.worldbank. org/indicator/SP.POP.TOTL?y), Dij , Bij (author’s calculations based on Google Maps), TSjt (Syropoulos et al. 2023), IPOTjt (RAEX, https://raex-rr.com/regions/investment_appeal/investment_potential_of_ regions/2020/), ESjt (OECDstat, https://stats.oecd.org/Index.aspx?DataSetCode=EPS), REjt (Energy Institute Statistical Review of World Energy, https://ourworldindata.org/grapher/modern-renewable-prod), SCjt (IRENA, https://ourworldindata.org/grapher/installed-solar-pv-capacity?tab=map), WCjt (IRENA, https://ourworldindata.org/grapher/cumulative-installed-wind-energy-capacity-gigawatts), ETIjt (WEF, https://www.weforum.org/publications/fostering-effective-energy-transition-2023/ country-deep-dives-a57a63d0d5/).

Source: compiled by the author.

The export flows from each region of Russia (84) to each trading partner country (204) over the period 2013-2021 are considered as a pairwise dependent variable of the empirical model. The total number of observations is approximately 155,000. The explanatory variables are represented by five blocks, designed to capture the impact of potential supply from the region and demand in the host markets, transportation costs, trade barriers, and transitional climate risks on export volumes. In turn, transitional climate risks are represented by three key components, which are as follows: The stringency of environmental policies of importing countries (ESjt), alternative energy production in host economies, installed alternative energy capacity (SCjt, WCjt), and the Energy Transition Index (ETIjt) in trading partner countries are the explanatory variables. The study posits that an increase in the index of environmental policy stringency indicates a greater likelihood of the government implementing trade barriers to limit the competitiveness of countries without active climate policies. The production volumes of alternative energy in importing countries may be indicative of a potential reduction in demand for conventional Russian energy. In conclusion, the global energy transition process is contingent upon the utilization of mineral products to facilitate the production of alternative energy capacity and electric vehicles. Consequently, the potential demand of importing countries for mineral products from Russian regions is represented by the accumulated alternative energy capacity and the Energy Transition Index.

The study posits that the impact of transitional climate risks varies across Russian regions, contingent on their respective socio-economic characteristics and the idiosyncrasies of their climate policy. For this reason, the analysis is conducted in two principal axes. The initial approach entails evaluating the influence of each transient climate risk factor on the exports of Russian regions, with the analysis stratified by the degree of mineral endowment. The second direction of the analysis entails an assessment of the impact of the stringency of environmental regulation (one of the components of the global energy transition) on the export performance of Russian regions. At this juncture, the role of regional socio-economic conditions of innovation and climate policy in shaping the impact of climate regulation of host markets on the export performance of Russian regions is under investigation (see Figure 9).

Figure 9. Research methodology

Note: division of regions depending on mineral resources endowment is made by means of cluster analysis (k-means method) on the basis of Rosstat data (https://rosstat.gov.ru/folder/210/document/13204/) on the share of extractive sector in the GRP structure of the region; division of regions depending on socio-economic conditions of innovation activity is made by means of cluster analysis (k-means method) on the basis of Higher School of Economics data (https://www.hse.ru/primarydata/rir) on the index of socio-economic conditions of innovation activity; the division of regions according to the degree of climate policy development is based on data on the index of Russian regions’ openness to the Green Deal (https://esg-library.mgimo.ru/publications/reyting-otkrytosti-regionov-rossii-k-zelyenomu-kursu/).

Source: compiled by the author.

The estimation of a gravity model is a challenging undertaking. The gravity model is subject to a number of econometric issues, including the presence of zero trade flows, heteroscedasticity, endogeneity, and the influence of unobserved factors [Yotov et al. 2016]. The Poisson pseudo maximum likelihood (PPML) method is an effective solution to the aforementioned issues. The method permits the incorporation of exporter and importer fixed effects, in addition to pairwise effects, into the model. This enables the control of the influence of unobserved factors. The approach employs the Poisson maximum likelihood function to estimate the gravity equation directly from its multiplicative form. Furthermore, this approach accounts for heteroscedasticity in the data, as demonstrated by Correia et al. (2019).

Results of empirical analysis and discussion

This study investigates the relationship between transitional climate risks and the value of exports of Russian regions using a gravity model of international trade, estimated by the PPML method. The results for the total subsample of Russian regions are presented in Table 1. The primary factors influencing the growth of exports from Russian regions are: The gross regional product (GRP) of the region in question, the gross domestic product (GDP) of the trading partner, the existence of a common land border between the exporting and importing regions, the availability of natural resources, and the level of investment potential are the primary factors influencing export performance. The costs associated with transportation and the implementation of trade restrictions have been identified as factors that exert a detrimental influence on the export performance of Russian regions.

A negative correlation is observed between the climate regulation of trading partner countries and the export performance of Russian regions. This dependence can be attributed to the following factors: carbon regulation acts as a trade barrier; the requirements of importing countries increase the costs of Russian exporters, which negatively affects competitiveness; Russian companies respond inefficiently to these requirements.

Table 1 also demonstrates that the influence of alternative energy generation in importing countries on the exports of Russian regions is similarly adverse, indicating the displacement of Russian energy by alternative energy sources. A similar conclusion is reached by a study conducted by Sokhanvar and Sohag (2022).

Table 1. Results of modeling the impact of transitional climate risks on export volumes of all Russian regions

|

Variables |

Model 1 |

Model 2 |

Model 3 |

Model 4 |

Model 5 |

| lGRPit |

0.802*** (0.088) |

0.677*** (0.069) |

0.672*** (0.069) |

0.680*** (0.071) |

0.674*** (0.072) |

| lGDPjt |

0.848*** (0.035) |

0.804*** (0.027) |

0.758*** (0.020) |

0.755*** (0.021) |

0.772*** (0.021) |

| lPit |

0.008 (0.070) |

0.069 (0.061) |

0.050 (0.062) |

0.063 (0.062) |

0.049 (0.064) |

| lPjt |

-0.138* (0.017) |

-0.045* (0.014) |

-0.066* (0.014) |

-0.046* (0.014) |

-0.059* (0.013) |

| lDij |

-1.536*** (0.074) |

-1.583*** (0.042) |

-1.559*** (0.041) |

-1.555*** (0.046) |

-1.509*** (0.046) |

| l(1+Bij) |

0.862*** (0.221) |

0.676*** (0.129) |

0.752*** (0.129) |

0.661*** (0.132) |

0.713*** (0.143) |

| lMABit |

0.315*** (0.123) |

0.268*** (0.016) |

0.263*** (0.016) |

0.270*** (0.016) |

0.271*** (0.017) |

| lIPOTit |

0.362** (0.135) |

0.491*** (0.094) |

0.508*** (0.095) |

0.490*** (0.090) |

0.505*** (0.099) |

| l(1+TSjt) |

-0.951*** (0.123) |

-0.666*** (0.089) |

-0.731*** (0.088) |

-0.757*** (0.088) |

-0.608*** (0.099) |

| lESjt |

-0.341** (0.099) |

|

|

|

|

| lREjt |

|

-0.140*** (0.010) |

|

|

|

| lSCjt |

|

|

0.030* (0.010) |

|

|

| lWCjt |

|

|

|

-0.010* (0.006) |

|

| lETIjt |

|

|

|

|

-0.189 (0.164) |

| Pseudo R2 |

0.580 |

0.652 |

0.673 |

0.640 |

0.510 |

Note: *** - significance at 1% level, ** - significance at 5% level, * - significance at 10% level. Models 1-5 show the impact of transitional climate risks on the export volumes of Russian regions. Since transitional climate risks are considered in different aspects, 5 different models were formulated. Model 1 reflects the impact of environmental regulation stringency. Model 2 is designed to assess the role of renewable energy production in trading partner countries. Models 3, 4, 5 analyze how readiness for energy transition in importing countries affects exports.

Source: calculated by the author.

Table 1 illustrates a negative correlation between the climate regulation of trading partner countries and the export earnings of all Russian regions. However, based on the findings of the literature review, the study posits that the stringency of climate policy may also contribute to the export growth of some Russian regions.

The empirical analysis permits the conclusion that the stimulating effect is observed in the case of regions with favorable conditions for innovation activity and active climate policy (see Table 2). When the innovation potential is considered separately, a positive effect is observed for regions such as the Republic of Tatarstan, Moscow, St. Petersburg, Sverdlovsk Oblast and Tomsk Oblast. Conversely, a negative effect is observed in Altai Krai, Bryansk Oblast, Zabaykalsky Krai, Kurgan Oblast, and other regions. With regard to the role of climate policy, a positive effect is observed in the case of Sakhalin Oblast, Sverdlovsk Oblast, Tomsk Oblast, Ulyanovsk Oblast, Khanty-Mansi Autonomous Okrug, and Yamalo-Nenets Autonomous Okrug. The negative effect is observed in the case of Amur Oblast, Voronezh Oblast, the Lipetsk Oblast, and others. Firstly, the developed innovation environment of the region allows companies to respond effectively to regulations and requirements. In point of fact, companies in such regions are presented with considerable opportunities to implement environmental innovations, technologies, and qualitative changes in products. Moreover, due to the higher labor productivity observed in these regions, firms are able to internalize environmental costs in an efficient manner. Our findings corroborate those of Costantini and Mazzanti (2012). Secondly, the implementation of climate regulation in importing countries has a negligible impact on regions that have their own environmental initiatives in place, as the products manufactured by firms in these regions already comply with the majority of environmental requirements. Furthermore, the implementation of active regional climate policies can facilitate export diversification and the development of new markets. This result lends support to the findings of Wang et al. (2022).

Table 2. Modeling results of the impact of environmental regulation strictness on export volumes of Russian regions: the role of socio-economic conditions of innovation activity and regional climate policy

|

Variables |

The role of socio-economic conditions for innovation |

The role of regional environmental policy |

||||

|

Russian regions with favorable socio-economic conditions for innovation activity |

Russian regions with moderate socio-economic conditions for innovation activity

|

Russian regions with unfavorable socio-economic conditions for innovation activity |

Russian regions with active climate policy

|

Russian regions with moderate climate policy |

Russian regions with “lagging” climate policy |

|

| lGRPit |

1.143*** (0.307) |

1.396*** (0.101) |

3.222*** (0.190) |

1.393*** (0.168) |

0.725*** (0.154) |

0.842*** (0.210) |

| lGDPjt |

1.066*** (0.077) |

1.112*** (0.080) |

0.959*** (0.258) |

1.581*** (0.162) |

0.914*** (0.075) |

0.657*** (0.066) |

| lPit |

0.121 (0.207) |

-0.882*** (0.118) |

-1.108*** (0.186) |

0.406* (0.162) |

-0.536*** (0.128) |

-0.168 (0.145) |

| lPjt |

0.057 (0.058) |

0.166*** (0.058) |

-0.021 (0.122) |

-0.056 (0.087) |

0.115 (0.075) |

-0.002 (0.045) |

| lDij |

-1.467*** (0.173) |

-1.881*** (0.077) |

-0.793*** (0.187) |

-2.415*** (0.133) |

-1.129*** (0.103) |

-1.560*** (0.130) |

| l(1+Bij) |

0.956*** (0.211) |

0.649*** (0.178) |

0.910*** (0.248) |

0.933*** (0.187) |

0.198 (0.081) |

0.671*** (0.123) |

| lMABit |

0.209*** (0.060) |

0.287*** (0.030) |

0.404*** (0.067) |

0.311*** (0.072) |

0.224*** (0.042) |

0.221*** (0.031) |

| lIPOTit |

0.347** (0.026) |

0.486*** (0.123) |

-1.058 (0.629) |

1.223** (0.358) |

0.961*** (0.143) |

0.315 (0.207) |

| l(1+TSjt) |

-0.604* (0.281) |

-0.757*** (0.242) |

-1.934* (0.789) |

-1.065*** (0.302) |

-0.623* (0.302) |

-1.056 (0.245) |

| lESjt |

0.307*** (0.120) |

-1.004*** (0.194) |

-0.321 (0.371) |

0.765*** (0.352) |

0.028* (0.016) |

-0.634*** (0.190) |

| Pseudo R2 |

0.640 |

0.581 |

0.529 |

0.601 |

0.612 |

0.590 |

Note: *** - significance at 1% level, ** - significance at 5% level, * - significance at 10% level.

Source: calculated by the author.

The results presented in Table 3 permit the formulation of a conclusion regarding the role of mineral resource endowment in Russian regions in shaping the impact of transitional climate risks on export volumes. The results indicate that the impact of installed solar and wind power capacity and the Energy Transition Index of the importing country have a positive impact on exports of regions that are moderately endowed and rich in mineral resources. These regions include Magadan, Orenburg, Sakhalin Oblasts, Komi Republic, Murmansk, Kursk, Sverdlovsk Oblasts, Perm Krai, Republic of Karelia, and others. The study finds that the global energy transition presents these regions with a greater number of opportunities than risks. This conclusion is consistent with the findings of a recent study by Islam et al. (2022).

Table 3. Results of modeling the impact of transitional climate risks on export volumes of Russian regions: the role of resource potential

|

Variables |

Mineral-deficient regions of Russia |

Russian regions moderately endowed with mineral resources |

Mineral-rich regions of Russia |

||||||||||||

|

Mod. 1 |

Mod. 2 |

Mod. 3 |

Mod. 4 |

Mod. 5 |

Mod. 1 |

Mod. 2 |

Mod. 3 |

Mod. 4 |

Mod. 5 |

Mod. 1 |

Mod. 2 |

Mod. 3 |

Mod. 4 |

Mod. 5 |

|

| lGRPit |

1.761*** (0.143) |

1.420*** (0.095) |

1.562*** (0.099) |

1.479*** (0.099) |

1.464*** (0.102) |

0.700*** (0.099) |

0.639*** (0.108) |

0.701*** (0.112) |

0.636*** (0.104) |

0.526*** (0.119) |

1.350*** (0.328) |

1.345*** (0.291) |

1.455*** (0.276) |

1.352*** (0.293) |

1.361*** (0.294) |

| lGDPjt |

0.901*** (0.038) |

0.674*** (0.026) |

0.729*** (0.021) |

0.707*** (0.020) |

0.703*** (0.021) |

0.666*** (0.036) |

0.721*** (0.031) |

0.669*** (0.025) |

0.647*** (0.023) |

0.696*** (0.023) |

0.928*** (0.067) |

1.220*** (0.059) |

0.919*** (0.059) |

0.986*** (0.046) |

0.979*** (0.045) |

| lPit |

-0.804*** (0.141) |

-0.550*** (0.093) |

-0.606*** (0.093) |

-0.600*** (0.096) |

-0.602*** (0.100) |

0.428* (0.254) |

1.098*** (0.219) |

1.129*** (0.215) |

1.165*** (0.222) |

1.053*** (0.224) |

0.647*** (0.125) |

0.571*** (0.109) |

0.545*** (0.111) |

0.568*** (0.108) |

0.593*** (0.111) |

| lPjt |

-0.120*** (0.019) |

0.016 (0.014) |

-0.023 (0.016) |

0.033* (0.017) |

-0.016 (0.013) |

-0.094*** (0.019) |

-0.036* (0.017) |

-0.066*** (0.018) |

-0.045* (0.018) |

-0.043* (0.015) |

-0.204*** (0.030) |

-0.193*** (0.030) |

-0.235*** (0.028) |

-0.194*** (0.027) |

-0.153*** (0.030) |

| lDij |

-1.380*** (0.055) |

-1.416*** (0.032) |

-1.437*** (0.032) |

-1.464*** (0.033) |

-1.353*** (0.035) |

-1.373*** (0.110) |

-1.616*** (0.059) |

-1.545*** (0.065) |

-1.479*** (0.066) |

-1.542*** (0.067) |

-2.733*** (0.151) |

-2.732*** (0.093) |

-2.576*** (0.108) |

-2.599*** (0.110) |

-2.611*** (0.105) |

| l(1+Bij) |

1.025*** (0.204) |

1.099*** (0.127) |

1.129*** (0.127) |

1.035*** (0.124) |

1.021*** (0.131) |

1.378*** (0.289) |

0.695*** (0.211) |

0.786*** (0.213) |

0.822*** (0.210) |

0.808*** (0.232) |

0.798*** (0.199) |

0.604*** (0.243) |

0.806*** (0.311) |

0.760*** (0.102) |

0.812*** (0.230) |

| lMABit |

0.230*** (0.030) |

0.202*** (0.020) |

0.193*** (0.020) |

0.199*** (0.021) |

0.219*** (0.022) |

1.189*** (0.193) |

1.208*** (0.160) |

1.225*** (0.159) |

1.185*** (0.162) |

1.112*** (0.160) |

5.739*** (0.526) |

4.942*** (0.420) |

5.001*** (0.443) |

5.147*** (0.449) |

5.135*** (0.448) |

| lIPOTit |

0.030 (0.146) |

0.161 (0.100) |

0.031 (0.107) |

0.134 (0.104) |

0.162 (0.108) |

1.323*** (0.321) |

1.138*** (0.256) |

1.264*** (0.265) |

1.172*** (0.265) |

1.141*** (0.269) |

1.315*** (0.468) |

1.596*** (0.424) |

1.719*** (0.407) |

1.407*** (0.430) |

1.414*** (0.434) |

| l(1+TSjt) |

-1.149*** (0.132) |

-1.016*** (0.093) |

-1.023*** (0.091) |

-1.067*** (0.089) |

-0.811*** (0.099) |

-0.477*** (0.145) |

-0.204*** (0.059) |

-0.460*** (0.107) |

-0.490*** (0.108) |

-0.412*** (0.099) |

-0.934*** (0.261) |

-0.595*** (0.232) |

-0.688*** (0.220) |

-0.705*** (0.230) |

-0.984*** (0.263) |

| lESjt |

-0.582*** (0.108) |

|

|

|

|

-0.261* (0.101) |

|

|

|

|

-0.427 (0.277) |

|

|

|

|

| lREjt |

|

-0.018 (0.012) |

|

|

|

|

-0.017 (0.016) |

|

|

|

|

-0.143*** (0.027) |

|

|

|

| lSCjt |

|

|

-0.040* (0.011) |

|

|

|

|

0.061*** (0.014) |

|

|

|

|

0.145*** (0.044) |

|

|

| lWCjt |

|

|

|

-0.058*** (0.008) |

|

|

|

|

0.028*** (0.009) |

|

|

|

|

0.155*** (0.016) |

|

| lETIjt |

|

|

|

|

-0.883*** (0.179) |

|

|

|

|

0.077 (0.259) |

|

|

|

|

1.809*** (0.527) |

| Pseudo R2 |

0.520 |

0.580 |

0.610 |

0.590 |

0.550 |

0.520 |

0.610 |

0.630 |

0.599 |

0.584 |

0.50 |

0.645 |

0.589 |

0.572 |

0.525 |

Note: *** - significance at 1% level, ** - significance at 5% level, * - significance at 10% level.

Source: calculated by the author.

Conclusion

Russian companies that are contemplating the expansion of their operations into international markets are confronted with a number of constraints, including elevated production costs, technological backwardness, and a discrepancy between the quality of their goods and the demands of the international market. In the context of the global climate agenda, Russian exporting companies are exposed to a novel category of economic risks, namely transitional climate risks.

From the perspective of the Russian economy and its exports, the global energy transition represents a significant vulnerability. This is due to the considerable contribution of the energy sector to GDP and the elevated carbon footprint associated with exports. Conversely, existing literature suggests that exports from countries with substantial mineral resources may increase during the energy transition. This is due to the fact that the production of alternative energy technologies requires the active use of mineral raw materials. Furthermore, the expansion of Russian regional exports can be attributed to another factor: the intensification of climate regulations, which are an integral aspect of transitional climate risks, compels companies to integrate green technologies into their routine operations, thereby enhancing their competitiveness.

The empirical results of the study demonstrate that, first, there is a negative relationship between the strictness of environmental regulation of trading partners and export volumes for the Russian economy. However, a stimulating effect is observed in the case of regions with a favorable innovation environment and active climate policy. Secondly, the process of global energy transition and the widespread use of alternative energy sources in importing countries serve to reduce dependence on Russian energy imports, which in turn undermines the economic stability of Russian regions that have developed a specialization in energy exports. Conversely, Russian regions with rich mineral resources, which are the primary suppliers of critical minerals essential for the production of alternative energy sources and electric vehicles, stand to gain the most from the energy transition process.

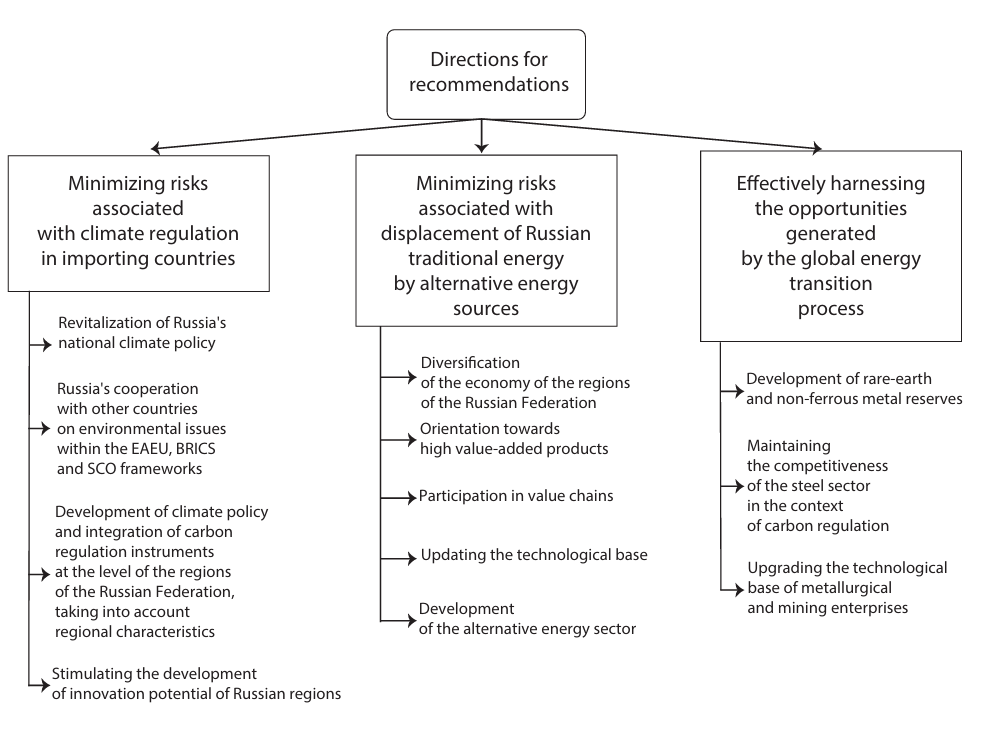

In light of these findings, recommendations can be formulated for the mitigation of risks and the exploitation of opportunities for different groups of regions in the context of the global energy transition (see Figure 10).

Figure 10. Directions of the research recommendations on minimizing risks and effective use of opportunities for exporters of Russian regions in the context of the global energy transition

The conclusions presented in this study are based on an analysis of trade flows for the period between 2013 and 2021. Therefore, the analysis of the impact of transitional climate risks on the export performance of Russian regions does not consider the period of notable intensification of geopolitical risks, which resulted in alterations to the structure and reorientation of exports. This is due to the unavailability of data on the export volumes of each Russian region to each trading partner country after January 2022. Notwithstanding the aforementioned limitations, the proliferation of carbon regulation, coupled with the advancements in the field of alternative energy and electric vehicles across an expanding number of countries, reinforce the continued relevance of the primary conclusions and recommendations presented in Figure 10, particularly in the context of the events that unfolded in 2022.

Bibliography

Albert, M., 2021. The global politics of the renewable energy transition and the non-substitutability hypothesis: towards a ‘great transformation’? Review of International Political Economy. Vol. 29. Issue 12. Pp. 1–16. https://doi.org/10.1080/09692290.2021.1980418

Andersen, E., Shan, Y., Bruckner, B., Černý, M., Hidiroglu, K., Hubacek, K., 2024. The vulnerability of shifting towards a greener world: the impact of the EU’s green transition on material demand. Sustainable Horizons. Vol. 10. No100087. https://doi.org/10.1016/j.horiz.2023.100087

Arndt, C., 2023. Climate change vs energy security? The conditional support for energy sources among western Europeans. Energy Policy. Vol. 174. No113471. https://doi.org/10.1016/j.enpol.2023.113471

Buhaug, H., Benjaminsen, T., Gilmore, E., Hendrix, C., 2023. Climate-driven risks to peace over the 21st century. Climate Risk Management. Vol. 39. No100471. https://doi.org/10.1016/j.crm.2022.100471

Carattini, S., Heutel, G., Melkadze, G., 2023. Climate policy, financial frictions, and transition risk. Review of Economic Dynamics. Vol. 51. Pp. 778-794. https://doi.org/10.1016/j.red.2023.08.003

Cergibozan, R., 2022. Renewable energy sources as a solution for energy security risk: empirical evidence from OECD countries. Renewable Energy. Vol. 183. Pp. 617–626. https://doi.org/10.1016/j.renene.2021.11.056

Chen, X., He, J., Qiao, L., 2022. Does environmental regulation affect the export competitiveness of Chinese firms? Journal of Environmental Management. Vol. 317. https://doi.org/10.1016/j.jenvman.2022.115199

Chepeliev, M., Hertel, T., Mensbrugghe, D., 2022. Cutting Russia’s fossil fuel exports: short-term economic pain for long-term environmental gain. The World Economy. 2022. Vol. 45. Issue 11. Pp. 3314-3343. https://doi.org/10.1111/twec.13301

Cherepovitsyn, A., Solovyova, V., 2022. Prospects for the development of the Russian rare-earth metal industry in view of the global energy transition-a review. Energies. Vol. 15. https://doi.org/10.3390/en15010387

Cherepovitsyn, A., Solovyova, V., Dmitrieva, D., 2023. New challenges for the sustainable development of the rare-earth metals sector in Russia: transforming industrial policies. Resources Policy. Vol. 81. No103347. https://doi.org/10.1016/j.resourpol.2023.103347

Chupina, D., 2022. Impact of the Green Deal on copper imports from Russia to the EU. Voprosy ekonomiki. No 1. Pp. 110–125. https://doi.org/10.32609/0042-8736-2022-1-110-125 (in Russian).

Correia, S., Guimaraes, P., Zylkin, T., 2019. Fast Poisson estimation with high-dimensional fixed effects. The Stata Journal. Vol. 20. Issue 1. Pp. 95–115. https://doi.org/10.1177/1536867X20909691

Costantini, V., Mazzanti, M., 2021. On the Green and Innovative Side of Trade Competitiveness? The Impact of Environmental Policies and Innovation on EU Exports. Research Policy. Vol. 41. Issue 1. Pp. 132–153. https://doi.org/10.1016/j.respol.2011.08.004

Crowley-Vigneau, A., Kalyuzhnova, Y., Ketenci, N., 2023. What motivates the ‘green’ transition: Russian and European perspectives. Resources Policy. Vol. 81. No103128. https://doi.org/10.1016/j.resourpol.2022.103128

Dunz, N., Naqvi, A., Monasterolo, I., 2021. Climate sentiments, transition risk, and financial stability in a stock-flow consistent model. Journal of Financial Stability. Vol. 54. No100872. https://doi.org/10.1016/j.jfs.2021.100872

Elshkaki, A., Graedel, T., Ciacci, L., Reck, B., 2016. Copper demand, supply, and associated energy use to 2050. Global Environmental Change. Vol. 39. Pp. 305–315. https://doi.org/10.1016/j.gloenvcha.2016.06.006

Fedyunina, A., Simachev, Y., Drapkin, I., 2023. Intensive and Extensive Margins of Export: Determinants of Economic Growth in Russian Regions under Sanctions. Ekonomika regiona / Economy of regions. Vol. 19. No 3. Pp. 884-897. https://doi.org/10.17059/ekon.reg.2023-3-20

Glazatova, M., Daniltsev, A., 2020. Main trends in the development of world trade and structural features of Russian exports. Journal of the New Economic Association. Vol. 45. No 1. P. 183–192. https://www.doi.org/10.31737/2221-2264-2020-45-1-8 (in Russian).

Gong, M., You, Z., Wang, L., Cheng, J., 2020. Environmental regulation, trade comparative advantage, and the manufacturing industry’s green transformation and upgrading. International Journal of Environmental Research and Public Health. Vol. 17. Issue 8. https://doi.org/10.3390/ijerph17082823

Hamaguchi, Y., 2023. Environmental tax evasion as a determinant of the Porter and Pollution Haven Hypotheses in a corrupt political system. Economic Analysis and Policy. Vol. 79. Pp. 610–633. https://doi.org/10.1016/j.eap.2023.06.032

Harpprecht, C., Xicotencatl, B., Nielen, S., Meide, M., Li, C., Li, Z., Tukker, A., Steubing, B., 2024. Future environmental impacts of metals: a systematic review of impact trends, modeling approaches, and challenges. Resources, Conservation and Recycling. Vol. 205. No107572. https://doi.org/10.1016/j.resconrec.2024.107572

Islam, M. M., Tareque, M., Moniruzzaman, M. & Ali, M. I., 2022. Assessment of Export-Led Growth Hypothesis: The Case of Bangladesh, China, India and Myanmar. Ekonomika regiona/Economy of regions, 18(3), 910-925, https://doi.org/10.17059/ekon.reg.2022-3-20

Islam, M., Sohag, K., 2023. Mineral import demand and wind energy deployment in the USA: co-integration and counterfactual analysis approaches. Mineral Economics. https://doi.org/10.1007/s13563-023-00382-2

Islam, M., Sohag, K., Alam, M., 2022. Mineral import demand and clean energy transitions in the top mineral-importing countries. Resources Policy. Vol. 78. No 102893. https://doi.org/10.1016/j.resourpol.2022.102893

Kadochnikov, S., Fedyunina, A., 2013. Economic growth due to export externalities: a spatial econometric analysis for Russian regions, 2003-2008. International Journal of Economic Policy in Emerging Economies. Vol. 6. Issue 4. Pp. 358–374. https://doi.org/10.1504/ijepee.2013.057909

Kutyrev, G., Kolomina (Apasova), A., Lebedev, M., 2021. Environmental protectionism as a factor in the transformation of the industrial and foreign trade structure on the example of Russia and GermanyRussia and the Contemporary World. Vol. 113. No 4. Pp. 121–140. https://www.doi.org/10.31249/rsm/2021.04.06 (in Russian).

Makarov, I., 2023. Taxonomy of trade barriers: five types of protectionism. Contemporary World Economy. Vol. 1. No 1. Pp. 74-94. https://cwejournal.hse.ru//makarov12023

Makarov, I., Chen, H., Paltsev, S., 2020. Impacts of climate change policies worldwide on the Russian economy. Climate Policy. Vol. 20. Issue 10. Pp. 1242–1256. https://doi.org/10.1080/14693062.2020.1781047

Makarov, I., Shuranova, A., 2023. Climate change as a new factor in international relations. International Analytics. Vol. 4. No 14. Pp. 52-74. https://doi.org/10.46272/2587-8476-2023-14-4-52-74 (in Russian).

Makarov, I., Sokolova, A., 2014. Carbon Emissions Embodied in Russia’s Trade. Economic Journal of Higher School of Economics. Vol. 18. No 3. Pp. 477–507. https://ej.hse.ru/2014-18-3/137770485.html (in Russian).

Makarov, I., Stepanov, I., 2017. Carbon regulation: options and challenges for Russia // Bulletin of Moscow University. Series 6: Economics. No 6. Pp. 3-22. https://doi.org/10.38050/01300105201761 (in Russian).

Nordhaus, W., 2015. Climate Clubs: Overcoming Free-riding in International Climate Policy. American Economic Review. Vol. 105. Issue 4. Pp. 1339-1370. https://doi.org/10.1257/aer.15000001

Ozturk, S., Demirer, R., Gupta R., 2022. Climate uncertainty and carbon emissions prices: the relative roles of transition and physical climate risks. Economics Letters. Vol. 217. No110687. https://doi.org/10.1016/j.econlet.2022.110687

Porfir’ev, B., Shirov, A., Kolpakov, A., 2020. Low-carbon development strategy: Prospects for the Russian economy. MEMO Journal. Vol. 64. No 9. Pp. 15-25. https://doi.org/10.20542/0131-2227-2020-64-9-15-25

Porter, M., Linde, C., 1995. Toward a new conception of the environment-competitiveness relationship. Journal of Economic Perspectives. Vol. 9. Pp. 97–118. https://doi.org/10.1257/jep.9.4.97

Saenko, V., Kolpakov, A., 2021. The prospects for Russian energy exports in the conditions of the implementation of international climate policy measures. Studies on Russian Economic Development. No 6. Pp. 113–124. https://doi.org/10.47711/0868-6351-189-113-124

Sanderson, H., Stridsland, T., 2022. “Cascading transitional climate risks in the private sector-risks and opportunities” In: Climate Adaptation Modelling. Conference Paper. Springer. Pp. 179–186. https://doi.org/10.1007/978-3-030-86211-4_21

Shang, Y., Sang, S., Tiwari, A., Khan, S., Zhao, X., 2024. Impacts of renewable energy on climate risk: a global perspective for energy transition in a climate adaptation framework. Applied Energy. Vol. 362. No122994. https://doi.org/10.1016/j.apenergy.2024.122994

Sheng, X., Gupta, R., Çepni, O., 2022. The effects of climate risks on economic activity in a panel of US states: the role of uncertainty. Economics Letters. Vol. 213. No110374. https://doi.org/10.1016/j.econlet.2022.110374

Shirov, A., Kolpakov, A., 2016. Russian economy and mechanisms of global climate regulation. Journal of the New Economic Association. Vol. 32. No 4. Pp. 87–110. https://www.econorus.org/repec/journl/2016-32-87-110r.pdf (in Russian).

Sokhanvar, A., Sohag, K., 2022. What does the clean energy transition look like for Russian oil exports? Energy Science & Engineering. Vol. 10. Issue 12. Pp. 4512–4519. https://doi.org/10.1002/ese3.1286

Syropoulos, C., Felbermayr, G., Kirilakha, A., Yalcin, E., Yotov, Y., 2023. The global sanctions data base release 3: COVID-19, Russia, and multilateral sanctions. Review of International Economics. https://doi.org/10.1111/roie.12691

Valero, A., Valero, A., Calvo, G., Ortego, A., 2019. Material bottlenecks in the future development of green technologies. Renewable and Sustainable Energy Reviews. Vol. 93. Pp. 178-200. https://doi.org/10.1016/j.rser.2018.05.041

Volchkova, N., 2013. How costly is exporting: an empirical assessment of trade model with heterogeneous firms? SSRN Electronic Journal. https://doi.org/10.2139/ssrn.2243135

Wang, J., Jin, Z., Yang, M., Naqvi, S., 2021. Does strict environmental regulation enhance the global value chains position of China’s industrial sector? Petroleum Science. Vol. 8. Issue 6. Pp. 1899-1909. https://doi.org/10.1016/j.petsci.2021.09.023

Weezel, S., 2020. Local Warming and violent armed conflict in Africa. World Development. 2020. Vol. 126. No104708. https://doi.org/10.1016/j.worlddev.2019.104708

Yotov, Y., Piermartini, R., Monteiro, A., Larch, M., 2016. An advanced guide to trade policy analysis: the structural gravity model. World Trade Organization. 144 p. https://doi.org/10.30875/ABC0167E-EN

Yu, H., Zheng, C., 2024. Environmental regulation, land use efficiency and industrial structure upgrading: test analysis based on spatial Durbin model and threshold effect. Heliyon. Vol. 10. Issue 5. https://doi.org/10.1016/j.heliyon.2024.e26508

Notes

1How state support helps exporters overcome borders and barriers// https://www.vedomosti.ru/partner/articles/2023/10/19/1000547-gospodderzhka-pomogaet-eksporteram (accessed December 2023).

2 What hinders Russian export: the results of a survey of enterprises (analytical note) // https://cbr.ru/StaticHtml/File/120062/analytic_note_apr21_dip.pdf (accessed December 2023); Exporters are confused by internal problems // https://www.kommersant.ru/doc/4763204 (accessed December 2023).

3 Minerals for Climate Action: the Mineral Intensity of the Clean Energy Transition // https://elperiodicodelaenergia.com/wp-content/uploads/2020/05/20200510-WORLD-BANK-GROUP-Rprt-MineralsforClimateAction-Transition.pdf (accessed December 2023).

4 EU completely stops buying Russian coal // https://www.rbc.ru/politics/10/08/2022/62e229b39a794791f3187fe3 (accessed December 2023); EU approves plan to reduce dependence on Russian energy // https://www.kommersant.ru/doc/5356577 (accessed December 2023); Carbon tax is still here // https://www.kommersant.ru/doc/6097901 (accessed December 2023).

5 Carbon Pricing Dashboard // https://carbonpricingdashboard.worldbank.org/ (accessed December 2023).

6 Task Force on Climate-related Financial Disclosures // https://www.fsb-tcfd.org/ (accessed December 2023).

1.jpg)