Global and Russian Energy Outlook Up to 2050

[Чтобы прочитать русскую версию статьи, выберите русский в языковом меню сайта.]

Viatcheslav Kulagin – Head of the Department for Research of the Energy Complex of the World and Russia, ERI RAS.

SPIN-RSCI: 4140-6845

ORCID: 0000-0001-8847-8882

Researcher ID: Z-5621-2019

Scopus Author ID: 56274242400

Dmitry Grushevenko – Senior Researcher at ERI RAS.

SPIN-RSCI: 7801-4079

ORCID: 0000-0002-8660-2576

Researcher ID: AAD-4257-2019

Scopus Author ID: 57039179500

Anna Galkina – Senior Researcher at ERI RAS.

SPIN-RSCI: 2474-7057

Researcher ID: M-9885-2013

Scopus Author ID: 56607057900

For citation: Kulagin, V., Grushevenko, D., and Galkina, A., 2024. Global and Russian Energy Outlook Up to 2050. Contemporary World Economy. Vol. 2. No 1.

Keywords: energy markets, long-term forecasting, energy demand, oil and gas markets, renewable energy sources.

Abstract

This article presents primary findings of the ERI RAS scenario forecast for the development of the global and Russian energy sector up to 2050. The scenarios presented in this article are not normative, but descriptive, illustrating the evolution of the global energy sector with specific assumptions.

The study contains forecasts of the volume and composition of energy consumption across countries and regions globally, categorized by energy type and end-use sector, power generation, greenhouse gas emissions, energy production, global trade, and fuel prices.

Under the assumption of slower economic growth (1.4–1.8 times in 2022–2050 compared to 1990–2021) and slower population growth (2 times compared to the 2021 level), the growth rates of primary energy consumption (2.5–3 times) and electricity consumption (1.3–2.5 times) are expected to decrease in all the scenarios considered. The most substantial growth in energy consumption is anticipated to originate in Asian developing countries, which are projected to exhibit the highest per capita GDP growth rates over the forecast period.

The electric power industry is undergoing a rapid transformation, with the share of renewable energy sources (RES) and nuclear energy projected to increase to 57–70% by the end of the forecast period. The energy end-use sectors are undergoing a gradual process of electrification. The era of active competition between various fuels in the transportation sector is now starting. Among fossil fuels, only natural gas will represent a relatively stable share in the global energy mix, accompanied by an increase in consumption volumes. Conversely, the shares of coal and oil will decline. Global greenhouse gas emissions from the combustion of fuels, including biofuels, will peak in all scenarios in the middle of the projection period, when excluding capture and storage. To a significant extent, by 2050, the energy intensity of the global economy, specific energy emissions, and progress toward the Sustainable Development Goals, including energy poverty, will be contingent upon the capacity of states to collaborate with one another, as well as upon policies pertaining to trade barriers and technology transfer.

The increased utilization of intermittent RES will result in elevated volatility in the prices of natural gas and coal, and increased demand for backup and storage systems. The Middle East, North America, and the Commonwealth of Independent States (CIS) will collectively retain their position as the world’s primary oil and gas producers, accounting for over 70% of global production.

Introduction

The global energy industry is entering a new phase of its development, which will be defined by a number of key characteristics.

These include:

- Active competition at the level of different fuels and within each production segment, which will be driven by rapid scientific and technological progress (STP).

- Increasing energy impacts from government energy policy and emissions regulation, which influence priorities in energy supply decisions and trade flows.

- A transition from the mono-fuel markets of individual energy resources to a unified energy market with high interdependence between energy sources.

- Changes in the structure of energy balances with electrification of end-use sectors and increased use of renewable energy sources (RES), especially in the power sector.

The global energy sector will be significantly influenced by geopolitical factors, which will determine opportunities for technology transfers, trade restrictions, and the capacity to develop collaborative approaches to market regulation.

The efficacy of decisions made in the present regarding investments in the fuel and energy sector, research and development priorities, the allocation of resources for training specialists, the development of certain territories, and the repositioning of others hinges on the accurate delineation of prospective transformations in the energy sector.

The findings of the research described in the article enable us to ascertain the nature of the transformation of the energy sector up to 2050, taking into account the diverse economic, technological, and geopolitical conditions of development.

1. Scenario assumptions and calculation methodology

The long-term outlook of global and Russian energy sector development presented in this paper is the result of research conducted by the Energy Research Institute of the Russian Academy of Sciences (ERI RAS). The forecasting toolkit used by the Institute is continuously evolving and incorporates a range of economic and mathematical techniques, including econometric, cluster analysis, optimization, simulation, and multi-criteria modeling. The optimization models for fuel markets consist of over 200 nodes, which contain information on over 2,000 fields and groups of carbon fuel fields, as well as on processing facilities and transport infrastructure. In these models, the objective is the minimization of the cost of meeting global demand, and more than 5,000 routes are employed to calculate the supply of energy resources [Grushevenko 2023; System Research in Energy... 2018; Prospects for the development of world energy... 2020].

The forecast considers three scenarios of world energy development which consider trading conditions in addition to economic growth, the priorities of state energy policies, and the course of STP. Currently, developed countries are predominantly more motivated to implement trade barriers (e.g., in the form of a border carbon offset mechanism) [Makarov 2023]. The Fog scenario posits that global trade will continue to be conducted with certain restrictions, that global development issues will be of secondary concern, that efforts to develop international regulation will have limited efficacy, and that countries will be predominantly self-interested in climate policy. The transfer of technology will continue to be constrained. The primary objective of energy policy will be to ensure affordable access to energy, both economically and physically. The price of carbon dioxide (CO2) in developed countries will continue to increase at a relatively slow rate, with an estimated value of 120–135 USD 2023/t by 2050. In contrast, the price of CO2 in developing countries is expected to be between 35–60 USD 2023/t by the same year. In the Split scenario, significant trade restrictions are established between two poles, within which trade is unrestricted. Some countries remain outside the aforementioned poles. By the year 2050, the price of carbon dioxide in developed countries is estimated to be between 100–150 USD 2023/t, while prices in developing countries will remain at negligible levels. In the Key scenario, states are able to establish mechanisms that facilitate collective action on global development issues, including climate-related concerns. The projected CO2 prices in developed countries by 2050 are estimated to be between 180–200 USD 2023/t, while in developing countries, it is set at a range of 70–150 USD 2023/t [Global and Russian Energy Outlook 2024].

In all scenarios, a single population forecast was adopted: the average scenario of the UN forecast [UN 2022] and, for Russia, the average scenario of the demographic forecast of Rosstat until 2046 with an extension [Rosstat 2023].

It is assumed that economic growth rates will be relatively modest: 1.9% in the Fog scenario, 2.2% in the Split scenario, and 2.5% in the Key scenario, in the period leading up to 2050. This corresponds to a deceleration of 1.4–1.8 times compared to the previous 30-year period (in 1990–2021 the world economy grew by an average of 3.5% per year, in 2023 by 3%). Some studies, for example those conducted by the World Bank [Kose et al. 2024] and the IMF [Bolhuis et al. 2023], indicate that the global economy may experience an even greater slowdown before the end of this decade. Additionally, these studies model the potential economic growth losses associated with the possibility of global economic fragmentation.

The calculations were based on statistical data on GDP from the International Monetary Fund (IMF) [IMF 2023], energy statistics from the International Energy Agency (IEA) [IEA 2023], and national statistical reports from countries included in the databases used for modeling.

2. Main results of scenario calculations of long-term development of the energy sector in the world and Russia

Energy consumption in final sectors

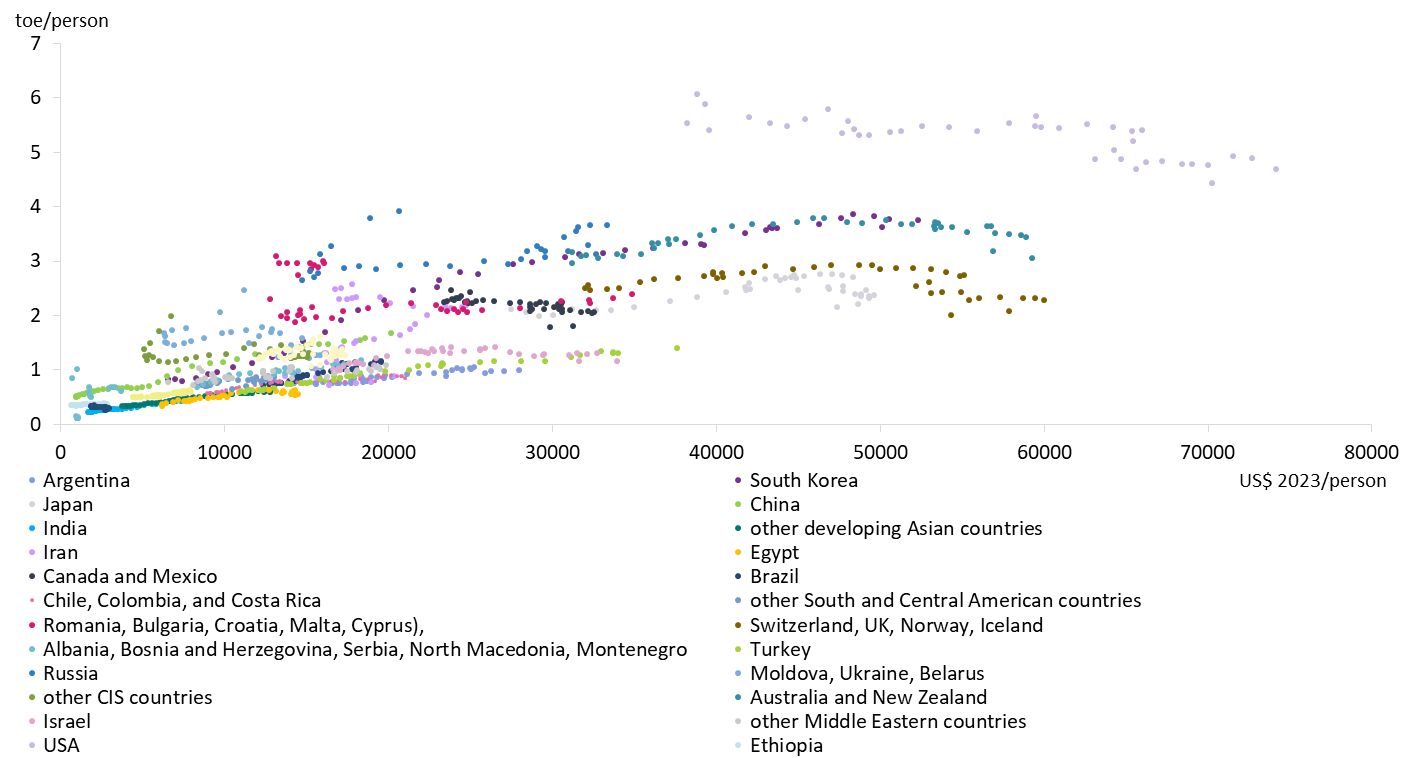

The rapid advancement of technology is continuously transforming all facets of the energy sector, including end-use segments. The solutions being developed for this sector are becoming more convenient, efficient, environmentally friendly, and easier to manage. Furthermore, the trend towards electrification is becoming increasingly common. The development of more cost-effective energy storage technologies will further encourage the use of such technologies by end consumers. Energy consumption is correlated with wealth. As per capita GDP rises, per capita final energy consumption tends to rise, then peak and decline (see Figure 1). A number of OECD countries have already passed the peak of per capita final energy consumption at relatively high levels of per capita GDP (40–50 thousand USD 2021/person) and levels of per capita final energy consumption (3–6 tons of oil equivalent/person). Technological advancement enables other states to reach a similar level of saturation at a lower per capita GDP. However, it should be noted that the per capita GDP level in non-OECD countries in the scenarios is 20–25 thousand USD 2021/person, per capita energy demand remains largely insolvent, with considerable differentiation within the group.

Figure 1. Per capita final energy consumption and per capita GDP in 1980–2021 by world countries and country groups

Source: ERI RAS calculations.

It is projected that final energy consumption will continue to grow in all sectors over the course of the forecast period, reaching 11.9–12.6 billion tons of oil equivalent by 2050. This represents an increase from the 10.0 billion tons of oil equivalent consumed in 2021. The transportation sector will experience the most rapid growth in demand (1.1–1.3% per year), while the commercial and residential sectors will experience the slowest growth in consumption (0.1–0.4% per year). In the regional context, the greatest absolute growth in final energy consumption will be observed in developing Asian countries, while the greatest growth rates will be observed in African countries. In OECD countries, final energy consumption is projected to decline in all scenarios.

Electricity consumption and production

Electricity consumption, the most convenient form of energy for consumers in most segments and a strong indicator of welfare, was found to be more sensitive to economic growth rates and other scenario parameters. In the long run, it was observed to increase by 0.4–1.5% annually under various scenarios. For comparison’s sake, the growth of final energy consumption was found to vary in a narrower range and to increase by 0.6–0.8% annually under various scenarios. The growth of electricity consumption was observed in almost all countries, although a growing number of developed countries reached a peak in their consumption in the second half of the forecast period. It is estimated that between two-thirds and three-quarters of the global growth in electricity consumption will be provided by developing Asian countries, which are the region with the fastest growing per capita GDP over the forecast period.

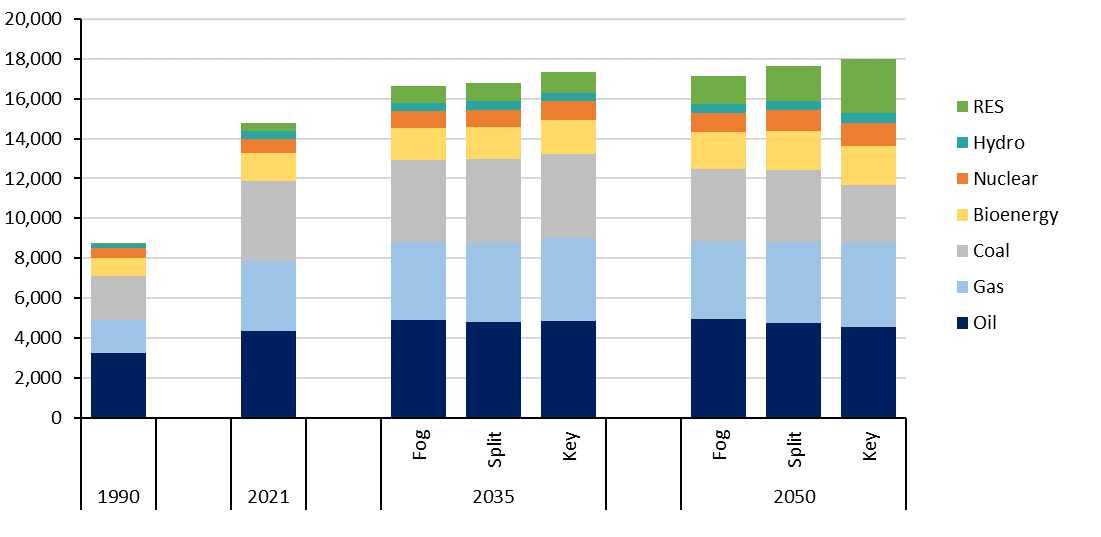

The global electricity sector is undergoing a significant transformation. The dynamic growth in demand will be supported not only by the increasing prosperity and electrification, but also by the increasing affordability of power generation technologies which are mainly based on RES. Wind and solar power generation is becoming increasingly competitive in many countries around the world, and in most cases, there are initial niches for RES. The weighted average cost of electricity generation from 2010 to 2022 for solar plants decreased from USD 0.43 to USD 0.08 per kilowatt-hour (kWh). By 2050, analysis of technology development indicates the potential for a further reduction in costs by 30%. Similarly, onshore wind farms have reduced costs from USD 0.11 to USD 0.07 2023/kWh over the 2010–2022 period, a further 10% reduction is expected by 2050. Offshore wind farms have also seen cost reductions, from USD 0.20 to USD 0.11 2023/kWh, and another 30% reduction is expected. The cost of generating electricity from large hydropower plants remains the lowest among alternatives and was estimated to be USD 0.01 2023/kWh. However, the natural potential for utilizing hydropower on a global scale is constrained, and the costs associated with small, medium, and micro hydropower plants are prohibitively high. Additionally, nuclear power has the potential to reduce production costs. Nuclear power plants in most countries are more expensive than gas and coal in terms of electricity generation. Renewable energy sources in the context of a rapid reduction in their costs also begin to show better performance in terms of production costs. At the same time, nuclear power plants, in contrast with renewable energy sources, are capable of providing a predictable and constant supply of electricity, which allows for a reliable coverage of the baseload consumption, or, through the use of storage with daily loads to be integrated into the main operational modes of the system. The electricity costs of coal and gas-fired power plants have the potential to be reduced by improving plant efficiency, but will depend on the price of coal and gas supply. Consequently, until the middle of the forecast period, the volumes of electricity generated from gas and coal will continue to increase, albeit at the expense of their share in the generation structure. Conversely, in the second half of the forecast period, the absolute volumes of generation from these power plants will also decrease, and their use in standby mode will become more prevalent due to the intermittency of generation from RES power plants. By 2050, global electricity consumption is projected to increase by 11,000–25,000 TWh (from 28,400 TWh in 2021), including 8,800–22,000 TWh due to increased generation at wind and solar power plants, 900–1,600 TWh at nuclear power plants, and 800–1,450 TWh at hydropower plants. By the year 2050, more than two-thirds of the world’s nuclear power plant electricity production will be accounted for four countries: China, the United States, France, and Russia, with China providing 54% of this growth. The non-OECD countries will account for most of the increase in electricity production from hydroelectric power plants (92–93%), wind power plants (74–75%), and solar power plants (80%). The proportion of RES in electricity generation is projected to increase from 38% to 57–70% by the end of the forecast period (see Figure 2).

Figure 2. World electricity production volumes by type of energy resources in different scenarios, TWh (left axis) and share of oil products, gas and coal in electricity production, % (right axis)

Source: ERI RAS calculations.

In the transition to exclusively carbon-free sources of electricity generation, the digitalization of the sector will enable efficient management of a more complex grid. Furthermore, solutions to intermittent generation from renewable energy plants, including the use of batteries and hydrogen for electricity storage, are technically feasible. However, the system costs of energy supply are rising rapidly as the share of renewables increases. Depending on the region, such a transition could lead to by 3–7 times higher costs of supplying electricity to consumers. Ultimately, each country’s electricity generation mix will be determined largely by the availability of technologies, local and imported energy resources, and the ambition of electricity decarbonization targets.

Primary energy consumption

The growth of total global primary energy consumption has slowed significantly compared to the previous 30-year period, as evidenced by Figure 3. In countries of Organization for Economic Co-operation and Development (OECD), the rate of decline is 0.3% per year over the forecast period. In non-OECD countries, the rate of increase is 0.9% to 1.1%. Global coal consumption will have passed its peak before the middle of the forecast period. In the Split and Key scenarios, the consumption of oil will reach its peak. Global gas consumption will continue to grow throughout the forecast period, albeit at a slower rate than global energy consumption. Technological advancement will facilitate the increased utilization of carbon-free energy sources for energy supply. The proportion of RES and nuclear energy is projected to reach 27–35% by 2050.

Figure 3. Volumes of primary energy consumption in the world by types of energy resources under the scenarios, million tons of oil equivalent

Source: ERI RAS calculations.

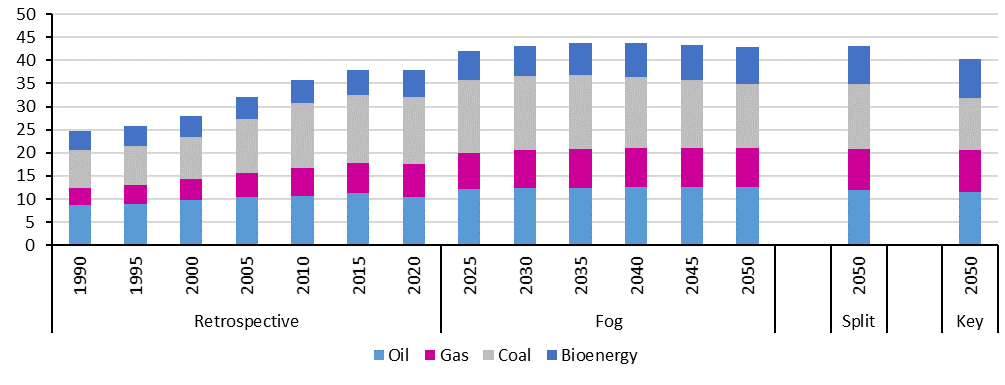

Greenhouse gas emissions

Global greenhouse gas emissions from fuel combustion in all scenarios under consideration will peak in 2034–2036. In absolute terms, it will amount to 37–38 billion t CO2 -eq., or 44–45 billion t CO2 -eq. if bioenergy combustion is considered (excluding possible capture, utilization and storage) (see Figure 4).

Figure 4. Global greenhouse gas emissions by type of fuel combusted, billion tons CO2 -eq.

Note: Emissions from fuel combustion are shown without taking into account possible capture, utilization, and storage.

Source: ERI RAS calculations.

Key is a rational scenario in terms of balancing the objectives of energy supply affordability and greenhouse gas emission reductions within given parameters of technological and socio-economic development. Deepening decarbonization requires a dramatic increase in investment and conflicts with the ability to sustain this rate of global economic growth.

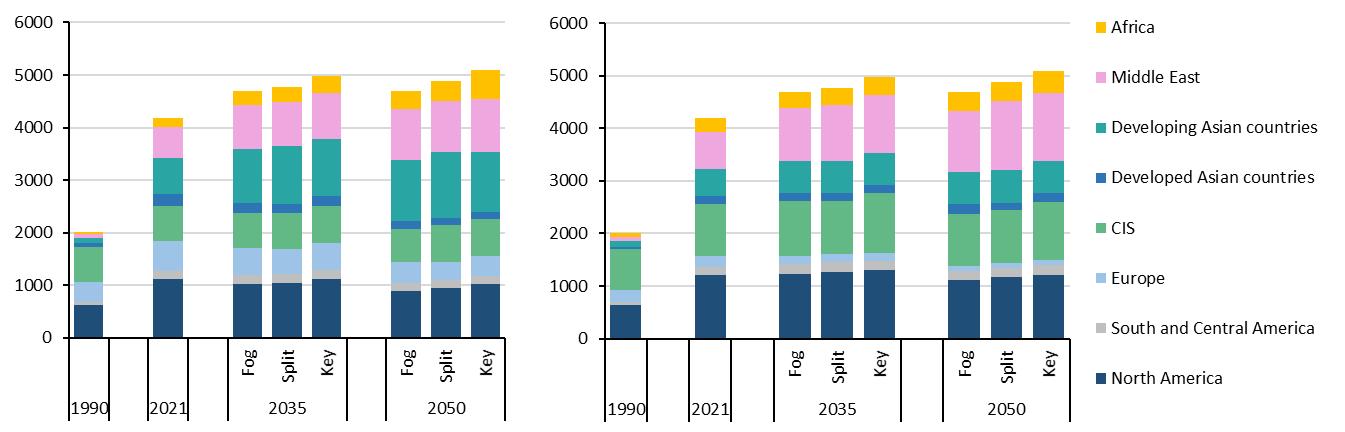

Liquid fuels market

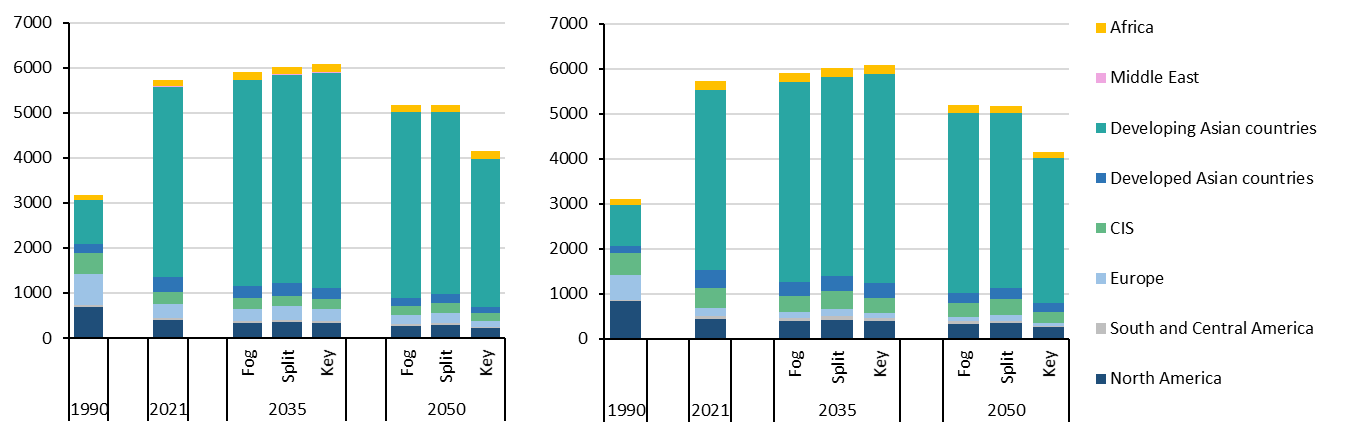

By 2050, the share of non-OECD countries in liquid fuels consumption will continue to grow against a background of declining absolute consumption in OECD countries. By 2035, China will overtake the US in terms of consumption, India will consume more liquid fuels than the EU after 2030, and liquid fuel consumption in the Middle East, Africa and other developing countries in Asia will grow significantly (see Figure 5).

Figure 5. Consumption of oil products, including own use by industry (left) and production of crude oil (right), by world region under the scenarios, million tons of oil equivalent

Source: ERI RAS calculations.

The structure of consumption of oil products by type will change significantly: global consumption of kerosene will increase in aviation, motor gasoline will increase in road transport, demand for diesel fuel will remain stable, and consumption of dark petroleum products will continue to decline. These changes will require significant investment to modernize oil refining capacities. In addition, the limited use of plastics in refining is expected thanks to waste reduction programs.

In 2016–2017, the world passed an intermediate peak in conventional oil production, which was offset by growth in unconventional oil production and gas condensate supply. Going forward, new conventional and unconventional oil reserves will need to be developed to maintain required production levels. The Middle East will remain the world’s largest oil producer, with production rising to 1.5–1.8 trillion tons (1.3 trillion tons in 2021). In North America, oil production will be fairly stable: in the first half of the forecast period, consisting mainly of US shale oil and Canadian heavy oil, while in the second half of the forecast period, the decline in their production will be offset by production growth from offshore fields in Mexico and from fields on the northern coasts of the US and Canada.

Production in the CIS countries will be sensitive to the scenario parameters, in particular trade restrictions and market accessibility, in 2050 it will be 682 million tons in the Fog scenario, and in the Key scenario it will gradually decline to the 2021 level (621 million tons), in the Split scenario it will be 675 million tons.

In the Fog scenario, which is characterized by the highest demand, the equilibrium oil supply and demand prices reach USD 100 2023/bbl by 2050. In the Key scenario, they would fall below USD 80 2023/bbl. In the Split scenario, they would end up at a global average of USD 90 2023/bbl, but would vary between the geoeconomic poles depending on the availability of supply in each (see Figure 6). Market prices would be volatile and may temporarily deviate significantly from equilibrium prices. During the forecast period, it is unlikely that equilibrium oil prices will escape the USD 50–120 2023/bbl range for more than 2–3 years (barring critical external factors) because exceeding the upper limit accelerates the transition to alternative fuels and consumption technologies (e.g., biofuels, electric transportation, plastics recycling) and improves fuel saving, while exceeding the lower limit significantly increases the risks of underinvestment in new production projects and makes a significant portion of oil production, especially unconventional oil, uneconomical.

Figure 6. Oil prices under the scenarios, USD 2023/bbl.

Source: ERI RAS calculations.

Gas market

According to the scenarios, world gas consumption will increase to 4.7–5.1 trillion cubic meters by 2050 (4.2 trillion cubic meters in 2021, 2.0 trillion cubic meters in 1990). Over the past 30 years, large gas markets have emerged in developing countries in Asia, Africa, and the Middle East (gas consumption in these regions grew from 0.2 to 1.4 trillion cubic meters between 1990 and 2021), and they will continue to grow strongly over the next 30 years, reaching 2.4–2.7 trillion cubic meters. Consumption in OECD countries will decline by 0.7–0.9% per year. The CIS, the Middle East, and North America will remain the largest gas and oil producing regions. The Middle East countries (Saudi Arabia, Iran, and Qatar) will provide the largest increase in gas production volumes, both for their own domestic markets and for global supply (see Figure 7).

Figure 7. Gas consumption (left) and production (right) by world regions under scenarios, billion cubic meters

Source: ERI RAS calculations.

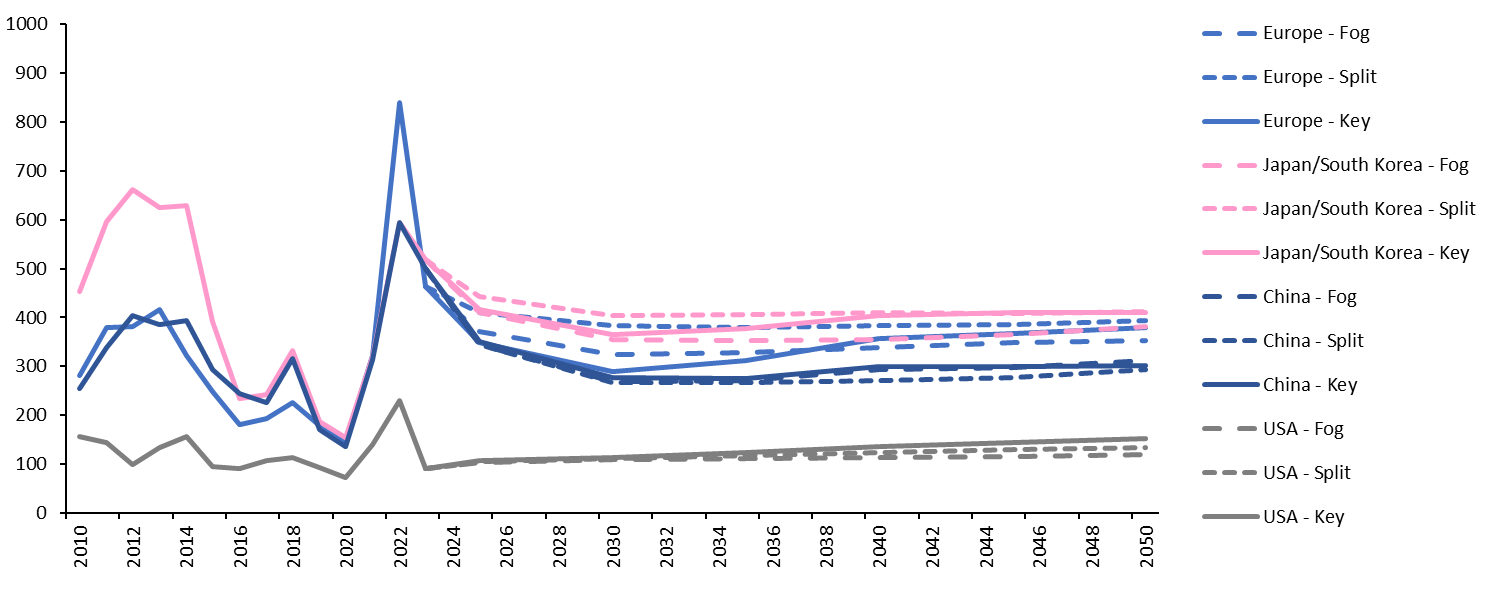

The results of the optimization calculations show that meeting the projected demand for gas will not require a significant increase in world trade (which is about 1.2 trillion cubic meters) due to increased demand in countries with their own gas resources. However, the share of liquefied natural gas (LNG) in world trade will increase significantly by 2035, reaching about 70% by 2050. More than 80% of interregional gas supplies will be provided by the largest gas producers: CIS, Middle East, and North America. Supplies from Nigeria, Mozambique, and Tanzania will increase, while the prospects for gas exports from Iran are highly uncertain. China and India will be the largest gas importers. Following the commissioning of LNG production facilities currently under construction, weighted average gas prices in the main importing regions—Europe and Asia—are expected to fall significantly by 2030. Thereafter, gas prices will rise moderately as production costs increase due to the need to bring more complex reserves into production (see Figure 8).

Figure 8. Weighted average regional gas prices under the scenarios, USD 2023/ thousand cubic meters

Source: ERI RAS calculations.

Coal market

The global coal market has changed rapidly over the past 30 years. Coal consumption in Europe, North America and the CIS almost halved between 1990 and 2021 due to substitution by alternatives in the industrial and power sectors and improvements in energy efficiency. During this period, coal consumption in developing Asia has more than quadrupled, fueling its rapid economic growth (see Figure 9). Nearly two-thirds of global coal consumption is used for power generation. Increased inter-fuel competition in the power sector, even in the absence of high CO2 prices in developing countries, will cause coal consumption growth before 2035 to be replaced by a decline after 2035. Coal consumption declines most rapidly in the Key scenario due to stricter environmental regulations and the highest scenario CO2 prices.

Figure 9. Coal consumption (left) and production (right) by world regions under scenarios, million tons of coal equivalent

Source: ERI RAS calculations.

The reduction of coal consumption in the OECD and the concentration of its use in countries that are largely self-sufficient will lead to a gradual decline in world trade—by a factor of 1.9 to 4.5, depending on the scenario.

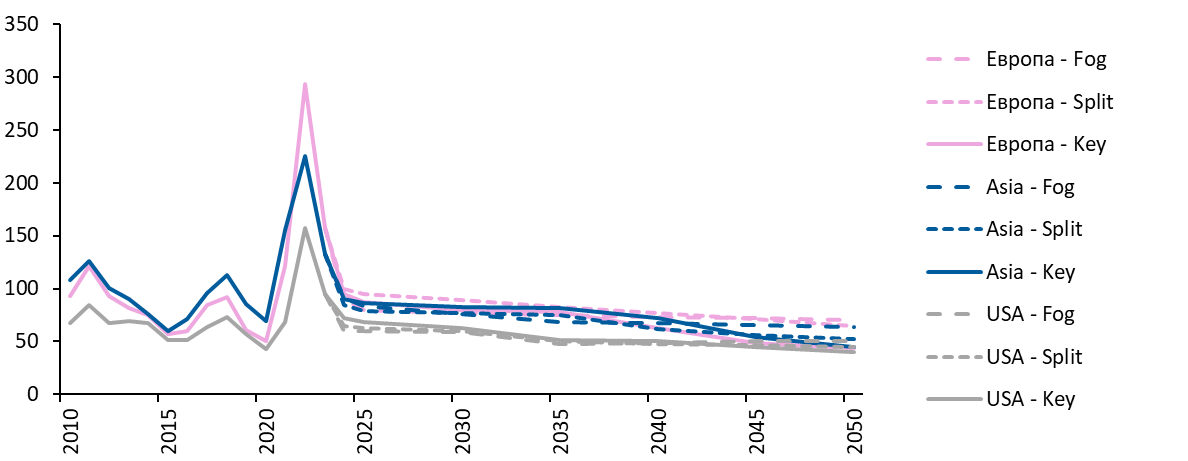

Coal prices in coal-importing regions will remain at relatively high levels in the first half of the projection period and then gradually decline as demand falls. In the Split scenario, prices in the European market are set at a premium to the Asian market due to the limited coal supply resulting from the scenario’s trade restrictions (see Figure 10).

Figure 10. Weighted average regional coal prices under the scenarios, US$ 2023/t

Source: ERI RAS calculations.

Development of Russia’s energy sector

The growth of GDP and per capita income of the population will demand energy. However, this demand will be offset by the realization of energy savings potential.

Energy consumption in the commercial and residential sectors will grow moderately, peaking in the middle of the forecast period as a result of increasing energy efficiency in electricity and heat supply systems. Consumption in the transport and industry sectors will also continue to grow, but at a much slower rate than in the previous period.

The electricity sector will account for the largest increase in energy demand: electricity consumption will increase by 1.1–1.4 times, driven by the ongoing electrification of end-use sectors. Natural gas will retain its key role in the power sector in the scenarios considered, while the generation volumes of gas-fired power plants, nuclear power plants and RES power plants will gradually increase and those of coal-fired power plants will decrease (especially in the Key scenario, taking into account the assumptions on regulatory measures, including emission charges). By 2050, the share of RES and nuclear power in electricity generation under the scenarios considered will be 40–46% (it was 40% in 2021).

The growth of the total primary energy consumption in Russia in the considered scenarios will slow down until 2050: the average annual rate will be 0.1–0.3%. The use of individual fuels will decrease (coal, in all scenarios; oil, in the Fog and Key scenarios in the second half of the forecast period). The share of RES and nuclear energy in the fuel and energy balance will increase from 10% to 11–14%, while the share of gas will remain stable at 54–56%.

The growth of demand for petroleum products in Russia in the first half of the forecast period will be supported by the growing need for mobility and the development of the petrochemical industry, while in the second half of the forecast period this growth will be offset by the expansion of the alternative transport fleet and energy efficiency in the transport sector, electrification in the commercial and household sectors. As importing countries begin to focus on importing oil for further refining at their own facilities, the niches for exporting petroleum products will shrink significantly in all scenarios. At the same time, domestic demand for gasoline will not decline in absolute terms. Thus, against the background of the expected decline in oil refining in Russia, it will be necessary to ensure moderately growing volumes of motor gasoline production, which will require significant investments in the modernization of domestic refining capacities. Shifting demand from gasoline to diesel fuel, LPG, natural gas and electricity may partially solve the problem. Exports of oil and gas condensate from Russia will be able to compensate for the decline in external supplies of oil products and will be primarily focused on Asian markets. The share of complex reserves in oil production will continue to grow. Maintaining the required level of production and export competitiveness will require the expansion of flexible regulation and preferential taxation.

In the Russian coal industry, production volumes will become even more dependent on niches in export markets against the backdrop of declining coal consumption in both the power sector and end-use sectors. Export volumes, in turn, may fluctuate 2–3 times due to decisions of major coal consumers on the structure of their fuel basket and plans for their own production, and will also be sensitive to the dynamics of world prices due to the long transportation shoulder.

Gas demand on the Russian domestic market will continue to grow moderately in all scenarios considered, reaching 520–574 billion m3 by 2050. The largest increase in gas demand is expected in the Key scenario, due to higher economic growth, increased gas use in the power industry, including in the east of the country, as well as expenditures for the industry’s own needs associated with the volume of export supplies. Pipeline gas supplies to the European market are economically attractive and will occupy a natural niche in this market in the absence of geopolitical restrictions. Pipeline gas supplies to Asia will increase within the framework of the agreements being reached. Gas exports in the form of LNG are expected to increase from the European part of Russia and the Arctic and, if resources are available, from the east of the country. In order to maintain the required level of gas production, it will be necessary to develop new complex reserves far from consumption centers, which will be associated with higher costs. There will be a growing need to adjust the fiscal regulation of the industry, not only to maintain the competitiveness of gas supplies to foreign markets, but also to ensure a sustainable energy supply to the domestic economy.

A more flexible energy policy will be required to facilitate the active adaptation of the Russian fuel and energy complex to changes in domestic and foreign markets. In export markets, the primary focus should be on the creation of infrastructure and related mechanisms (insurance, financial, etc.) to ensure the viability of promising supply routes, international support for the establishment of liquid trading platforms and reasonable price indicators in new major consumption centers, increase of operational flexibility in the fuel markets to respond to price and volume fluctuations in the context of growing use of intermittent RES generation through schemes involving logistical optimization of trade using different resource bases. It is important to note that the energy sector encompasses not only fuel supplies but also significant markets for equipment and services. These markets are not inferior in terms of financial turnover to fuel markets. Expansion of operations in these markets will not only bring additional revenues but also provide contracts for industry and stimulate R&D.

Despite the interest in exports, the primary objective of the Russian fuel and energy complex is the sustainable supply of the domestic market. It is thus necessary to complete the process of ensuring technological sovereignty, at least in terms of key equipment and software, modernization of energy sector and consumption segments to improve the efficiency of resource use, synchronization of territorial development plans with plans to launch new energy facilities. It is of the utmost importance to ensure self-sufficiency of domestic energy markets, create conditions for the development of competition and the formation of objective price indicators.

Conclusion

The global energy sector will undergo a significant transformation in the period up to 2050, in the context of a notable deceleration in the growth of primary energy consumption. The substantial potential for energy demand in low-income countries will remain largely unrealized due to the insufficient ability to pay. In developed countries, which are distinguished by high levels of per capita energy consumption, absolute energy consumption is anticipated to decline. Developing countries with average and above-average levels of per capita income will be the primary drivers of growth in global energy demand. Over the next 30 years, the world will pass the cumulative peak in fossil fuel consumption. By the conclusion of the projected period, fossil fuels will account for 65–73% of global energy consumption, a notable shift from the 80% recorded in 2021. This transformation can be regarded as a significant qualitative shift within the global energy sector, particularly when considering the extended lifespan of many energy-consuming systems and infrastructure. Additionally, the peaks in greenhouse gas emissions from fuel combustion are also projected to be surpassed during this period.

Annual electricity consumption growth will be increasingly covered by renewable energy sources, in particular due to their growing economic efficiency. By 2050, wind and solar generation will account for almost all of the increase in global electricity consumption. The proportion of renewable and nuclear energy sources is projected to reach 57–70% in the scenarios addressed, up from 38% in 2021. In conjunction with fossil fuels, they will constitute supplementary components of the prospective energy system. The technical feasibility of achieving 100% carbon-free sources in electricity generation is also a possibility. However, as their role in electricity supply grows, system costs increase disproportionately fast, in particular due to the need to utilize electricity storage systems and to expand grid capacity at different sites. The ultimate system costs of switching to carbon-free sources are contingent upon a number of factors, including the region in question, the availability of energy resources, import possibilities, the dynamics and level of demand, the ability to pay, the requirements for power supply stability, and the possibilities for synchronization with neighboring power systems.

The role of gas and coal as reserve fuels in the power sector will contribute to their increased price volatility. The transportation sector, which plays a pivotal role in the oil industry, is entering an era of rapidly evolving inter-fuel competition. It is anticipated that LNG, ammonia, and methanol will experience growth in the maritime transport sector, while use of electricity, gas, and biofuels will expand in road transport.

The world’s potential to achieve high levels of economic growth and to address global challenges, including climate policy and achievement of the Sustainable Development Goals, will be contingent upon the ability of countries to move away from practice of trade barriers and increasing restrictions and towards the implementation of harmonized mechanisms to address emerging challenges.

Bibliography

Bolhuis, M., Chen, J., Kett, B., 2023. Fragmentation in Global Trade: Accounting for Commodities. IMF Working Paper, No. WP 23/73. Available at: https://www.imf.org/en/Publications/WP/Issues/2023/03/24/Fragmentation-in-Global-Trade-Accounting-for-Commodities-531327

Global and Russian Energy Outlook 2024 / edited by A.A. Makarov, V.A. Kulagin, D.A. Grushevenko, A.A. Galkina. Moscow: ERI RAS, 2024. Available at: https://www.eriras.ru/files/prognoz-2024.pdf (in Russian).

Grushevenko, D. A., 2023. “Model toolkit for assessing the prospects of development of interfuel competition in the global transport sector” in: Actual problems of oil and gas complex development in Russia: Proceedings of the XVI All-Russian Scientific and Technical Conference / edited by V.G. Martynov. Moscow: Gubkin Russian State University of Oil and Gas, 2023. P. 489-498 (in Russian).

IEA, 2023. World Energy Balances. Available at: https://www.iea.org/data-and-statistics/data-product/world-energy-balances-highlights

IMF, 2023. World Economic Outlook Database. October 2023. Available at: https://www.imf.org/en/Publications/WEO/weo-database/2023/October

Kose, A., Ohnsorge, F., 2024. Falling Long-Term Growth Prospects: Trends, Expectations, and Policies. Washington, DC: World Bank. Режим доступа: https://openknowledge.worldbank.org/server/api/core/bitstreams/3f6fa335-c843-47c1-b466-74be203875fc/content, https://doi.org/10.1596/978-1-4648-2000-7

Makarov, I.A., 2023. Taxonomy of trade barriers: five types of protectionism. Contemporary World Economy. Vol. 1. No. 1(1). Available at: https://cwejournal.hse.ru/article/view/17239

Prospects for the development of world energy taking into account the impact of technological progress / edited by V.A. Kulagin. Moscow: ERI RAS, 2020. Available at: https://www.eriras.ru/files/monograph_2020_ed_kulagin_v_a.pdf (in Russian).

Rosstat, 2023. Demographic forecast. Federal State Statistics Service (Rosstat). Available at: https://rosstat.gov.ru/folder/12781 (in Russian).

System research in the energy sector: methodology and results / edited by A.A. Makarov, N.I. Voropay. Moscow: ERI RAS, MPEI, 2018. Available at: https://www.eriras.ru/files/sistemnye_issledovaniya_-mch-.pdf (in Russian).

UN, 2022. World Population Prospects. United Nations Department of Economic and Social Affairs Population Division. Access mode: https://population.un.org/wpp/

1.jpg)