International Trade Under "Slowbalization": Latest Trends

[Чтобы прочитать русскую версию статьи, выберите русский в языковом меню сайта.]

Elena Sapir — professor, head of the Department of World Economy and Statistics, P.G. Demidov Yaroslavl State University.

Scopus Author ID: 56529364900

ORCID: 0000-0002-2754-0985

Alexander Vasilchenko — junior researcher at the Institute of Europe of the Russian Academy of Sciences, postgraduate student of the Department of World Economics and Statistics, P.G. Demidov Yaroslavl State University

Scopus Author ID: 57219454963

ORCID: 0000-0002-4904-1562

For сitation: Sapir, E., Vasilchenko, A., 2024. International Trade under “Slowbalization”: Latest Trends. Contemporary World Economy, Vol. 2, No 4.

Keywords: international trade, global value chains, slowbalization, vertical specialization, Industry 4.0, servitization.

Abstract

This article presents the results of a comparative analysis of global trends in world trade after the global financial crisis of 2008–2009, with special focus on the balance of macroregions in international trade, their self-sufficiency in the supply of intermediate goods, and the growing role of services in the transformation of the architecture of economic globalization at the current stage. The research methodology was based on quantitative indicators of trade openness, geographical concentration and participation in global value chains. As a result, it was found that since 2009, international trade openness has been declining in Asia, remaining at precrisis levels in North America and increasing in Europe, with Asia displacing Europe as the largest macroregion in terms of merchandise exports. Asia and North America strengthened the regional component of value chains during this period, while Europe increased its dependence on external intermediate supplies. It is found that international trade in services continued to grow in absolute and relative terms after 2009. China and India have been integrating into the “service” segments of value chains at a faster pace, strengthening their weight in relation to developed countries. It appears that the growth potential of international trade in services is far from being exhausted. It is this sector that could be the engine of the future wave of economic globalization.

Introduction

In recent decades, the world economy has undergone multidirectional trends in the development of intercountry commodity exchange and cooperation. Two of these factors have garnered particular interest from researchers. The terms “hyperglobalization” and “slowbalization” are often used to describe the increasing interconnectedness of the global economy and the growing influence of global markets. Hyperglobalization is defined in the extant literature as a process of accelerated densification of trade and production ties between countries and regions of the world. This process is accompanied by a rapid growth of exports in relation to GDP, increasing countries’ interdependence in global value chains (GVCs), and a burgeoning influence of multinational enterprises (MNEs) [Antràs 2020]. Conversely, slowbalization is manifested in decelerating development of established and practical trade and economic ties between nations [Linsi 2021]. The term’s semantic content frequently encompasses the processes of strengthening protectionism and increasing autonomy of the national economy [Benabed, Moncea 2024]. In the Report of the European Parliament for 2020, slowbalization is contemplated within the framework of five dimensions: trade in goods and services, an open financial system, the exacerbation of inequality, tourism and migration, and the digitalization of the economy and society [Kononenko et al. 2020]. Concurrently, the term “slowbalization” is broadly deemed in the literature to be synonymous with “deglobalization” or “fragmentation.” It is our contention that the latter two categories reflect conceptually different processes. Deglobalization, understood as the process opposite to globalization, is defined as a weakening of the unity and integrity of the world economic system through the strengthening of regional and local trade and economic, investment, monetary, financial, infrastructural, and other economic cooperation between countries. Fragmentation, in turn, implies the isolation of territorial economic entities in the context of the distorting trade and economic relations among the leading global economic actors. As it will be demonstrated subsequently in the paper, at the present moment, there is inadequate evidence to support the propositions of deglobalization or fragmentation in the world economy.

The period of hyperglobalization is associated with the end of 20th – beginning of 21st century. The volume of world exports for 25 years increased from 5 to 16 trillion dollars. Its share in world GDP increased from 16 to 25% [UNCTAD Stat]. During this period, world economic relations were undergoing a transformation under the “second unbundling,” namely the simultaneous reduction of control and coordination costs [Baldwin 2016]. Between 1995 and 2007, the cost of storing information in a computer plummeted from $5 million to $20,000 per terabyte.1 Technological innovations enabled multinational firms to pursue extensive outsourcing policies, which gave a significant boost to trade in intermediate products. Over the same period, developed countries’ exports of intermediates grew from about $300 million to about $1.5 trillion [UNCTAD Stat]. Meanwhile, it is worth recognizing that the unfolding of global value chains at this stage took the form of a mesh of dense regional production networks; linkages between macroregions were critical but not dominant [Stephenson 2013].

However, as experts underscore, the terminal point of the hyperglobalization era was the global financial crisis of 2008–2009. The collapse of the US banking system inflicted a cascade of multidirectional destructive shocks that painfully affected the real sector of the economy in most countries of the world. Such a resounding shock to the world economy shattered illusions about the infinite multiplication of the benefits of economic globalization. Both large companies and national governments have been challenged to reprioritize their cooperation with foreign partners. The policy of economic reindustrialization [Capello, Cerisola 2023], manifested in the reshoring of production and fostering of the developed countries’ domestic resource and technological base in critical industries, became the cumulative form of response to external shocks. States and businesses sought to reduce dependence on foreign counterparties or to “simplify” and “shrink” trade and cooperation ties in order to throttle the channels of shock propagation. An additional incentive for reshoring was the reduction of costs in Western countries for operations previously offshored to Southeast Asia driven by an automation and technological development.

Meanwhile, the 2008–2009 crisis itself was not the sole driver of the slowdown in economic globalization. For example, the growth of China’s position in the world economy was increasingly supported by domestic sources, which was reflected in the growth of the average labor remuneration in the country. While in 2010 the gap between China and the US was about 7 times, by now it has narrowed to about 3 times.2 In the post-crisis period, R&D expenditures in relation to GDP in China increased by 1 p.p. (from 1.5% to 2.5%); Chinese corporations now receive about $10 billion in annual revenues for the use of intellectual property, which is 10 times higher than in 2010.3 Under these conditions, the benefits of outsourcing production from developed countries to China have come to naught; moreover, multinational enterprises in the United States and Europe are facing the challenge of technological competition from the Chinese “Celestial Empire.” Thus, the “factory China” model of trade and production globalization has de facto faded into oblivion.

However, it seems that the underlying causes of the slowdown in economic globalization lie in the exhaustion of the organizational and technological potential of global expansion in tangible production sectors. Production fragmentation in sectors such as automobiles or electronics has reached its natural limits, where further fragmentation of individual operations becomes problematic [Brakman, van Marrewijk 2022]. The potential for geographical expansion of material production has also shrunk significantly. The multilink GVC architecture of the hyperglobalization period, served by an extensive network of international maritime logistics, proved unviable amidst supply chain disruptions. For instance, according to UNCTAD estimations,4 the increase in the cost of maritime transportation in 2020 has led to an annual increase of 1.7% in average world prices for consumer goods and 3.3% for intermediate goods. Last but not least, significant technological convergence in the world economy of the hyperglobalization period could, following Torrens’ law of diminishing trade [Torrens 1821], cause an increase in the share of non-traded goods in the world GDP.

At the same time, it appears reasonable to maintain that the slowbalization of the world economy is not a precondition for deglobalization and fragmentation, but rather a natural attribute of globalization manifesting an essential transformation of its underlying mainstays. The article aims at a comparative analysis of global trends in world trade in the aftermath of the crisis of 2008–2009 and revealing the growing role of services in the transformation of the architecture of economic globalization at the present stage.

Literature review

Modern scientific works pay close attention to the problem of development of international trade and global value chains in the period after the global financial crisis. Aspects of rebalancing the role of principal actors in the world economy, as well as potential drivers of further development of trade and economic cooperation between countries are critically dissected.

As V.G. Varnavskii [Varnavskii 2024] notes, in the post-crisis period the dynamics of international trade desynchronized with the world GDP, which demonstrated steady growth before the COVID-19 pandemic crisis. This phenomenon, according to the author, explains the growth of competition in the world commodity markets and the subsequent strengthening of trade protectionism. Varnavskii also points out that international trade has reached a certain “stationary state” and the potential for further growth has been exhausted. At the same time, in the second decade of the 21st century the problem of trade imbalances between countries and regions of the world has become pronounced. Since 2010, the cumulative average annual global current account deficit amounted to about $1.2 trillion [UNCTAD Stat]. This trend is particularly evident in Europe [Giovanetti et al. 2023]. The region’s economies in the post-2009 period have collectively run substantial trade deficits with China in both consumer goods (about $120 billion per year) and, most importantly, capital goods with the average annual deficit increased from $60 billion in 2009 to $120 billion in 2021 [UNCTAD Stat]. A.V. Kholopov [Kholopov 2022] articulates the following reasons for the growth of trade imbalances: the bias toward consumer spending as a driver of GDP growth in the United States, the growing propensity for deferred consumption against the background of the aging world’s population, as well as the global savings glut triggered by limited capacity of financial markets in developing countries.

In the aftermath of the crisis of 2008–2009, the trend toward regionalization of the trade in finished and intermediate products become more pronounced. A.A. Maltsev [Maltsev 2024] in his paper stresses that in recent years domestic production of finished goods in the United States significantly outstrips its import from Asian countries with traditionally low production costs. Meanwhile, in the author’s opinion, reshoring still has not established itself as the modus operandi of developed economies at the present stage; the processes of branching of economic globalization shreds occur in new forms, although “reshoring” economies accelerate the “vicious circle” of value chain compression.

A recent IMF study [Gopinath et al. 2024] also underscores the limited nature of the closure of trade and production ties at the present stage. According to estimations, the intensity of trade between political blocs is currently decreasing in relation to intra-bloc trade, but the scale of weakening is not comparable to the Cold War period. As the authors of the report note, geo-economic fragmentation neither at the current stage nor in the past has facilitated deglobalization. That said, the nature of this speculative contradiction is diverse. The fragmentation of the mid-20th century manifested itself through regional economic fragmentation within political blocs; subsequently, international trade underwent a rapid surge with the integration of Eastern European countries into the world economy. Today, however, the situation looks different. The relative sustainability of trade on a global scale is ensured by the so-called “connector countries” that ensure value-added spillovers. Both examples illustrate the prevalence of centripetal forces in the world economy, which is not conducive to the implementation of localization strategies.

A rather sharp criticism of how GVC regionalization processes are reflected in the academia is presented in the work of B. Thakur-Weigold and S. Miroudot [Thakur-Weigold, Miroudot 2024]. The authors consistently challenge the thesis that foreign sourcing reduces the sustainability of the value chain. The line of argumentation grounds on empirical evidence revealing that during crises economies sustaining a dense network of trade links mitigating the negative shock managed to recover faster and adapt to new challenges. According to the researchers, global value chains have become so complex and filled with unique country-specific technologies in recent decades that localization of critical links in the chain today appears unfeasible for any country. For this reason, the authors conclude, reshoring affects primarily assembly plants; it only redistributes, not eliminates, risks across the value chain.

Nonetheless, this view of the international trade resilience has a downside. Field experts note the growing share of so-called “bottleneck products” with low elasticity of substitution and a high degree of geographical concentration of supply. According to Borin, Mancini and Taglioni [Borin et al. 2021], pharmaceuticals and computer production are the most exposed to the risk of bottleneck products supply shortages. In addition, the estimated model suggests that participation in the GVCs reduces the negative effects of shocks to the national economy and trade in final goods while increasing the susceptibility to disruptions in production linkages that can cascade to other sectors of the economy. The cornerstone position of China in the supply chain of bottleneck products is highlighted in the work of R. Baldwin [Baldwin et al. 2023]. Based on the original index of on external imports’ dependence, the reliance of the US industry on supplies from China after 2009 increased approximately 1.5 times, the similar dependence of Germany and Japan doubled.

The magnification of GVC related risks in industrial sectors also unbalanced modes of integration in certain macroregions. To note, the EU countries manage to effectively reduce dependence on external critical supplies through functional diversification of national economies. At the same time, these strategies are implemented under low inter-national coordination, which undermines the sustainability of economic integration [Coveri, Zanfei 2023].

To recap, the authors by and large agree that economic globalization is far from being over. It is also speculated that the current slowbalization is merely a specific phenomenon that will not alter long-term trends [Roudometof 2024]. The current stage of economic globalization is probably a period of its transformation. As rightly outlined by E. Marvasi [Marvasi 2023], “in the new type of globalization, security and resilience matter more than mere efficiency as businesses need to find reliable partners in countries linked by stable relationships.” Meanwhile, the mainstream discourse in the literature tends to assess trade and GVCs from the perspective of material flows. It is likely that the new wave of trade and economic cooperation between the countries will take place in intrinsically different planes of the world economy. This paper attempts to trace some promising development paths of future economic globalization.

Methodology

In order to answer the research question, the authors applied a number of quantitative methods allowing for uncovering structural imbalances in how countries and regions participate in international trade and global value chains.

First, the basic indicators of foreign trade in goods of the enlarged regions of the world—Asia, Europe and North America are calculated. The region’s share in world merchandise exports, as well as the export quota indicator (formula 1), which reflects the importance of foreign demand for the formation of national income are estimated.

|

(1) |

Where i – macroregion of study, – commodity export quota, – commodity exports, – GDP. The indicator takes values from 0 to 100, where 100 corresponds to the absolute dependence of the country’s national income on foreign demand.

The paper further assesses indicators of the efficacy of mobilizing labor resources to solidify the region’s position in international trade. In particular, the ratio of the region’s share in international trade to its share in the world population is studied. A value of the indicator greater than one indicates that the region utilizes labor to expand trade connections more effectively than the average of all countries in the world, and vice versa.

Specific attention is paid to the indicators of GVC participation of countries and enlarged regions. At the level of macroregions, the change in the value added content of domestic commodity exports produced by other regions is assessed (formula 2). Positive values of the indicator trigger increased regional economy’s dependence on foreign intermediate supplies, and vice versa.

|

(2) |

Where i is the exporting region, j is the region of value added origin, is j’s value added in i’s merchandise exports, is i’s merchandise exports.

Similar analysis is conducted at the national level within individual macroregions. Reconfiguration of regional value chains, as well as rebalancing of inter-country production linkages are investigated.

For the five largest economies of the world by GDP in current prices for 2023, namely China, the United States, India, Germany and Japan, the change in the GVC position of individual sectors is assessed. For this purpose, the dynamics of the vertical specialization index [Hummels et al. 2001] is studied (formula 3), which allows for an identification of tangible production sectors in which the country is more actively involved in cooperation with third countries.

|

(3) |

Where – indicator of vertical specialization of country i in sector p, – exports of sector p of country i, – matrix of technical coefficients of imports of country i, – “Leontief inverse” for internal production linkages of country i, – total exports (goods and services) of country i. The indicator takes values in the range from 0 to 1, where growth indicates an increase in the country’s dependence on imports for the production of exported goods and services.

At the final stage of the study, the frontier aspects of international trade in services are studied. In particular, the export quota indicator, reflecting the contribution of services exports to the regions’ GDP, is also estimated. Then the degree of concentration of exporting countries in international trade in services is analyzed by quantifying the Herfindahl-Hirschman index (formula 4). It is assumed that increasing geographical concentration indicates the dominance of a limited number of countries, which reduces the opportunities for other players to establish additional trade and cooperation linkages.

|

(4) |

Where – Herfindahl-Hirschman index, – country i exports of goods (services), – world exports of goods (services).

Finally, the share of value added of business services (R&D, engineering, etc.) incorporated in merchandise exports of macroregions is estimated. The research hypothesis is that with the advent of Industry 4.0 and widespread adoption of automated and digital technologies, an increasingly large portion of value of final products is attributable to manufacturing services that maintain production and perform specific functions (e.g. robot manipulators).

Results

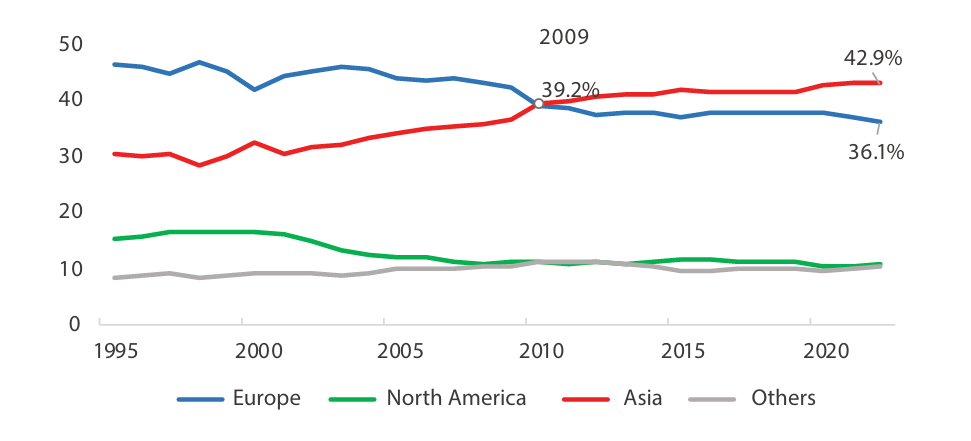

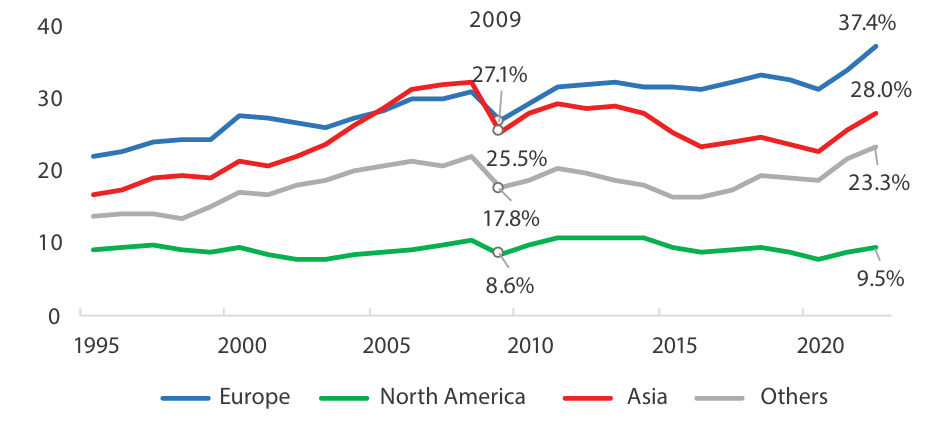

In the aftermath of the global financial crisis, a notable shift occurred in the leading region in world merchandise trade. Europe’s preeminent position was superseded by Asia, primarily at the expense of China (see Figure 1). In 2009, the regions’ shares in world merchandise exports were almost equal (39% each), but in recent years, Asia’s share has been approximately 7 percentage points higher than Europe’s. North America’s involvement in global merchandise trade remains marginal, underscoring the region’s persistent reliance on domestic consumption as a primary contributor to its GDP.

Figure 1. Share of the region in world merchandise exports, %

Source: authors’ elaboration on UNCTAD Stat.

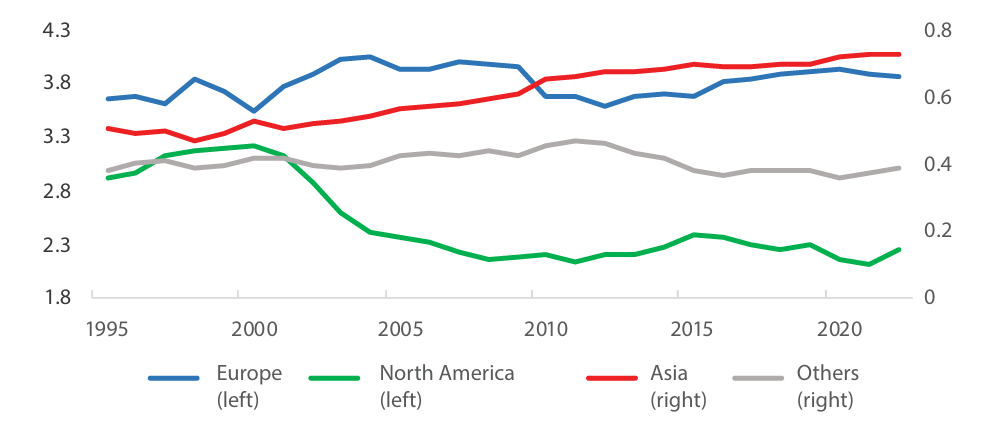

Considering the prevailing trend of slowbalization, numerous experts frequently cite the export quota indicator, which has remained static since 2009 in the calculation of global exports. Concurrently, within the context of specific regions worldwide, it is evident that while the indicator exhibits a decline in Asia following a period of accelerated growth from 1995 to 2009, the ratio of total exports from European countries to GDP is growing steadily at a rate comparable to the period of hyperglobalization (refer to Figure 2). The dynamics of the indicator for Asia can be attributed to the increase in domestic demand in China, as well as the superior growth of domestic investment. Moreover, the Chinese economy has fallen into the so-called “middle-income trap,” and China’s exported products have lost their former competitiveness on the international market. Europe’s GDP is contingent on external markets, suggesting that the regional economy exhibits inadequate capacity.

Figure 2. Share of merchandise exports in GDP by world regions, %

Source: authors’ elaboration on UNCTAD Stat.

As shown in Figure 3, the ratio of the Asian region’s share in world merchandise exports to its share in world population has exhibited a consistent increase throughout the observation period, approaching unity after 2009. As long as China is concerned, this phenomenon can be attributed, in part, to the observed decline in fertility rates over recent decades. Concurrently, the analogous indicator for Europe exhibits a substantially higher level. The region’s contribution to global merchandise exports is approximately fourfold its contribution to global population.

Figure 3. Ratio of the region’s share of world merchandise exports to the region’s share of world population

Source: authors’ elaboration on UNCTAD Stat.

With respect to global GDP, the state of events appears to be somewhat different. While the contribution of the United States and Europe to world GDP is an order of magnitude higher than their contribution to world population (5.8 and 2.5 times, respectively), Asia’s share in world GDP is slightly more than half of its share in world population (see Figure 4). However, the positive dynamics of the indicator for Asia (+20%) denotes an increase in the efficiency of utilizing the region’s labor resources for value creation. A negative trend has been observed in Europe. From 2009 to 2021, the ratio of the region’s share in world GDP to its share in world population decreased by 22%, symbolizing a decline in the overall competitiveness of the European economy.

Figure 4. Ratio of the region’s share of world GDP to the region’s share of world population

Source: compiled by the authors on the basis of UNCTAD Stat.

The post-global financial crisis structural shifts in global value chains are also regionally specific (see Table 1). During the period of hyperglobalization, the regional component of value added of merchandise exports contracted in Asia, Europe, and North America. Put differently, each region established robust cooperative networks with other regions globally. Nonetheless, during the period of globalization in Asia and North America, there was an observable trend of accelerated growth in domestic value added relative to foreign value added. Consequently, the regions reinforced their autonomy in the production of exported goods. Meanwhile, Europe persisted in augmenting the external component of export value added from 2007 to 2019, thereby fortifying its reliance on foreign suppliers.

Table 1. Value added growth in exports of world regions, p.p.

|

Region of origin of value added |

Exporting region |

|||||

|

East and South-East

|

Europe

|

North America

|

||||

|

1995–2007 |

2007–2019 |

1995–2007 |

2007–2019 |

1995–2007 |

2007–2019 |

|

|

Africa |

0.1 |

-0.1 |

0.1 |

0.0 |

0.1 |

-0.2 |

|

East and South-East Asia |

-4.9 |

2.1 |

0.8 |

1.1 |

0.1 |

-0.1 |

|

Europe |

0.9 |

-0.7 |

-2.7 |

-2.2 |

0.5 |

-0.6 |

|

North America |

0.0 |

-0.6 |

0.5 |

1.1 |

-1.9 |

1.7 |

|

South and Central America |

0.5 |

-0.1 |

0.1 |

0.1 |

0.2 |

-0.1 |

|

Other countries |

3.4 |

-0.6 |

1.3 |

0.1 |

1.0 |

-0.8 |

Source: authors’ elaboration on OECD TiVA data.

On the level of individual countries, more detailed facets of the transformation of value-added flows in the world can be traced (see Table 2). From 1995 to 2007, European countries experienced a rapid increase in intermediate inputs from regional partner countries. The regional component of value added exhibited a substantial growth in exports of Germany, Spain, and Russia. In the aftermath of the 2008–2009 economic crisis, the regional contribution to merchandise exports remained stagnant or experienced a decline for the majority of European economies, with notable exceptions including the Netherlands and, to a certain extent, Russia. Based on the evidence presented, one can conclude that the potential of European value chains to boost regional exports during the period of globalization has been fully realized.

The evolution of regional value chains in Asia and North America over the post-crisis period exhibited distinct characteristics. Japan’s role as an intermediary exporter to South Korea and China has experienced a notable shift. Japan’s value-added contribution to these countries’ exports shrank by 21% and 8%, respectively, during the period from 2007 to 2019. Concurrently, Japan has also confined its cooperative ties with South Korea while increasing its dependence on China. During the period of globalization, production relations between China and South Korea exhibited a marked expansion at a relatively high rate. As for North America, the dissolution of its cooperative ties has not been observed among any pair of counterpart countries. While the relationship between the United States and Canada appears to be stagnant, Mexico and the United States are proportionately advancing their value-added interchange.

Table 2. Value added growth in exports of countries in selected regions of the world, times

|

1995–2007 |

|||||||

|

Country of origin |

France |

Germany |

Italy |

Netherlands |

Spain |

UK |

Russia |

|

France |

1.88 |

2.76 |

1.87 |

1.37 |

2.55 |

1.65 |

3.83 |

|

Germany |

2.28 |

2.21 |

2.42 |

1.38 |

3.19 |

1.94 |

5.47 |

|

Italy |

2.32 |

2.78 |

1.88 |

1.48 |

3.1 |

1.95 |

4.18 |

|

Netherlands |

1.89 |

2.77 |

2.23 |

1.84 |

2.66 |

1.85 |

4.07 |

|

Spain |

3.1 |

3.8 |

3.4 |

1.95 |

2.59 |

2.84 |

4.31 |

|

UK |

2.24 |

3.62 |

2.53 |

2.41 |

3 |

2.28 |

5.29 |

|

Russia |

5.46 |

7.46 |

4.26 |

4.5 |

7.43 |

4.62 |

4.18 |

|

2007–2019 |

|||||||

|

Country of origin |

France |

Germany |

Italy |

Netherlands |

Spain |

UK |

Russia |

|

France |

1.11 |

1.04 |

0.88 |

1.32 |

1.04 |

1.01 |

1.33 |

|

Germany |

1.07 |

1.18 |

0.92 |

1.69 |

0.94 |

0.99 |

1.05 |

|

Italy |

0.89 |

1.02 |

1.02 |

1.61 |

0.79 |

0.81 |

1.18 |

|

Netherlands |

1.2 |

1.28 |

0.99 |

1.25 |

1.24 |

0.93 |

1.3 |

|

Spain |

1.13 |

1.26 |

1.07 |

1.65 |

1.27 |

1.02 |

1.45 |

|

UK |

0.99 |

0.92 |

0.62 |

1.48 |

0.87 |

1.06 |

0.99 |

|

Russia |

0.95 |

1.28 |

1.16 |

2.07 |

0.67 |

0.78 |

1.33 |

|

1995–2007 |

|||||||

|

Country of origin |

Japan |

South Korea |

China |

Country of origin |

Canada |

Mexico |

US |

|

Japan |

1.5 |

2.32 |

8.81 |

Canada |

2.38 |

5.33 |

2.74 |

|

South Korea |

3.84 |

2.63 |

13.92 |

Mexico |

2.66 |

3.15 |

3.64 |

|

China |

12.15 |

12.65 |

7.93 |

US |

1.57 |

2.39 |

1.93 |

|

2007–2019 |

|||||||

|

Country of origin |

Japan |

South Korea |

China |

Country of origin |

Canada |

Mexico |

US |

|

Japan |

1.11 |

0.79 |

0.92 |

Canada |

1.08 |

1.28 |

1.02 |

|

South Korea |

0.96 |

1.52 |

1.47 |

Mexico |

1.86 |

1.65 |

1.4 |

|

China |

1.59 |

2.26 |

2.37 |

US |

1.26 |

1.59 |

1.52 |

Source: authors’ elaboration on OECD TiVA data.

Today, the participation of the world’s largest economies in GVCs has idiosyncratic features. Germany, as the predominant contributor to European industry, marginally reliant on foreign intermediate supplies in the domains of tangible production, specifically in machinery. At the same time, the provision of country’s business services, chiefly R&D, is facilitated by foreign entities. Japan exhibits a level of reliance on foreign partners in manufacturing sectors, particularly in the field of transportation engineering, that is one order of magnitude greater than that observed in Germany. India’s engagement in global value chains (GVCs) is minimal within the primary sectors of the economy. However, in the services sector, the nation maintains close collaboration with foreign suppliers. A comparison of the modes of US and Germany GVCs participation reveals some common features. For example, both countries are actively engaged in international cooperation in R&D, engineering, and consulting services. China is distinctive in that its reliance on global value chains, measured in relative terms, is currently the greatest among the countries under study. The most extensive embeddedness in cooperative relations with third countries is observed in the chemical products and electronics sectors, as well as in business services. The provision of financial services by Chinese banks and other organizations is also facilitated by foreign partners. The nation’s thriving transportation manufacturing sector is noteworthy for its substantial degree of self-sufficiency.

Table 3. Vertical specialization index of selected countries, breakdown by industry, %, 2023

|

sector |

China |

Germany |

India |

Japan |

US |

|

Chemical industry |

12.77 |

1.49 |

5.81 |

4.38 |

3.65 |

|

Construction |

0.93 |

2.99 |

5.33 |

0.87 |

0.71 |

|

Electronics and optics |

16.76 |

1.43 |

0.81 |

4.96 |

1.26 |

|

Financial services |

8.63 |

3.48 |

6.23 |

3.75 |

5.53 |

|

Business services |

10.73 |

17.53 |

2.95 |

8.12 |

18.80 |

|

Transport manufacturing |

4.11 |

2.69 |

0.87 |

7.30 |

1.96 |

Source: authors’ elaboration on ADB MRIO 2023 data.

Following the global financial crisis, there has been a notable shift in the pattern of the five economies’ participation in the global value chains (GVCs) (see Figure 5). In particular, the phenomenon of vertical specialization has been most distinctive in the services sector. China has firmly established cooperative linkages in the financial and business services. A substantial upgrading of India’s position in global value chains is evident in the construction sector. The United States and Germany have also developed external cooperative linkages in the production of intangibles; however, the dynamics of these linkages were considerably lower than those observed for China and India. Yet, in the industrial sectors, the United States and Germany maintained balanced relationships with foreign partners. Noteworthy is the case of Japan. The country, which traditionally exploited the advantages of the global intermediate goods and services market, has resorted to the actual curtailment of external production ties in all the aforementioned sectors. Nevertheless, there is a general tendency to employ GVCs in the intangible sector of the world economy, a phenomenon that is actively supported and balanced by developing countries.

Figure 5. Change in the vertical specialization index of selected countries, breakdown by industry (2011–2023, %)

Source: authors’ elaboration on ADB MRIO 2011, 2023.

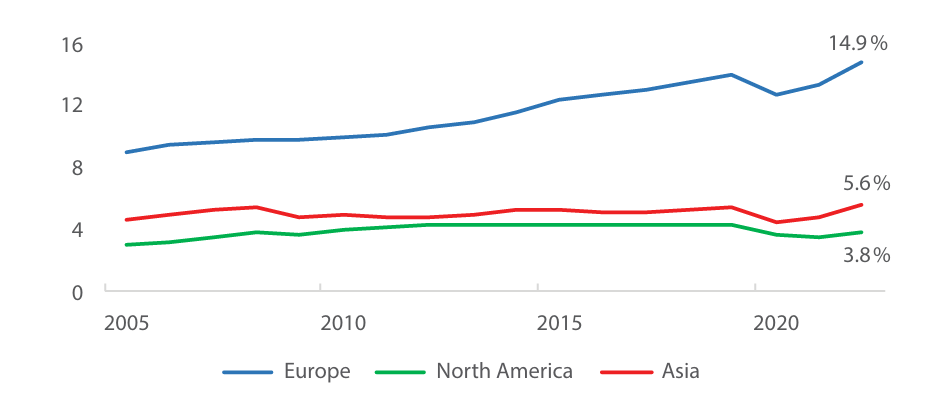

Undeniably, the services sector occupies a distinctive position in the contemporary global economy, particularly within the context of international trade and value chains. In contrast to the realm of commodity production, the potential for enhanced intercountry collaboration in this sector remains substantial. The proportion of services exports to gross domestic product (GDP) remains comparatively low in Asia and North America, while in Europe it has been increasing at a steady rate (see Figure 6). Furthermore, in the aftermath of the global financial crisis, Europe has witnessed a pronounced escalation in the contribution of services exports to gross domestic product, surpassing pre-crisis levels. Therefore, one can conclude that the notion of slowbalization is likely not applicable to the realm of international trade in services.

Figure 6. Share of services exports in the region’s GDP, %

Source: authors’ elaboration on UNCTAD Stat.

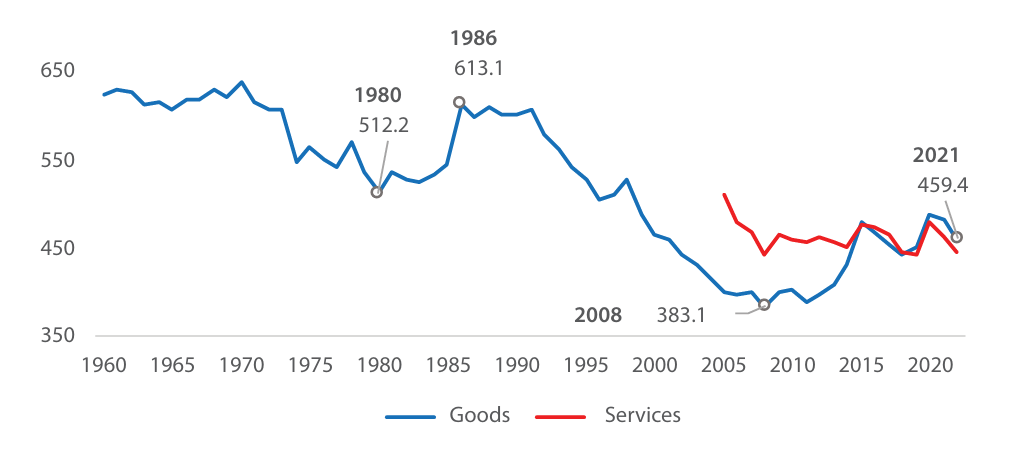

It is noteworthy that the balance of the primary service-supplying countries in the global economy has remained stable over the last two decades, as evidenced by the dynamics of the Herfindahl-Hirschman index (see Figure 7). In the aftermath of the global financial crisis of 2008–2009, the international trade in goods has witnessed a persistently increasing export concentration, signifying the emergence of a select few epicenters of influence that have amassed the predominant share of benefits from foreign trade. Concurrently, the distribution of exporters’ shares in services remains constant, suggesting an absence of prominent leaders and evenly balanced distribution of benefits.

Figure 7. Herfindahl-Hirschman index of world exports of goods and services by exporting country, 1960–2022

Source: authors’ elaboration on UNCTAD Stat.

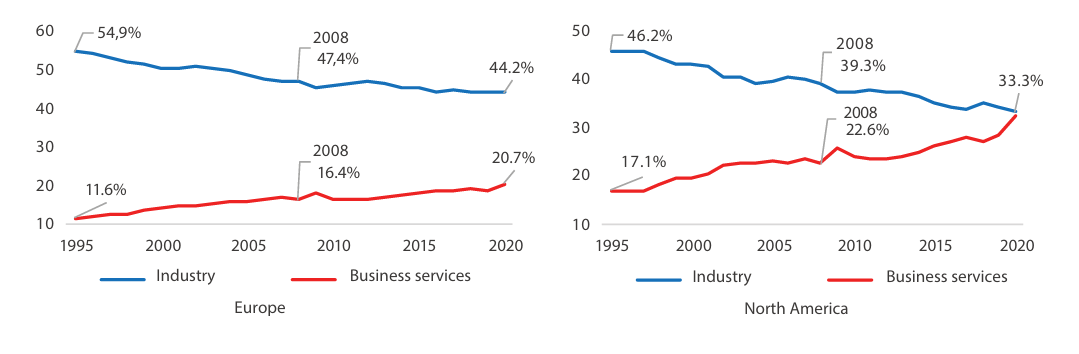

The strengthening of the intangible sector of the world economy is not only limited by international trade in services. A rising proportion of the value-added of traditional goods is attributable to sectors such as R&D, engineering, and ICT, indicating a “servitization” of commodity exports [Kondrat’ev et al. 2021]. Besides, contemporary high-tech goods comprise a substantial proportion of software, which is furnished to the user along with the goods and subsequently constitutes the value of final products. This phenomenon has been designated “servitification” in the present literature. As demonstrated in Figure 8, there has been a steady convergence of the contributions of industry and intermediate services to the value of exported goods in Europe and North America in recent decades. In the contemporary global economic landscape, approximately 20% of Europe’s merchandise exports value added is created in intangible production. For North America, this figure is even higher, reaching 33%, which is nearly commensurate to the value added by manufacturing.

Figure 8. Contribution of regional industry and business services to the value of the region’s merchandise exports, %

Source: authors’ elaboration on OECD TiVA data.

Discussion

The results obtained indicate a discernible trend toward slow pace globalization of international trade in goods. According to P. Krugman (2023), the decline in the share of goods in world consumption, concomitant with rising global income, is a contributing factor to the observed slowdown. Baldwin, who posits that trade and economic globalization extend beyond the realm of trade in goods, has embarked on an extramural polemic with Krugman [Baldwin et al. 2024]. According to the aforementioned perspective, the phenomenon of globalization is expected to persist until the potential for arbitrage on inter-country differences in factor costs is completely dissipated. Indeed, inter-country arbitrage in the productive sector has contracted, as evidenced by the decline in interregional FDI flows and the increasing regionalization of commodity flows. Nevertheless, Baldwin identifies the presence of such arbitrage in the services sector, wherein distinct countries offer services at remarkably disparate costs.

It is evident that the growth rates of the share of services exports in world trade and GDP do not demonstrate values comparable to the growth rates of trade in goods during the period of “hyperglobalization.” However, the sector of services and their “logistics” has not undergone transformations on a par with those experienced by the manufacturing sector at the turn of the century. As Krugman observes, from 1947 to the present, labor productivity in the service sector has increased by a factor of 2.5 globally, while in the manufacturing sector it has increased by a factor of 5.5. Presently, the preponderance of services is still conducted in person. The infrastructure for the international provision of numerous services remains underdeveloped, and the level of legal restrictions on their provision remains highly prohibitive. However, it is imperative to acknowledge that the realm of trade in services has expanded beyond the conventional transport and travel services. Over the past 15 years, the share of “modern” services, particularly business, telecommunication, and financial services, in world services exports has experienced a substantial increase, reaching approximately 70%. In the realm of business services, which represent the majority of contemporary services, there has been a notable surge in “intermediate” services provided between firms operating across different jurisdictions.

In the contemporary economic landscape, the digital sector has emerged as a significant contributor to the value of finished goods. Since the global financial crisis, the share of intermediate services in world merchandise exports has increased substantially [Blázquez et al. 2023]. At the present stage, trade in such services is more evenly distributed than trade in goods, in which the main flows are concentrated in the triangle “US–Germany–China.” The contemporary provision of intermediate services is predominantly facilitated by international platforms, including freelancing platforms (e.g., Upwork, Fiver), international firms engaged in business process outsourcing, and shared service centers.

The utilization of international arbitrage in the services sector appears to be in its nascent stages. The intensification of the global economy, concomitant with the reduction of legal restrictions on international trade in services and the productivity gains in this sector, will precipitate the unfolding of the subsequent wave of globalization. On both fronts, the potential for expanding international trade in intermediate services appears substantial. The OECD’s Services Trade Restrictiveness Index remains elevated. Brazil, India, and Kazakhstan have achieved the most substantial liberalization during the period from 2014 to 2023. In contrast, countries in Europe, East Asia, and North America have maintained high barriers to trade in services.5 According to the OECD, the international liberalization of trade in services has the potential to yield long-term growth of 6–16% in services overall, 20–37% in commercial banking, 7–22% in legal services, 6–20% in accounting, and 5–17% in engineering.

Consequently, the productivity growth in the intermediate services sector is inextricably linked to the transformation of global value chains through Industry 4.0 technologies, which encompass digitalization, automation, and additive manufacturing. Digitalization will standardize low-value logistics and distribution services, while the production process itself will become more “servitized” and research and development (R&D) and customer data will be top priority. This will add value to R&D, marketing, and after-sales services. The digitalization of manufacturing and the Internet of Things (IoT) will have a significant impact on the configuration of GVCs and the volume of trade in services worldwide. This effect will be manifested in the substitution of labor by production and management robots. The increase in labor productivity resulting from automation is expected to lead to higher value added across all stages of the global value chains. Furthermore, with the integration of digital technologies and AI-driven automation, the field of robotics is anticipated to permeate the high-value business services sector. The integration of additive manufacturing technology, exemplified by 3D printing, will facilitate the implementation of “mass customization” strategies, thereby generating substantial added value at the marketing and after-sales stages. In addition, the advent of 3D printing technology has precipitated a perpetual evolution of novel virtual designs for finished products, which is responsible for augmenting the share of added value derivable from R&D services within GVCs.

In effect, it is the “intermediate” services that may constitute the “core” of a new wave of trade and economic globalization in the near future. The advent of technological advancements in global value chains has precipitated a period of accelerated productivity growth in the services sector. Besides, in recent years, the goal of reducing barriers to international trade in services has become a priority for international development institutions. The contemporary global trade structure in intermediate services that is fairly balanced is anticipated to evolve into a new “triangle” of the predominant suppliers of such services. The new triangle is likely to include those countries that are most successful in integrating Industry 4.0 technologies into global value chains. Furthermore, sectoral progress in the liberalization of international trade in services may also alter the configuration of the aforementioned triangle. Yet, it is challenging to forecast adequately, as two equal but oppositely directed trends are now emerging. On the one hand, there are decoupling processes induced by the repercussions of trade wars, sanctions, and regional isolation of groups of countries. In addition to the protracted trade confrontation between the United States and China that transpired over the past decade, the EU-US contradictions have lately amplified significantly. There is an increasing call in Europe for greater self-sufficiency in the region’s economies.6 The latest development on this front was the announcement by US President D. Trump at the first cabinet meeting of his administration of plans to impose unprecedented 25 percent duties on imports of all goods from the European Union.7 On the other hand, a number of researchers underscore the trend toward economic convergence of national production systems to be increasingly manifested due to the universal and cross-border nature of modern, primarily digital, production and management technologies [Zagashvili 2022].

Conclusion

The analysis conducted in this paper has yielded the following qualitative conclusions.

Firstly, Asia has overtaken Europe as the foremost exporting region, while domestic consumption has emerged as the primary catalyst of its economic growth. Asian countries have also demonstrated a capacity to enhance the efficiency of labor mobilization, thereby fortifying their standing within the global trade arena.

Secondly, the regional component of value chains in Asia and North America underwent augmentation during the period of slowbalization. Conversely, Europe was experiencing a heightened reliance on external intermediate supplies.

Thirdly, following 2009, developing countries, notably China and India, have been integrating into global value chains at an accelerated rate, particularly in intangible production sectors. The GVCs have undergone a notable shift in the post-crisis period, marked by the waning prominence of Japan, once a leading force in the field of competence.

Fourthly and finally, while trade and value chains in the real sector were contracting and slowing down, there was an active expansion of international trade in services. In Europe, the predominance of the services sector is particularly evident. In recent years, trade in services in the world economy has exhibited a more equitable distribution among countries in comparison to trade in goods. A recent analysis has revealed that business and digital services currently comprise approximately one-third of the value added in developed countries’ merchandise exports.

In summary, the trajectories of trade and GVCs in the tangible and intangible sectors of the economy present a distinct picture. The thesis of globalization, as it pertains to the real sector, is not applicable to the services sector. The deployment of Industry 4.0 infrastructure is anticipated to enhance the efficacy of information and communication technology (ICT) and telecommunication services within the primary stages of value chains. Concurrently, the trend of technological division—which in recent years has determined the interaction between the West and China, as well as the countries’ pursuit of technological sovereignty—will spur on the rebalancing of both inter-country and inter-regional cooperation in most sectors of the non-productive sphere.

Bibliography

Antràs, P., 2020. De-globalisation? Global value chains in the post-COVID-19 age (No. w28115). National Bureau of Economic Research. Available at: https://www.nber.org/system/files/working_papers/w28115/w28115

Asian Development Bank. Regional Input-Output Tables. Available at: https://www.adb.org/what-we-do/data/regional-input-output-tables (accessed 10 October 2024).

Baldwin, R., 2016. The Great Convergence: Information Technology and The New Globalization. Harvard University Press.

Baldwin, R., Freeman, R., Theodorakopoulos, A., 2023. Hidden Exposure: Measuring US Supply Chain Reliance (No. w31820). National Bureau of Economic Research.

Baldwin, R., Freeman, R., Theodorakopoulos, A., 2024. Deconstructing deglobalization: the future of trade is in intermediate services. Asian Economic Policy Review, Vol. 19, No 1. P. 18–37.

Benabed, A., Moncea, M., 2024. Slowbalization: Rising Trends for the Global Economy and Business. Proceedings of the International Conference on Business Excellence, Vol. 18, No 1. P. 283–294.

Blázquez, L., Díaz-Mora, C., González-Díaz, B., 2023. Slowbalisation or a “New” type of GVC participation? The role of digital services. Journal of Industrial and Business Economics, Vol. 50, No 1. P. 121–147.

Borin, A., Mancini, M., Taglioni, D., 2021. Economic Consequences of Trade and Global Value Chain Integration: A Measurement Perspective. Policy Research Working Paper; No. 9785. Washington, DC: World Bank. Available at: http://documents.worldbank.org/curated/en/476361632831927312/Economic-Consequences-of-Trade-and-Global-Value-Chain-Integration-A-Measurement-Perspective

Brakman, S., van Marrewijk, C., 2022. Tasks, occupations and slowbalisation: on the limits of fragmentation. Cambridge Journal of Regions, Economy and Society, Vol. 15, Issue 2. P. 407–436.

Capello, R., Cerisola, S., 2023. Regional reindustrialization patterns and productivity growth in Europe. Regional Studies, Vol. 57, Issue 1. P. 1–12.

Coveri, A., Zanfei, A., 2023. The virtues and limits of specialization in global value chains: analysis and policy implications. Journal of Industrial and Business Economics, Vol. 50, Issue 1. P. 73–90.

Giovannetti, G., Marvasi, E., Ricchiuti, G., 2023. The future of global value chains and International trade: an EU perspective. Italian Economic Journal, Vol. 9, No 3. P. 851—867. Available at: https://doi.org/10.1007/s40797-023-00252-4

Gopinath, G., Gourinchas, P. O., Presbitero, A. F., Topalova, P., 2024. Changing global linkages: A new Cold War? IMF Working Papers, Issue 076.

Hummels, D., Ishii, J., Yi, K.-M., 2001. The nature and growth of vertical specialization in world trade. Journal of International Economics. Elsevier, Vol. 54, Issue 1, June. P. 75–96.

Kholopov, A., 2022. Global Imbalances: Evolution of Approaches. World Eсonomy and International Relations, Vol. 66, No 9. P. 19–28. Available at: https://doi.org/10.20542/0131-2227-2022-66-9-19-28 (in Russian).

Kondrat’ev V., Kedrova G., Popov V. Servitization of Industry: New Evidence. World Eсonomy and International Relations, 2021, Vol. 65, No 8. P. 22–30. Available at: https://doi.org/10.20542/0131-2227-2021-65-8-22-30 (in Russian).

Kononenko, V. et al., 2020. Slowing down or changing track? Understanding the dynamics of “Slowbalisation”. European Parliamentary Research Service.

Krugman, P., 2023. Technology and Globalization in the Very Long Run. Stone Center on Socio-Economic Inequality. Working Paper Series, No. 63.

Linsi, L., 2021. Speeding up “slowbalization”: The political economy of global production before and after COVID-19. Global Perspectives, Vol. 2, No 1.

Maltsev, A.A., 2024. “Regionalization” of Global Value Chains: Off-Shoring or Re-Shoring? Russian Foreign Economic Journal, No 4. P. 7–25 (in Russian).

Marvasi, E., 2023. Global Value Chain resilience and reshoring during Covid-19: Challenges in a post-Covid world. In: Inequality, Geography and Global Value Chains. Cham: Springer International Publishing. P. 231–262.

OECD Data Explorer. Trade in Value Added. Available at: https://www.oecd.org/en/topics/sub-issues/trade-in-value-added.html (accessed 16 November 2024).

Our world in data. Historical price of computer memory and storage. Available at: https://ourworldindata.org/grapher/historical-cost-of-computer-memory-and-storage (accessed 23 November 2024).

Roudometof, V., 2024. How should we think about globalization in a post-globalization era? Dialogues in Sociology [Online first].

Stephenson, S., 2013. Global Value Chains: The New Reality of International Trade. Geneva: ICTSD & WEF.

Thakur-Weigold, B., Miroudot, S., 2024. Supply chain myths in the resilience and deglobalization narrative: consequences for policy. Journal of International Business Policy, Vol. 7, No 1. P. 99–111.

The Conference Board. The Conference Board International Labor Comparisons. Available at: https://www.conference-board.org/ilcprogram/index.cfm (accessed 20 December 2024).

Torrens, R., 1821. An Essay on the Production of Wealth: With an Appendix, in which the Principles of Political Economy Are Applied to the Actual Circumstances of this Country. Longman, Hurst, Rees, Orme, and Brown.

UNCTAD Stat. Merchandise Trade Matrix, Annual. Available at: https://unctadstat.unctad.org/datacentre/dataviewer/US.TradeMatrix (accessed 02 November 2024).

UNCTAD. Review of Maritime Transport 2021. Available at: https://unctad.org/system/files/official-document/rmt2021_en_0.pdf (accessed 15 December 2023).

Varnavskii, V., 2024. Global Trade: Long-Term Trends and Structural Changes. World Eсonomy and International Relations, Vol. 68, No 1. P. 5–18. Available at: https://doi.org/10.20542/0131-2227-2024-68-1-5-18 (in Russian).

World Development Indicators. Available at: https://databank.worldbank.org/reports.aspx?source=2&Topic=14# (accessed 04 November 2024).

Zagashvili, V., 2022. Economic Globalization and Regional Integration in the Post-Covid Era. World Eсonomy and International Relations, Vol. 66, No 4. P. 5–13. Available at: https://doi.org/10.20542/0131-2227-2022-66-4-5-13 (in Russian).

Notes

1 Our world in data. Historical price of computer memory and storage. Available at: https://ourworldindata.org/grapher/historical-cost-of-computer-memory-and-storage (accessed 23 November 2024).

2 The Conference Board. The Conference Board International Labor Comparisons. Available at: https://www.conference-board.org/ilcprogram/index.cfm (accessed 20 December 2024).

3 World Development Indicators. Available at: https://databank.worldbank.org/reports.aspx?source=2&Topic=14# (accessed 04 November 2024).

4 UNCTAD. Review of Maritime Transport 2021. Available at: https://unctad.org/system/files/official-document/rmt2021_en_0.pdf (accessed 15 December 2023).

5 OECD. Services Trade Restrictiveness Index. Available at: https://www.oecd.org/en/topics/services-trade-restrictiveness-index.html (accessed 03 December 2024).

6 Portansky, A., 2025. Mario Draghi once again calls Europe for decisive action. IMEMO RAS Official website. Available at: https://www.imemo.ru/publications/policy-briefs/text/mario-draghi-renews-call-for-decisive-action-in-europe (accessed 23 February 2025).

7 The White House. Remarks by President Trump before cabinet meeting. February 26, 2025. Access mode: https://www.whitehouse.gov/remarks/2025/02/remarks-by-president-trump-before-cabinet-meeting/ (accessed 27 February 2025).

1.jpg)