Цифровое завтра: как АСЕАН стимулирует рост цифровой экономики

[To read the article in English, just switch to the English version of the website.]

Титов Александр — PhD, заместитель генерального секретаря Международной ассоциации цифровых экономик (IDEA), руководитель направления ведения международного бизнеса маркетинговой компании GeiserMaclang Marketing Communications Inc (Филиппины) и крупнейшей частной экосистемы высокотехнологичных компаний Филиппин Digital Pilipinas, соучредитель консалтингового сервиса для помощи инвесторам, стартапам и масштабируемым компаниям Astrolabe.

Налеванко Оливер — менеджер по международному бизнесу и маркетингу маркетинговой компании GeiserMaclang Marketing Communications Inc (Филиппины), крупнейшей частной экосистемы высокотехнологичных компаний Филиппин Digital Pilipinas и консалтингового сервиса для помощи инвесторам, стартапам и масштабируемым компаниям Astrolabe.

Гайнтдинов Роман — независимый эксперт по региону Юго-Восточной Азии.

Дизон Дуэйн — менеджер по стратегическим и кризисным коммуникациям маркетинговой компании GeiserMaclang Marketing Communications Inc (Филиппины) и крупнейшей частной экосистемы высокотехнологичных компаний Филиппин Digital Pilipinas.

Макланг Амор — почетный доктор Университета Рай, участник программы UID-MIT IDEAS Asia Pacific Школы менеджмента Слоана Массачусетского технологического института, генеральный секретарь и соучредитель Международной ассоциации цифровых экономик (IDEA), основатель и руководитель крупнейшей частной экосистемы высокотехнологичных компаний Филиппин Digital Pilipinas, директор-основатель маркетинговой компании GeiserMaclang Marketing Communications Inc (Филиппины).

Для цитирования: Титов А., Налеванко О., Гайнтдинов Р., Дизон Д., Макланг А. Цифровое завтра: как АСЕАН стимулирует рост цифровой экономики // Современная мировая экономика. 2024. Том 2. №1(5).

Ключевые слова: АСЕАН, цифровая экономика, Мировое большинство, цифровизация, экономическое развитие, развивающийся регион

Аннотация

Появление цифровизации предоставляет беспрецедентные возможности для трансформации в нашу эпоху. Ключевые отрасли, имеющие фундаментальное значение для развития общества, такие как здравоохранение, образование, энергетика и сельское хозяйство, всё больше опираются на глобальную связь и обмен данными. Однако инфраструктура, поддерживающая эти взаимосвязи, должна соответствовать критериям финансовой и физической доступности, а также безопасности, чтобы обеспечить бесперебойное использование.

Интернет, постоянно развивающийся благодаря таким инновациям, как искусственный интеллект (ИИ), открывает уникальные перспективы. Тем не менее, неравенство сохраняется, особенно в развивающихся странах, в которых доступ к ежедневному использованию интернета и владение цифровыми технологиями отстают от развитых государств. Без сопоставимых возможностей доступа и необходимых навыков миллиарды людей, особенно в странах Мирового большинства, рискуют оказаться лишенными современных технологических достижений.

По состоянию на 2023 г. примерно треть населения планеты — почти 3 млрд человек1 — остаются без доступа в интернет. Устранение этого цифрового разрыва требует активизации глобального сотрудничества для ускорения внедрения технологий и распространения преимуществ подключения для всех.

Переход к цифровизации требует грамотного обеспечения баланса между снижением рисков и максимизацией возможностей. По мере того, как частные лица и предприятия внедряют цифровую трансформацию, первостепенное значение приобретает принятие защитных мер для повышения доверия пользователей. Для создания устойчивых, взаимосвязанных цифровых экосистем необходима основополагающая политика, включающая правила обеспечения конфиденциальности данных, протоколы кибербезопасности и надежные институциональные рамки. Передовые системы должны не только проводить идентификацию, но и обеспечивать безопасные и выгодные транзакции, одновременно способствуя ответственному обмену данными.

Азия как один из наиболее динамичных и быстро развивающихся регионов мира является олицетворением экспансивного прогресса в условиях глобальной цифровой экономики. Главный фокус данной статьи — впечатляющие достижения, наблюдаемые в регионе Юго-Восточной Азии, которая, по сути, превратилась в координационный центр растущей цифровизации.

Введение: АСЕАН и ее роль в Мировом большинстве

Ассоциация государств Юго-Восточной Азии (АСЕАН) выделяется как успешная модель региональной интеграции, способствующая экономическому росту, стабильности и региональной дипломатии среди десяти государств-членов. Основанная в 1967 г., АСЕАН первоначально сосредоточилась на экономическом сотрудничестве и урегулировании конфликтов. Однако со временем она превратилась в многогранную организацию, занимающуюся безопасностью, социально-культурными проблемами и региональной дипломатией. Такие принципы, как невмешательство во внутренние дела, уважение суверенитета и принятие решений на основе консенсуса, сыграли важную роль в поддержании стабильности и укреплении позиций АСЕАН на мировой арене.

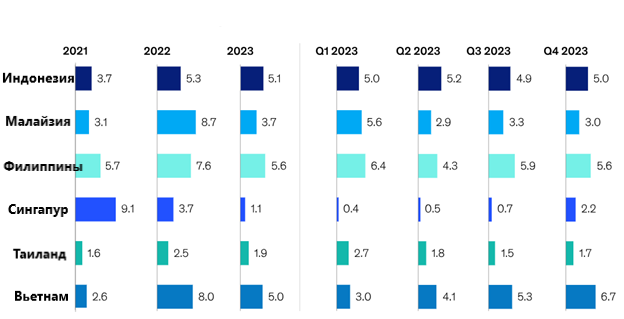

Этот акцент на региональной интеграции стал ключевым драйвером прогресса АСЕАН. Совместными усилиями решая проблемы экономики, безопасности и социальной сферы, государства-члены добились значительного экономического роста (см. рисунок 1): совокупный ВВП в 3,3 трлн долл. в 2021 г. ставит АСЕАН на пятое место в глобальной экономике. Эта экономическая мощь делает объединение основной силой в мировой торговле и инвестициях.

Глобальный сдвиг в сторону многополярного мира открывает перед АСЕАН уникальные возможности. Как представитель развивающегося Глобального Юга АСЕАН служит примером успешной стратегии развития для других развивающихся регионов. Его комплексный подход представляет собой ценную модель сотрудничества по линии Юг–Юг, подчеркивая важность регионального сотрудничества в решении общих проблем и содействии инклюзивному глобальному управлению.

Рисунок 1. Реальный рост ВВП в сравнении с предыдущим периодом, %

Источник: [McKinsey 2024]

Меняющийся глобальный ландшафт подчеркивает значимость интеграции АСЕАН и ее модели регионального и глобального сотрудничества. Действительно, в последнее время глобальный геополитический и экономический ландшафт стал свидетелем заметного перехода к многополярности. Этот процесс отражает растущее влияние стран Мирового большинства. В основном речь идет о регионах, для которых характерны более низкий уровень доходов, развивающаяся экономика и многообразие культур, прежде всего это Африка, Латинская Америка, Азия и отчасти Ближний Восток. Однако в последние годы многие из этих стран достигли значительного экономического роста и развития благодаря таким факторам, как богатство природных ресурсов, индустриализация, прорывные технологии и стратегическое геополитическое положение. АСЕАН, как одно из самых прогрессивных региональных объединений, служит отличным примером для многих.

Кроме того, подъем этих стран привлек внимание к таким вопросам, как сотрудничество Юг–Юг, содействие развитию и необходимость более инклюзивных структур глобального управления, которые бы отражали разнообразие населения мира и помогали противодействовать вызовам, с которыми сталкиваются страны в этих регионах. Таким образом, сдвиг в сторону многополярности подчеркивает направление развития международного сообщества, сигнализируя о более разнообразном и сложном глобальном ландшафте, в котором традиционные структуры власти перестраиваются новыми силами из ранее маргинализированных регионов.

Организация Объединенных Наций (ООН) высоко оценивает и поддерживает АСЕАН как ключевого игрока Мирового большинства. Всемирная организация выражает глубокую благодарность АСЕАН за партнерство и непоколебимую приверженность принципам многосторонности и регионального взаимодействия. АСЕАН играет ключевую роль в продвижении прав человека, основных свобод и инклюзивного политического участия, которые являются неотъемлемыми компонентами построения настоящего, устойчивого и гармоничного общества. Кроме того, вклад АСЕАН безусловно важен для укрепления глобальной экономики в мировом масштабе. ООН неоднократно подтверждала готовность быть надежным партнером АСЕАН в преодолении грядущих вызовов [United Nations].

В этой статье детально рассматривается модель АСЕАН, в частности как именно интегрированный подход ассоциации формирует ее участие в цифровой экономике. Изучается историческое участие АСЕАН в процессе цифровизации, возможности и вызовы, с которыми она сталкивается, ее уникальный вклад и будущая траектория развития. Благодаря этому анализу мы получим понимание решающей роли АСЕАН в продвижении регионального и глобального цифрового развития.

1. Эволюция цифровой повестки АСЕАН

На протяжении более четверти века АСЕАН активно вовлечена в цифровую трансформацию, а именно с момента принятия в 1997 г. «Видения АСЕАН – 2020» (ASEAN Vision 2020). Этот документ был нацелен на укрепление сообщества АСЕАН и положил начало инициативам, направленным на развитие информационных и коммуникационных технологий во всем регионе [ASEAN 1997]. Впоследствии, в 2000 г. лидеры АСЕАН подписали Рамочное соглашение об электронной АСЕАН (e-ASEAN), ставшее важным шагом на пути к «цифровой реальности» [Agreements, ASEAN]. С тех пор были запущены десятки других инициатив по стимулированию цифровизации в рамках АСЕАН.

С начала XXI в. в Юго-Восточной Азии в целом и в АСЕАН в частности наблюдается быстрое распространение цифровых технологий, чему способствует технически подкованное молодое поколение и почти 700-миллионное население региона, 61% которого, т.е. 383 млн, — это люди моложе 35 лет. В регионе АСЕАН произошел резкий рост числа интернет-пользователей — на 100 млн за четыре года с 2015-го и еще на 100 млн с 2019-го. К 2022 г. насчитывалось уже 460 млн интернет-пользователей [ASEAN 2022].

С началом интернет-бума мессенджеры, социальные сети, кар- и кикшеринг, мобильные приложения служб доставки, интернет-банкинг и многие другие «цифровые продукты» стали неотъемлемой частью жизни большинства людей в Юго-Восточной Азии. Распространенность онлайн-покупок подкрепляется доступностью и использованием цифровых устройств. Это стало очевидным на фоне пандемии COVID-19, когда произошел существенный сдвиг в ретейле — из традиционных магазинов в онлайн. В 2022 г., когда пандемия все еще вызывала беспокойство в некоторых отраслях, валовая выручка цифровой экономики Юго-Восточной Азии достигла почти 200 млрд долларов [Bain and Company].

За последние два десятилетия АСЕАН заключила около семидесяти соглашений, программ комплексного развития, рамочных договоренностей, планов действий и связанных с ними деклараций, что показывает, насколько серьезно эта тема освещена в регионе. Это выходит за рамки простого согласования политики государств — членов АСЕАН по содействию торговле и инвестициям в продукты ИКТ и цифровые услуги и сродни многогранной экономической интеграции, которая выходит за рамки либерализации и упрощения процедур торговли товарами, услугами и инвестициями. Такая цифровая интеграция включает в себя несколько ключевых компонентов, в т.ч. развитие инфраструктуры ИКТ, поощрение цифровых инноваций, сотрудничество в области кибербезопасности, создание вспомогательных учреждений для государств — членов АСЕАН, улучшение цифрового образования и развитие цифровых навыков рабочей силы. Важно отметить, что она включает в себя транзакции как между странами, так и внутри страны, например, инициативы, направленные на расширение широкополосного доступа в сельских районах, где отсутствует адекватная связь.

Однако важно подчеркнуть значительные различия среди членов АСЕАН с точки зрения их готовности к цифровой экономике. Например, в Индексе сетевой готовности 2023 г. Сингапур занял 2-е место из 131 страны мира, Малайзия заняла 40-е место, Индонезия — 59-е, а Филиппины — 69-е. Камбоджа и Лаосская Народно-Демократическая Республика, напротив, имеют низкий рейтинг — 108-е и 109-е места соответственно. Это говорит о том, что прогресс стран АСЕАН в области цифровизации пока неоднородный.

Тем не менее, даже отстающие страны предпринимают ощутимые усилия по укреплению своей цифровой экономики. Возьмем, к примеру, Лаос, который осуществляет активные шаги на пути к цифровому будущему. Телекоммуникационная инфраструктура в стране стала доступна для более чем 98% населения. Около миллиона лаосцев пользуются услугами мобильного банкинга, что свидетельствует о развитии цифровой финансовой экосистемы. Более того, в столице появляется все больше цифровых стартапов, что свидетельствует о расцвете предпринимательской деятельности в цифровой сфере [The World Bank 2022].

Камбоджа также предприняла серьезные шаги, благодаря которым удалось достичь быстрых результатов в цифровой трансформации. Страна достигла одного из самых быстрых в мире темпов внедрения цифровых технологий. В 2023 г. количество пользователей мобильных телефонов и интернета превысило население Камбоджи, составляющее 16 млн человек, а число активных пользователей социальных сетей составило 65% от общей численности населения [UNESCO 2023]. Одновременно страны, занимающие передовые позиции, в настоящее время смещают акцент на расширение своего цифрового присутствия, что укрепит позиции АСЕАН в глобальной цифровой экономике.

2. Основные вехи и инициативы на цифровом пути АСЕАН

На пути АСЕАН в цифровую сферу можно выделить основные вехи и стратегические инициативы, формирующие ее траекторию к цифровому интегрированному сообществу.

Первой важной вехой стало заключение Рамочного соглашения об электронной АСЕАН (e-ASEAN) в 2000 г. В этом знаковом документе были определены ключевые цели, включая содействие сотрудничеству для ускорения развития и конкурентоспособности сектора ИКТ, преодоление цифрового разрыва между участниками объединения и внутри каждой из стран, а также активизация взаимодействия между государством и частным сектором для реализации концепции электронной АСЕАН и содействия либерализации торговли ИКТ-товарами, услугами и инвестициями.

Следующей важной вехой стало подписание «Плана создания Экономического сообщества АСЕАН» в 2007 г. К основополагающим целям усиления динамики экономического развития, устойчивого процветания, инклюзивного роста и комплексного развития в документ в рамках расширения экономической интеграции добавлены задачи, связанные с цифровыми технологиями [ASEAN 2012a].

Следующей вехой стало обнародование Плана комплексного развития ИКТ — 2015, в котором отмечались достижения в сфере ИКТ в странах АСЕАН. В частности, речь шла о расширении экспорта ИКТ-услуг, снижении стоимости доступа к интернету и мобильной связи, а также такие успехи, как рост занятости, связанный с развитием ИКТ, цифровизация государственных услуг и информирование о киберугрозах [ASEAN 2015].

В 2015 г. также был разработан проект Экономического сообщества АСЕАН, представляющий собой комплексный стратегический план, направленный на достижение экономической интеграции между государствами — членами АСЕАН. В Плане изложена дорожная карта по преобразованию АСЕАН в единый рынок и производственную базу, способствующую экономическому росту и развитию во всем регионе. План структурирован по четырем ключевым направлениям, а именно: единый рынок и производственная база, конкурентоспособный экономический регион, справедливое экономическое развитие, интеграция в мировую экономику [The ASEAN Secretariat 2008].

В 2016 г. был создан Координационный комитет АСЕАН по электронной торговле, что свидетельствовало о приверженности объединения цифровой интеграции. Комитет, сформированный на совещании старших должностных лиц по экономике, играет ключевую роль в обеспечении сближения секторов ИКТ и электронной торговли, а также реализации инициатив по цифровой интеграции в рамках ассоциации.

Еще одной вехой стал Рамочный план действий по цифровой интеграции (DIFAP), который консолидирует усилия, перечисленные в различных стратегических документах, включая проект Экономического сообщества АСЕАН – 2025 и план комплексного развития ИКТ – 2020. Являясь наиболее полным рамочным документом в рамках АСЕАН, DIFAP охватывает широкий спектр областей, подчеркивая значительные достижения в консолидации цифровой политики [Economic Research Institute for ASEAN and East Asia 2023].

Быстрая цифровая трансформация, ускоренная пандемией COVID-19, дополнительно подчеркнула важность цифровизации в рамках экономической интеграции АСЕАН. Это понимание подтолкнуло АСЕАН к смещению стратегического фокуса на приоритеты цифровой политики и постановке цифровых инициатив на передний план своей повестки дня.

Ожидается, что Рамочное соглашение по цифровой экономике (DEFA) и Повестка дня на период после 2025 г. станут предстоящими вехами, намечающими курс цифрового будущего АСЕАН. В совокупности эти инициативы отражают приверженность АСЕАН целям расширения цифровой экономики и реализации своего видения интегрированного в цифровом отношении сообщества.

3. Возможности АСЕАН в новой цифровой экономике

АСЕАН находится в авангарде самого быстрорастущего цифрового рынка в мире с ежедневным притоком более 100 000 новых пользователей. Пандемия COVID-19 стала катализатором глубокого перехода к цифровой трансформации, приняв в ряды дополнительно 60 млн цифровых потребителей. В результате этого всплеска число интернет-пользователей в АСЕАН в 2022 г. превысило 460 млн, и эта цифра продолжает расти (см. таблицу 1).

Таблица 1. Число интернет-пользователей в Юго-Восточной Азии, млн чел.

|

2019 г. |

2020 г. |

2021 г. |

2022 г. |

|

360 |

400 |

440 |

460 |

Источник: [The ASEAN Magazine 2022]

Помимо традиционных цифровых продуктов еще пять технологических трендов — интернет вещей, большие данные, искусственный интеллект, блокчейн и финтех — изменят экономику АСЕАН и окажут влияние на производство, структуру промышленности и внешнюю торговлю [Asia – Nikei 2021]. Развитие интернета вещей, включая облачные сервисы, межмашинное взаимодействие и сенсорные технологии произведут революцию в различных сферах в АСЕАН. По прогнозам, к 2030 г. 25 млрд взаимосвязанных умных устройств будут обеспечивать эффективность производства, логистики и цепочек поставок, что позволит сократить затраты и повысить производительность. И все это найдет применение в странах АСЕАН.

Большие данные, основанные на сложной аналитике, позволят бизнесу, правительствам и частным лицам использовать массивы информации для принятия решений и совершенствования продукции в режиме реального времени. Понимание данных позволит предприятиям, правительствам и частным лицам отслеживать и совершенствовать свою деятельность, а также принимать решения в режиме реального времени на основе полученной информации. Это также дает организациям возможность совершенствовать свои продукты и услуги для лучшего удовлетворения потребностей клиентов. В сочетании с искусственным интеллектом большие данные меняют такие отрасли, как финансы, улучшают алгоритмическую торговлю и аналитику рынка, а также открывают путь для квантовых вычислений и достижений в области телекоммуникаций.

3.1. Углубленный анализ технологий в регионе

Искусственный интеллект представляет собой преобразующую силу, примером которой является появление генеративного ИИ, такого как ChatGPT [INNOMA 2023]. Используя анализ данных и машинное обучение, ИИ управляет автономным принятием решений и адаптивной робототехникой, что позволяет им работать в различных рабочих средах и постоянно независимо обучаться. Более того, стартапы в области искусственного интеллекта заработали более 2,5 млрд долл. в странах Юго-Восточной Азии [INNOMA 2023], что подчеркивает растущий интерес к искусственному интеллекту в регионе.

Искусственный интеллект, 5G, блокчейн и Web 3.0 способствуют развитию технологического сектора в регионе. В частности, ИИ наращивает обороты — 149 компаний [The New York Times 2023] активно используют его возможности. Эти компании задействуют такие ИИ-технологии, как машинное обучение, глубокое обучение, обработка текстов на естественном языке, компьютерное зрение, прогностическая аналитика, нейросети, древовидная схема принятия решений и кластеризация.

Значительные инвестиции в ИИ-компании подтверждают важную роль интеллекта во внедрении инноваций. Рост инвестиций отражает популярность основанных на данных стратегий, автоматизации и умных решений, направленных на революционное изменение индустриальных норм и повышение эффективности работы.

Блокчейн, который часто ассоциируется с криптовалютой, также представляет собой революционную технологию. Это децентрализованная база данных, функционирующая как открытый и надежный публичный реестр, устойчивый к попыткам взломов и при этом доступный всем. Обеспечивая трансфер ценностей через компьютерные сети, протоколы повышают доверие к транзакциям без какого-либо центрального регулирования. Блокчейн изначально был связан с криптовалютами, но затем продемонстрировал более масштабный потенциал. Его применение охватывает различные секторы, включая финансовые трансакции, ведение учета, системы проверки и смарт-контракты. Например, блокчейн способен совершить революцию в сфере трансграничных переводов, существенно сократив комиссии за операции. Кроме того, он обещает повысить прозрачность и доступность регистрации земли и подтверждения владения активами, одновременно укрепляя целостность государственных отчетов и сервисов, таких как сбор налогов.

Еще одна возможность, которая открывается для АСЕАН в новой цифровой экономике, — это финансовые технологии (финтех), переживающие фактически взрывной рост в регионе. Этому процессу способствует молодое технически продвинутое население, которому удобно совершать цифровые трансакции, а также бум цифровой экономики. Мобильный кошелек и оплата по QR-коду — самые популярные сервисы, а с улучшением доступа к интернету на горизонте появляется перспектива бесшовных трансграничных платежных операций. Финтех оказывает существенное воздействие на финансовую инклюзивность, позволяя быстрее одобрять заявки на кредиты и интегрируя финансовые возможности в повседневную онлайн-деятельность. Затронута и сфера страхования. InsurTech предлагает такие инновационные продукты, как микрострахование, которое привлекательно для тех, у кого нет достаточного доступа к банковским услугам. Но и это еще не всё. Финтех стремится вовлечь талантливых людей, бесшовно интегрировать финансовые услуги в повседневную жизнь и найти баланс между передовыми разработками и прибыльностью.

Перечисленные выше технологии, безусловно, окажут значительное влияние на производительность труда, экономический рост, развитие профессиональных навыков, распределение доходов, благосостояние и экологическую устойчивость в странах АСЕАН. Ряд исследований показывает преимущества, связанные с «будущей промышленной революцией», или индустрией 4.0. Эта революция предполагает интеграцию цифровых технологий в промышленное производство, стимулирование инноваций, эффективности и в некоторых случаях создание новых товаров и услуг [Raykan 2023].

Но как можно преобразовать технологии в преимущества и прибыль для жителей стран АСЕАН? Почему регион заслуживает глобального внимания и какие возможности требуют детального изучения?

3.2. Молодое и технически продвинутое население

Пандемия COVID-19 стала серьезным испытанием на прочность и способность адаптироваться, особенно для молодого поколения. Жители Юго-Восточной Азии продемонстрировали впечатляющие успехи в адаптации к современным реалиям и вызовам. Включившись в цифровизацию, молодежь стран АСЕАН доказала свои умения, стремление к инновациям и готовность использовать открывшиеся в постпандемийную эпоху возможности [The World Economic Forum 2020b].

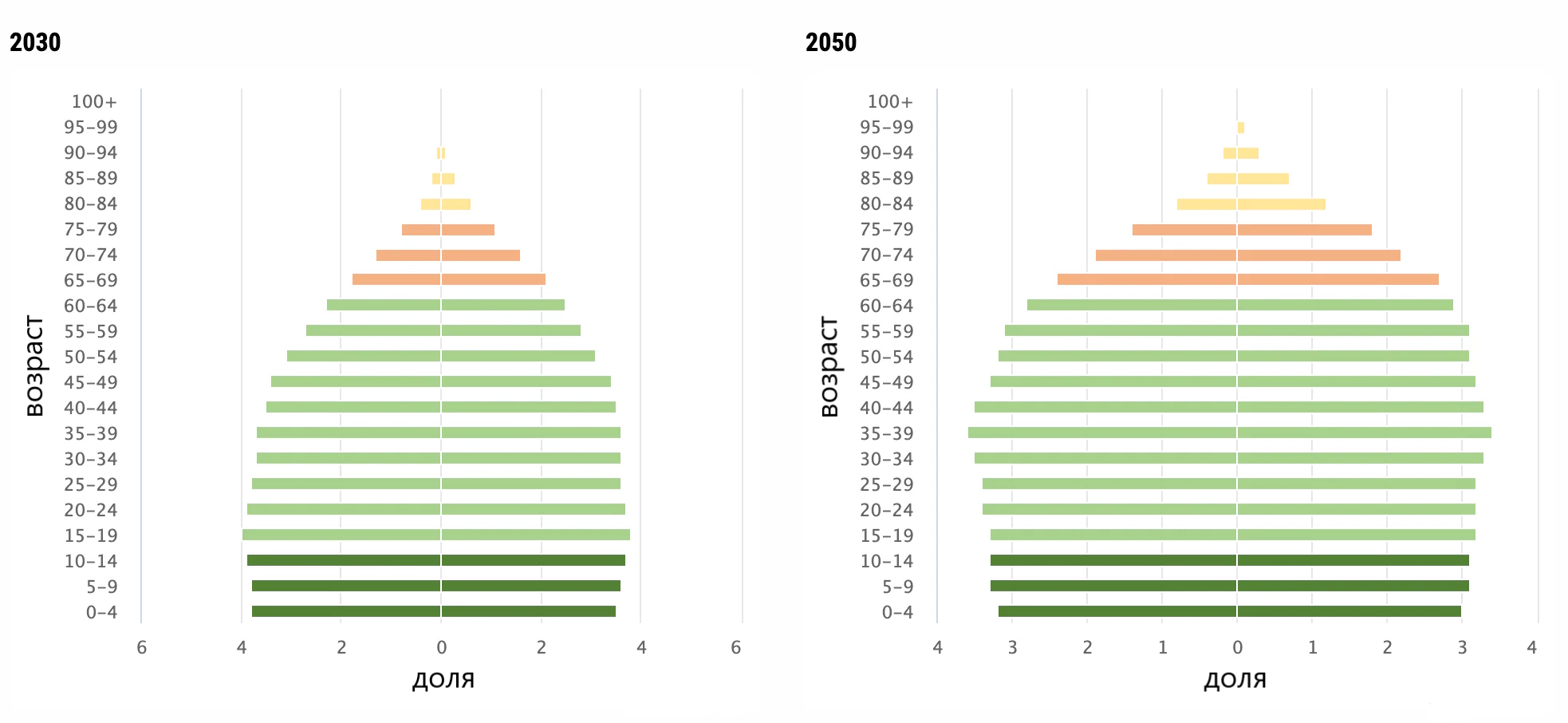

Как следствие, государства — члены АСЕАН становятся свидетелями всплеска цифровой трансформации, способствующей формированию поколения, владеющего технологиями и готового обеспечить устойчивый рост цифровой экономики. Опрос, проведенный среди более чем 68 000 человек в возрасте от 16 до 35 лет в шести странах АСЕАН, дал убедительные выводы. Почти девять из десяти молодых людей сообщили об активном использовании по меньшей мере одного цифрового инструмента в период пандемии, почти половина (42%) освоили хотя бы один новый цифровой инструмент [The World Economic Forum 2020a]. Кроме того, молодежь региона оказалась вовлеченной в различные цифровые виды деятельности, включая онлайн-шопинг, цифровое обучение, электронный банкинг, электронные кошельки, онлайн-игры (GameFi, Play-To-Earn) и исследование метавселенной. (Прогноз для возрастной структуры населения стран ЮВА см. на рисунке 2.)

Цифровой сдвиг не ограничился только потребителями, продавцы тоже охотно приняли цифровую сферу. Как показывают исследования, треть предпринимателей фиксирует рост использования платформ электронной торговли, а четверть из них впервые вышли на эти платформы во время пандемии.

3.3. Растущая цифровая экономика

Иностранные инвесторы все чаще рассматривают технологии и инновации в качестве главных драйверов инвестирования в АСЕАН, обеспечивающих развитие потребительских рынков и сокращение производственных издержек. По прогнозам, к 2030 г. вклад этого региона с населением, превышающим 660 млн человек, в цифровую экономику составит 1 трлн долл. Притоку прямых иностранных инвестиций способствует огромный потенциал цифровой торговли. На фоне инновационного бизнес-ландшафта ожидается, что почти 70% новой добавленной стоимости, создаваемой в АСЕАН в ближайшие 10 лет, будет обеспечено цифровыми платформами [Bloomberg].

Например, доходы интернета вещей к 2024 г., по прогнозам, превысят 60 млрд долл. Кроме того, в регионе зафиксировано создание более 600 крипто- и блокчейн-стартапов, которые привлекли 737 млн долл. инвестиций [Korea Blockchain Week 2023]. Инвесторов все больше привлекают растущие возможности в цифровом ландшафте АСЕАН, в этом процессе лидирует Сингапур с самой передовой экономикой в регионе, занимающий пятое место в Глобальном индексе инноваций.

Рисунок 2. Возрастная структура населения стран Юго-Восточной Азии, 2030-2050 гг.

Источник: [Economic and Social Commission for Asia and the Pacific].

Цифровые платежи переживают настоящий бум в регионе — их объем превысил 800 млрд долл. в 2022 г. Чтобы сохранить конкурентоспособность, предприятия электронной коммерции должны обеспечить бесшовную интеграцию оплаты наличными и цифровых платежей в режиме реального времени, оптимизировав свою работу. Для решения этой проблемы онлайн-продавцы все чаще применяют инновационные финансовые решения «подключи и работай» для таких задач, как сверка денежных потоков и управление платежным циклом [Bloomberg Sponsored 2023].

Развитие данных процессов поддерживается целым набором инновационных решений для финансовых услуг. На фоне распространения цифровых экосистем и эволюции норм регулирования идет новая волна партнерства банков и финтеха по программированию интерфейса приложений, чтобы обеспечить взаимодействие в режиме реального времени. Удобные для пользователя, доступные приложения играют важнейшую роль, особенно в регионе, в котором 70% взрослого населения не имеет доступа к банковским услугам [Temenos 2023]. Поэтому дальнейшее развитие открытых цифровых банковских решений — это значительный шаг на пути к большей финансовой инклюзивности для жителей Юго-Восточной Азии.

Таблица 2. Страны с самым низким уровнем доступа к банковским услугам

|

|

Марокко |

Вьетнам |

Египет |

Филиппины |

Мексика |

Нигерия |

Перу |

Колумбия |

Индонезия |

Аргентина |

|

Население, млн чел. |

36,9 |

97,3 |

102,3 |

109,6 |

128,9 |

206,1 |

33,0 |

50,9 |

273,5 |

45,2 |

|

Население, не имеющее доступа к банковским услугам, % |

71 |

69 |

67 |

66 |

63 |

60 |

57 |

54 |

51 |

51 |

|

Трансакции наличными, % |

41 |

26 |

55 |

37 |

21 |

24 |

22 |

15 |

13 |

18 |

|

Трансакции по картам, % |

27 |

35 |

27 |

22 |

44 |

27 |

62 |

55 |

34 |

45 |

|

Число банкоматов на 100 000 взрослых |

28,6 |

25,9 |

20,1 |

29,0 |

61,5 |

16,9 |

126,7 |

41,3 |

53,3 |

60,9 |

|

Интернет-охват, % |

62 |

66 |

45 |

60 |

66 |

70 |

49 |

62 |

55 |

76 |

Источник: [Mercuryo]

3.4. Региональное сотрудничество

Приверженность АСЕАН региональной интеграции посредством таких инициатив, как Генеральный план цифрового развития — 2025, закладывает фундамент для гармонизации политики, развития инфраструктуры и совместных усилий в сфере кибербезопасности и распространения цифровых навыков. Такой коллективный подход позволит максимально увеличить влияние региона в цифровом пространстве. Документ, опубликованный в январе 2021 г. после первой встречи министров цифрового развития, подтверждает важность ускоренной цифровизации, о которой говорилось в предыдущих планах. Однако План-2025 уделяет значительно больше внимания внедрению цифровых услуг и развитию вспомогательной инфраструктуры [ASEAN 2021]. Для достижения поставленных задач требуется проактивная политика в сочетании с развитием необходимой инфраструктуры, механизмов поддержки и бесшовной интеграции [Quah, Chen 2021].

3.5. Инновационная экосистема

АСЕАН развивает динамичную экосистему стартапов и инноваций, привлекает инвестиции и стимулирует разработку новых цифровых решений, адаптированных к местным потребностям. Такой подход не только создает возможности трудоустройства, но и способствует региональному экономическому росту. АСЕАН проактивно развивает экосистему, в равной степени привлекательную для новаторов, разработчиков, трейдеров, клиентов и потребителей. После трансформирующего влияния COVID-19 во всем мире наблюдается поиск инновационных центров, которые позволят предпринимателям и компаниям осваивать новые возможности через инновационные процессы, продукты и услуги.

Таким образом, существует острая необходимость создать экосистему для поддержки предпринимателей — она обеспечит им доступ на ключевые рынки, финансирование, сети, квалифицированные человеческие ресурсы, учитывая особую значимость новых знаний и обучения. Чтобы добиться роста инновационного предпринимательства, нужно проработать географическое и секторальное распределение. Именно в этом аспекте АСЕАН играет ключевую роль, предлагая растущие рынки, огромное количество профессиональных кадров и инклюзивность, включая основы для обеспечения роста цифровых стартапов в АСЕАН. Главная цель этой структуры — «разработать фундамент жизнеспособной экосистемы для цифровых стартапов в АСЕАН… и стимулировать выработку соответствующими министерствами основанной на передовой практике политики в целях укрепления экосистем стартапов, в особенности в целях продвижения роста цифровых стартапов в странах объединения» [ASEAN 2023]. Чем больше открывается стартапов, тем более зрелой становится предпринимательская экосистема Юго-Восточной Азии, следовательно, закладывается фундамент для последующих поколений стартапов и инноваций, а регион становится примером для подражания в глобальном масштабе.

Кроме того, крайне важно учитывать стратегическое положение и статус, которые АСЕАН приобрела за последние десятилетия. Во-первых, с географической точки зрения Юго-Восточную Азию часто называют «перекрестком мира» [Alberts 2013], т.к. она имеет важное значение для соединения крупных рынков, таких как Китай и Индия, тем самым поддерживая потенциал региональных и глобальных торговых потоков. К тому же АСЕАН активно реализует стратегии прорывного роста, выходя за рамки традиционного поэтапного движения. Так, инновационные решения принимаются не только в электронной коммерции и индустрии развлечений, но и в таких важнейших секторах, как здравоохранение, образование и финансовая доступность. Эти решения обещают решить проблемы в этих сферах и расширить возможности маргинализированных сообществ, сокращая разрыв в развитии внутри государств-членов и между ними.

4. Вызовы

За последние десять лет цифровая трансформация стала одной из самых мощных инноваций, формирующих современную жизнь. Несмотря на некоторое замедление в 2022-м, начиная с 2020 г. технологические стартапы в Юго-Восточной Азии привлекли более 8 млрд долл. АСЕАН может похвастаться более чем 30 стартапами в 2021-м, которые оцениваются в 1 млрд долл. Это свидетельствует об увеличении базы интернет-пользователей в регионе и улучшении доступа к интернету [Yan Ing, Markus 2023]. Однако на пути цифровой трансформации регион по-прежнему сталкивается с различными вызовами.

Главный из них — это цифровой разрыв, т.е. неравномерность скорости интернета и его использования, а также доступа к технологическим продуктам в различных сегментах общества. Кроме того, озабоченность вызывают киберугрозы, которые несут риски для частных лиц, бизнеса и правительств. Вопрос цифровой грамотности остается серьезным вызовом практически везде, поскольку многим не хватает навыков эффективного использования цифрового ландшафта.

Кроме того, существует заметный дефицит профессиональных навыков среди рабочей силы, что препятствует использованию потенциала цифровых технологий в полной мере. Вопросы управления данными, фрагментация норм регулирования и этические проблемы также осложняют цифровую трансформацию в регионе АСЕАН. Необходимо разобраться с этими многофакторными вызовами, чтобы блага цифровизации распределялись равномерно и способствовали инклюзивному росту и развитию всех стран АСЕАН.

4.1. Цифровой разрыв

Одна из главных проблем цифровой трансформации заключается в неравномерном распределении современных технологий, обусловленном ограниченным доступом и возможностями. Готовность стран к новой цифровой эпохе существенно отличается по трем показателям: скорость интернета, пользование интернетом и технологичность производства.

Например, в Камбодже и Мьянме скорость интернета составляет 44 и 20 Мбит/сек соответственно, что заметно ниже лидирующего по скорости Сингапура, где этот показатель более 270 Мбит/с. Ярко выраженные различия в этой области между странами очевидны.

Еще один разрыв связан с использование интернета. В 2020 г. в странах с высоким доходом интернет-охват достигал 90%, в странах со средним доходом — около 45%, а в странах с низким доходом — менее 21%. Рейтинг по доле интернет-пользователей возглавлял Бруней (95,0% населения), затем следовали Сингапур (92,0%) и Малайзия (89,6%). Самые низкие показатели демонстрировали Мьянма (35,1%) и Лаос (33,8%).

Неравномерность инфраструктуры

Сингапур и Малайзия являются лидерами региона по цифровой инфраструктуре. Сингапур может похвастаться практически повсеместным интернет-охватом и современными оптоволоконными сетями. Приоритетом для Малайзии стало расширение зоны покрытия широкополосным мобильным интернетом в сельских районах [Infocomm Media Development Authority]. Такие члены АСЕАН, как Лаос и Мьянма, напротив, сталкиваются с вызовами из-за ограниченного доступа к интернету, особенно в отдаленных районах. Необходимость развития инфраструктуры для преодоления цифрового разрыва в АСЕАН отмечается Азиатским банком развития [Asian Development Bank 2017].

Разрыв в цифровой грамотности

Разрыв в цифровых навыках — еще один ключевой дифференцирующий фактор. В Сингапуре и Таиланде созданы системы обучения, приоритетами которых стали цифровая грамотность и программа STEM (образование на стыке нескольких наук). Таким образом трудовые ресурсы готовят к цифровой экономике. Однако другие члены АСЕАН борются с ограниченным доступом к качественному образованию, особенно в сельских районах. В результате трудовые ресурсы в этих странах менее подготовлены к полноценному участию в цифровой революции [Bangkok Post 2022].

Неравномерность развития электронной торговли

Использование платформ электронной торговли в странах АСЕАН тоже различается. Сингапур с его хорошо развитой цифровой инфраструктурой и высоким уровнем проникновения интернета является лидером по внедрению электронной коммерции [Singapore Business Federation]. Некоторые члены, наоборот, находятся на более ранних стадиях, при этом большая часть населения полагается на традиционные магазины. Существуют различия в инфраструктуре цифровых платежей и логистических сетях, что влияет на рост электронной коммерции во всем регионе [Bloomberg – Sponsored].

Государственная политика и цифровизация

Правительственные инициативы играют ключевую роль в формировании усилий по цифровизации. Некоторые члены АСЕАН, например Сингапур, выработали четкую политику и нормы регулирования, направленные на продвижение цифровизации и привлечение инвестиций в технологический сектор [Smartnation]. Эта политика часто фокусируется на развитии инфраструктуры, развитии талантов и стимулировании инноваций. Другие страны находятся пока на ранних стадиях создания благоприятной нормативной среды для цифровой экономики.

Цифровые государственные сервисы

Сингапур является лидером и в предоставлении цифровых государственных услуг. Граждане и бизнес имеют доступ к широкому спектру услуг онлайн, что упрощает процессы и повышает эффективность [Singapore Government Agency Website]. Другие члены находятся на разных стадиях реализации аналогичных инициатив, причем некоторые сталкиваются с проблемами при внедрении цифровых государственных услуг из-за таких факторов, как ограниченная инфраструктура или более низкий уровень цифровой грамотности среди населения.

4.2. Киберугрозы

В современном цифровом ландшафте киберугрозы превратились из проблем, возникающих периодически, в ежедневный вызов для многих видов бизнеса. От сложных схем фишинга до атак с использованием программ-вымогателей и шпионажа — организации сталкиваются с множеством киберрисков, сложность которых постоянно возрастает. Эти угрозы, использующие даже малейшие уязвимые места, подчеркивают острую необходимость в передовых мерах кибербезопасности для защиты активов и данных клиентов, включая кадровое обеспечение специалистами по кибербезопасности.

К счастью, правительства стран АСЕАН заняли проактивную позицию в вопросе усиления мер кибербезопасности. Посредством выработки и имплементации жестких норм регулирования они намерены обеспечить надежную защиту региона от киберугроз. Такие инициативы, как Стратегия сотрудничества АСЕАН в сфере кибербезопасности, служат примером неизменной приверженности повышению осведомленности и потенциала кибербезопасности в государствах-членах [ASEAN 2022].

4.3. Управление данными в регионе

Необходимость сбалансировать проблемы конфиденциальности данных с потребностью внедрения основанных на данных инноваций подчеркивает важность разработки четких и гармонизированных систем управления данными во всем регионе АСЕАН. Несмотря на цифровую интеграцию, прогресс в регулировании данных происходит медленно. Существующие структуры и планы управления данными в основном состоят из общих принципов. Например, Рамочный документ АСЕАН по защите персональных данных [ASEAN 2012c] излагает принципы защиты персональных данных, а Рамочный документ АСЕАН по управлению цифровыми данными предлагает общие руководящие принципы, но они не имеют обязательной силы [ASEAN 2012b].

В странах — членах АСЕАН действуют разные нормы регулирования в отношении данных, что отражает различия в приоритетах и усилиях по гармонизации законодательства. В некоторых странах вступили в силу всеобъемлющие законы об ограничении потоков данных, другие отдают приоритет нормам защиты. Например, в Индонезии и Вьетнаме приняты законы о локализации данных. В соглашениях о свободной торговле принятие государствами — членами АСЕАН правил использования данных остается непоследовательным. На этом фоне выделяется Сингапур, который в многочисленных соглашениях о свободной торговле прописывает положения, связанные с данными, другие страны берут на себя лишь ограниченные обязательства [Lee 2023].

Однако во многих соглашениях о свободной торговле в рамках АСЕАН есть строгие положения, разрешающие определенные исключения с точки зрения защиты данных, в частности касающиеся национальной безопасности. Различная система регулирования данных в Юго-Восточной Азии препятствует достижению цели АСЕАН по развитию единой цифровой экономики и ставит регион перед проблемами в глобальном управлении данными, подчеркивая необходимость существенных улучшений.

4.4. Фрагментация нормативно-правовой базы

Фрагментированная регулятивная база представляет серьезное препятствие для эффективного функционирования цифровой экономики АСЕАН. Унификация норм регулирования позволит компаниям региона выйти за пределы локальных рынков и охватить более широкий круг потребителей, что обеспечит увеличение доходов. В настоящее время многие компании, работающие в АСЕАН, сталкиваются с ограничениями, обусловленными несовершенством цифрового регулирования на национальном уровне. К этому добавляются различные правила, введенные глобальными торговыми партнерами. Из-за расхождений в регулировании потоков данных фирмы, занимающиеся трансграничной электронной торговлей, вынуждены работать на неоднородном ландшафте. А это не только ведет к увеличению издержек, связанных с соблюдением норм регулирования, но и препятствует участию в цифровой экономике и доступу на рынки АСЕАН. Как показывают исследования, проблемы с трансграничной передачей данных в таких странах, как Индонезия или Вьетнам, потенциально могут сократить их ВВП на 0,5 и 1,7% соответственно. Основным барьером на пути цифровой торговли, как подтверждает большинство опрошенных компаний, являются ограничения информационных потоков [Cory 2020].

Чтобы создать целостную нормативно-правовую базу для региональной цифровой экономики, у АСЕАН и ее торговых партнеров в приоритете должна быть прозрачность при выработке и имплементации цифрового регулирования. Торговый реестр АСЕАН должен быть расширен, чтобы охватить области, влияющие на операции цифрового бизнеса, такие как управление данными и модерация контента, и должен интегрироваться с национальными торговыми репозиториями ключевых торговых партнеров.

АСЕАН необходим системный подход по аналогии с Рамочным соглашением по управлению цифровыми данными и Соглашением по электронной торговле с акцентом на обеспечение безопасных трансграничных потоков данных и вспомогательные приоритетные секторы, чтобы стимулировать рост региональной цифровой экономики. Ускорение реализации Рамочного соглашения АСЕАН по цифровой экономике (DEFA) и АСЕАН+ DEFA повысит открытость, безопасность, взаимодействие и конкурентоспособность цифровых экономик региона [Sithanonxay 2023].

Развивающаяся региональная цифровая экономика обладает огромным потенциалом для модернизации АСЕАН за счет внедрения цифровых технологий, способствуя росту на базе частного сектора. Для реализации этих планов необходима повышенная прозрачность цифрового регулирования, более унифицированная нормативная база в Юго-Восточной Азии и стратегическое сотрудничество с основными мировыми торговыми партнерами.

4.5. Разрыв в цифровой грамотности и навыках

Ликвидировать разрыв в цифровой грамотности и навыках, учитывая различную демографию стран региона, — ключевая задача для обеспечения инклюзивного участия в цифровой экономике и использования преимуществ цифровой трансформации. Опросы показывают, что, хотя большинство молодых людей осознают важность цифровой грамотности для своего будущего, многие чувствуют, что им не хватает достаточных цифровых навыков [Marwaan 2024]. Определенные демографические группы — сельские жители, этнические меньшинства, пожилые люди, как правило, демонстрируют более низкий уровень цифровой грамотности по сравнению с молодежью.

Те, кому не хватает этих знаний, воспринимают цифровую грамотность как важный элемент развития навыков и содействия более эффективному обучению. Такие виды деятельности, как поиск информации онлайн, стали привычными, однако малое число людей занимается более сложными вопросами — созданием цифрового контента или разрешением проблемных задач. Существуют заметные расхождения в уровне цифровой грамотности в странах АСЕАН: в Мьянме и Лаосе меньшее число школьников обучается цифровым навыкам. В некоторых других странах значительная доля молодых людей не проходит официальное цифровое обучение, а качество имеющихся образовательных программ часто оценивается как среднее.

Ограниченный доступ к техническим ресурсам и инфраструктуре в сочетании с неадекватной подготовкой в школах создает серьезные барьеры для повышения цифровой грамотности. Чтобы решить эту проблему, молодежь выступает за увеличение числа практических занятий, расширение доступа к технологиям, предоставление квалифицированных преподавателей и вовлечение всех заинтересованных сторон.

4.6. Этические проблемы

Широкое распространение цифровых платформ вывело на первый план этические проблемы, связанные с конфиденциальностью данных, модерацией онлайн-контента и потенциальным усилением социального и экономического неравенства. Правительства стран АСЕАН осуществляют мониторинг цифрового развития и инициировали стратегии и рамочные соглашения, направленные на решение этих проблем. Более того, АСЕАН совместными усилиями готовит региональное руководство по решению этических вопросов. К работе привлечены правительства, представители промышленности, ученые, активисты гражданского общества. Их цель — максимально расширить блага цифровой экономики и одновременно эффективно и устойчиво минимизировать риски [Lee Kok Thong 2024]. Членам АСЕАН необходимо последовательно продолжать работу над нормами, которые не только решат этические проблемы, но и будут способствовать инновациям в цифровой сфере.

5. Что дальше?

Несмотря на вызовы, созданные глобальной пандемией COVID-19 и продолжающейся геополитической напряженностью, отрасли, использующие цифровизацию, продемонстрировали устойчивость и стабильный рост, а также многообещающие перспективы. В Юго-Восточной Азии цифровизация идет стремительными темпами благодаря притоку новых интернет-пользователей и активному развитию электронной торговли, финтеха, криптосферы, искусственного интеллекта и других видов деятельности. Если заглянуть вперед, будущее цифровой экономики в регионе выглядит многообещающим и открывает огромные возможности для новых инвесторов, которые стремятся диверсифицировать свои инвестиционные портфели и изучают динамичные рынки, обладающие потенциалом устойчивого развития в различных отраслях.

Как отмечалось выше, цифровая экономика стран — членов АСЕАН, по прогнозам, превысит 1 трлн долл. к 2030 г. Траекторию роста поддерживают впечатляющие показатели интернет-охвата в АСЕАН — сегодня это 75%, или 350 млн цифровых пользователей [YCP Solidiance 2021].

Ожидается, что в АСЕАН произойдет значительный рост валовой стоимости товаров электронной коммерции на 62%, который потенциально достигнет 234 млрд долл. к 2025 г., превысив предыдущие оценки в 172 млрд долл. Такой стремительный рост открывает огромные возможности для всех заинтересованных сторон, вызывая растущий интерес со стороны инвесторов, присматривающихся к возможностям региона, в котором АСЕАН занимает лидирующие позиции.

Например, платформы электронной коммерции, независимо от их текущего положения на рынке, по прогнозам, потребуют постоянного притока новых продавцов для поддержания траектории своего роста, тем самым открывая значительные возможности для новых участников и малых и средних предприятий как поставщиков товаров и услуг. Кроме того, предприятия в смежных секторах, таких как логистика, могут извлечь выгоду от электронной коммерции, поскольку растет спрос на такие услуги, как доставка в тот же день и на большие расстояния [YCP Solidiance 2021].

Несмотря на вызовы, АСЕАН остается одним из самых привлекательных регионов мира с точки зрения инвестиций. Правительства стран ассоциации сфокусированы на активном развитии тех сфер, где наблюдается отставание. Об этом свидетельствует, к примеру, План АСЕАН по комплексному развитию сельских районов на 2022–2026 гг. В нем зафиксировано обязательство властей обеспечить внедрение новых цифровых технологий и инноваций в целях развития сельских районов, чтобы ускорить движение региона по пути цифровой трансформации [ASEAN 2021].

Выводы

Цифровая экономика — это трансформирующий путь регионального роста, который открывает множество возможностей для стран — членов АСЕАН. Благодаря все более высокому уровню проникновения интернета ассоциация демонстрирует прочный фундамент для цифрового прогресса и потенциально может стать моделью для других развивающихся регионов Мирового большинства. Однако полный потенциал цифровизации остается нереализованным: существуют значительные пробелы во внедрении и монетизации бизнеса, несмотря на имеющиеся успешные кейсы в частном секторе. Признавая наличие этого потенциала, страны АСЕАН активно формулируют национальные и региональные планы по развитию цифровой экономики.

Для полноценного осуществления цифровой революции АСЕАН необходимо выработать интегрированный подход к сотрудничеству. Правительства стран региона должны продолжать совместную работу по созданию безопасных и привлекательных условий для цифровой экономики. Приоритетными являются пять ключевых сфер: платежная инфраструктура, развитие цифровых навыков, гармонизация политики и норм регулирования, эффективные логистические сети и жесткие рамки управления данными. Сотрудничество особенно необходимо для ликвидации расхождений в нормативной базе, прежде всего касающейся защиты потребителей и конфиденциальности данных. Кроме того, гармонизация регулирования в странах-членах важна для продвижения трансграничных потоков данных и внедрения инноваций.

Хотя вмешательство государства необходимо, чтобы заложить фундамент для преобразований, не менее важно расширить возможности частного сектора как движущей силы инноваций и инвестиций. Оптимизация национальных и региональных планов по цифровой экономике и обеспечение прочного государственно-частного партнерства имеют решающее значение для успешной реализации. Такой совместный подход может обеспечить частному сектору необходимую поддержку и четкую нормативную базу для дальнейшего процветания.

Цифровая экономика потенциально может способствовать инклюзивности в рамках АСЕАН за счет расширения доступа более широких слоев населения к информации и экономическим возможностям. Снижение затрат на мобильную широкополосную связь имеет решающее значение для преодоления цифрового разрыва, позволяя частным лицам и предпринимателям участвовать в глобальном цифровом рынке. Достижения в сфере финансовых технологий ведут к дальнейшей демократизации финансовых услуг, а использование искусственного интеллекта облегчает решение различных задач и резко повышает производительность в различных секторах. Однако при этом важно признать существующий цифровой разрыв как между странами АСЕАН, так и внутри каждой из них. Неравный доступ к интернету, особенно в сельских и отдаленных районах, представляет собой серьезный барьер для инклюзивности. Усилия по преодолению разрыва критически важны для обеспечения равноправного участия в цифровой революции.

Иностранные инвестиции остаются жизненно важным источником капитала для цифровой трансформации АСЕАН. Правительства стран региона активно создают привлекательную инвестиционную среду, предлагая стимулы для иностранных инвесторов. Важно отметить, что инвестиционные возможности выходят за рамки цифровой сферы: значительные потребности в таких секторах, как логистика, розничная торговля и производство, создают диверсифицированные возможности для инвестиционной деятельности.

Используя успешную модель региональной интеграции, АСЕАН имеет хорошие возможности стать лидером в эпоху цифровых технологий. Благодаря совместным усилиям, целевым инвестициям и ориентации на инклюзивность АСЕАН может использовать огромный потенциал цифровой экономики, продвигая регион к процветающему и взаимосвязанному будущему.

Библиография

Agreements, ASEAN. e-ASEAN Framework Agreement. Режим доступа: https://agreement.asean.org/media/download/20140119121135.pdf (дата обращения 13 апреля 2024).

Alberts, T., 2013. Conflict and Conversion: Catholicism in Southeast Asia, 1500-1700 (Introduction: The Crossroads of the World). Oxford: Oxford University Press.

ASEAN, 2024. The Founding of ASEAN. Режим доступа: https://asean.org/the-founding-of-asean/ (дата обращения 10 апреля 2024).

ASEAN +3 Macroeconomic Research Office, 2024. ASEAN+3 Regional Economic Outlook 2024. Режим доступа: https://amro-asia.org/asean3-regional-economic-outlook-2024/ (дата обращения 12 апреля 2024).

ASEAN, 2021. ASEAN Master Plan on Rural Development 2022 to 2026. Режим доступа: https://asean.org/wp-content/uploads/2022/11/34-ASEAN-Master-Plan-on-Rural-Development-2022-2026.pdf (дата обращения 20 апреля 2024).

ASEAN, 1997. 1997 ASEAN Vision 2020. Режим доступа: https://www.icnl.org/wp-content/uploads/Transnational_vision.pdf (дата обращения 13 апреля 2024).

ASEAN, 2012a. Declaration on the ASEAN Economic Community Blueprint. Режим доступа: https://asean.org/declaration-on-the-asean-economic-community-blueprint/ (дата обращения 17 апреля 2024).

ASEAN, 2012b. Framework on Digital Data Governance. Режим доступа: https://asean.org/wp-content/uploads/2012/05/6B-ASEAN-Framework-on-Digital-Data-Governance_Endorsedv1.pdf (дата обращения 19 апреля 2024).

ASEAN, 2012c. Framework on Personal Data Protection. Режим доступа: https://asean.org/wp-content/uploads/2012/05/10-ASEAN-Framework-on-PDP.pdf (дата обращения 19 апреля 2024).

ASEAN, 2015. ASEAN ICT Masterplan 2015. Режим доступа: https://asean.org/wp-content/uploads/images/2015/December/telmin/ASEAN%20ICT%20Completion%20Report.pdf (дата обращения 17 апреля 2024).

ASEAN, 2021. ASEAN Digital Master Plan 2025. Режим доступа: https://asean.org/wp-content/uploads/2021/09/ASEAN-Digital-Masterplan-EDITED.pdf (Дата обращения 19 апреля 2024).

ASEAN, 2022. ASEAN Cybersecurity Cooperation Strategy. Режим доступа: https://asean.org/wp-content/uploads/2022/02/01-ASEAN-Cybersecurity-Cooperation-Paper-2021-2025_final-23-0122.pdf (дата обращения 19 апреля 2024).

ASEAN, 2023. Framework for Promoting The Growth of Digital Startups in ASEAN. Режим доступа: https://asean.org/wp-content/uploads/2023/03/1.Framework-for-Promoting-the-Growth-of-Digital-Startups-in-ASEAN-1.pdf (дата обращения 19 апреля 2024).

Asian Development Bank, 2017. Meeting Asia's Infrastructure Needs. Режим доступа: https://www.adb.org/publications/asia-infrastructure-needs (дата обращения 01 июня 2024).

Asia-Nikei, 2021. ASEAN‘s Digital Economy Projected to Hit $1tn by 2030. Режим доступа: https://asia.nikkei.com/Business/Business-trends/ASEAN-s-digital-economy-projected-to-hit-1tn-by-2030 (дата обращения 17 апреля 2024).

Bain and Сompany, 2022. e-Conomy SEA 2022. Режим доступа: https://www.bain.com/insights/e-conomy-sea-2022/ (дата обращения 27 мая 2024).

Bangkok Post, 2022. Education Reform Project Aligns with Thailand 4.0. Режим доступа: https://www.bangkokpost.com/thailand/general/2258299/education-reform-project-aligns-with-thailand-4-0 (дата обращения 01 июня 2024).

Bloomberg – Sponsored. Open for Business: Southeast Asia’s Digital Payments Revolution. Режим доступа: https://sponsored.bloomberg.com/article/hsbcasean/open-for-business-southeast-asia-s-digital-payments-revolution) (дата обращения 01 июня 2024).

Bloomberg Sponsored (by Standard Chartered), 2023. Banking On ASEAN’s Digital Economy. Режим доступа: https://sponsored.bloomberg.com/article/sc/banking-on-asean-s-digital-economy#_ftn13 (дата обращения 18 апреля 2024).

Bloomberg. How Digital Technology Is Transforming Asia’s Economy. Режим доступа: https://sponsored.bloomberg.com/article/axa-investment-managers/whats-driving-asias-digital-evolution (дата обращения 18 апреля 2024).

Cory, N., 2020. Surveying the Damage: Why We Must Accurately Measure Cross-Border Data Flows and Digital Trade Barriers. Режим доступа: https://itif.org/publications/2020/01/27/surveying-damage-why-we-must-accurately-measure-cross-border-data-flows-and/ (дата обращения 19 апреля 2024).

Economic and Social Commission for Asia and the Pacific. A significant proportion is made up of young generations who are receptive to blockchain. Режим доступа: https://www.population-trends-asiapacific.org/data/sea (дата обращения 28 мая 2024).

Economic Research Institute for ASEAN and East Asia, 2023. ASEAN’s Digital Integration: Evolution of Framework Documents. Режим доступа: https://www.eria.org/uploads/media/Books/2023-ASEAN-Digital/5_Executive-Summary.pdf (дата обращения 17 апреля 2024).

Infocomm Media Development Authority. Internet Penetration Rates. Режим доступа https://www.imda.gov.sg/about-imda/research-and-statistics/telecommunications (дата обращения 01 июня 2024).

INNOMA, 2023. Southeast Asia’s Venture Market Dynamics in Post-COVID Era. Режим доступа: https://innoma.vc/2024/02/09/southeast-asia-vc-report-2024/ (Дата обращения 17 апреля 2024).

Korea Blockchain Week, 2023. Blockchain and crypto in Southeast Asian countries. Режим доступа: https://koreablockchainweek.com/blogs/kbw-blog/blockchain-and-crypto-in-southeast-asian-countries (дата обращения 18 апреля 2024).

Lee Kok Thong J., 2024. The Right to Data Privacy in the Digital Economy. Режим доступа: https://theaseanmagazine.asean.org/article/the-right-to-data-privacy-in-the-digital-economy/ (дата обращения 20 апреля 2024).

Lee, J., 2023. ASEAN’s Window of Opportunity for Shaping Global Data Governance. Режим доступа: https://thediplomat.com/2023/09/aseans-window-of-opportunity-for-shaping-global-data-governance/ (дата обращения 19 апреля 2024).

Marwaan, M.M., 2024. ASEAN's digital economy growth hinges on upskilling: BCG chair. Режим доступа: https://asia.nikkei.com/Editor-s-Picks/Interview/ASEAN-s-digital-economy-growth-hinges-on-upskilling-BCG-chair (дата обращения 20 апреля 2024).

McKinsey, 2024. Southeast Asia quarterly economic review: Proving resilient [e-journal]. Режим доступа: https://www.mckinsey.com/featured-insights/future-of-asia/southeast-asia-quarterly-economic-review (дата обращения 12 апреля 2024).

Mercuryo, Unbanked Regions in Asia. Режим доступа: https://mercuryo.io/explore/article/unbanked-asia (дата обращения 28 мая 2024).

Quah S, Chen K., 2021. Digital masterplan. Getting the next five years right for ASEAN // The Business Times, 19(1). Режим доступа: https://lkyspp.nus.edu.sg/docs/default-source/aci/digital-masterplan-getting-the-next-five-years-right-for-asean.pdf?Status=Temp&sfvrsn=a4632b0a_2 (дата обращения 19 апреля 2024).

Rayhan, Abu, 2023. The Future of Work: How AI and Automation Will Transform Industries. Режим доступа: https://www.researchgate.net/publication/372589640_THE_FUTURE_OF_WORK_HOW_AI_AND_AUTOMATION_WILL_TRANSFORM_INDUSTRIES

Singapore Business Federation. E-commerce in Singapore. Режим доступа: https://www.sbf.org.sg/ (дата обращения 01 июня 2024).

Singapore Government Agency Website, Singapore Government Services. Режим доступа: https://go.gov.sg/#/ (дата обращения 01 июня 2024).

Singh S., 2022. ASEAN Goes Full Throttle on Digital Transition. Режим доступа: https://theaseanmagazine.asean.org/article/asean-goes-full-throttle-on-digital-transition/ (дата обращения 15 апреля 2024).

Sithanonxay, S., 2023. Fragmented Digital Regulations are Constraining ASEAN’s Digital Economy. Режим доступа: https://fulcrum.sg/fragmented-digital-regulations-are-constraining-aseans-digital-economy/ (дата обращения 19 апреля 2024).

Smartnation. Singapore’s Smart Nation Initiative. Режим доступа: https://www.smartnation.gov.sg/ (дата обращения 01 июня 2024).

Temenos, 2023. Charting the Future of Banking in ASEAN. Режим доступа: https://www.temenos.com/news/2023/08/21/charting-the-future-of-banking-in-asean/ (дата обращения 18 апреля 2024).

The ASEAN Magazine, 2022. Digital Economy: Facts and Figures. Режим доступа: https://theaseanmagazine.asean.org/article/digital-economy-facts-and-figures/ (дата обращения 28 мая 2024).

The ASEAN Secretariat, 2008. ASEAN Economic Community Blueprint. Режим доступа: https://www.asean.org/wp-content/uploads/images/archive/5187-10.pdf (дата обращения 27 мая 2024).

The New York Times, 2023. How ChatGPT Kicked Off an A.I. Arms Race. Режим доступа: https://www.nytimes.com/2023/02/03/technology/chatgpt-openai-artificial-intelligence.html (дата обращения 17 апреля 2024).

The World Bank, 2022. Positioning the LAO PDR for a Digital Future. Режим доступа: https://thedocs.worldbank.org/en/doc/c01714a0bc2ca257bdfe8f3f75a64adc-0070062022/original/Positioning-The-Lao-PDR-for-a-Digital-Future-11-10-22.pdf (дата обращения 16 апреля 2024).

The World Economic Forum, 2020a. COVID-19 – The True Test of ASEAN Youth’s Resilience and Adaptability Impact of Social Distancing on ASEAN Youth. Режим доступа: https://www3.weforum.org/docs/WEF_ASEAN_Youth_Survey_2020_Report.pdf (дата обращения 18 апреля 2024).

The World Economic Forum, 2020b. Young people in ASEAN have emerged from lockdowns more resilient and digitally switched on. Here’s how. Режим доступа: https://www.weforum.org/agenda/2020/10/young-people-asean-digital-adoption-covid-19/ (дата обращения 17 апреля 2024).

UNESCO, 2023. UNESCO and Partners to Lead Workshop on Digital Transformation in Cambodia. Режим доступа: https://www.unesco.org/en/articles/unesco-and-partners-lead-workshop-digital-transformation-cambodia (дата обращения 16 апреля 2024).

United Nations. UN Chronicle, A Special Partnership With the UN: An Asian Perspective. Режим доступа: https://www.un.org/en/chronicle/article/special-partnership-un-asian-perspective (дата обращения 13 апреля 2024).

Yan Ing L., Markus I., 2023. ASEAN Digital Community 2040, Economic Research Institute for ASEAN and East Asia. Режим доступа: https://www.eria.org/uploads/media/policy-brief/FY2022/ASEAN-Digital-Community-2040..pdf (дата обращения 19 апреля 2024).

YCP Solidiance, 2021., Digital Economy Growth in ASEAN. Режим доступа: https://ycpsolidiance.com/article/digital-economy-growth-in-ASEAN (дата обращения 20 апреля 2024).

Примечания

1 World Economic Forum. These Are the Places in the World Where Internet Access Is Still an Issue – And Why. Режим доступа: https://www.weforum.org/agenda/2023/09/broadband-no-luxury-basic-necessity/ (дата обращения: 10 апреля 2024).

.jpg)