The Evolution of Technological Globalization

[Чтобы прочитать русскую версию статьи, выберите русский в языковом меню сайта.]

Natalya Ivanova is a member of the Directorate at the Primakov Institute of World Economy and International Relations (IMEMO) and academician of the Russian Academy of Sciences.

ORCID: 0000-0001-7247-1731

ResearcherID: I-6276-2017

Scopus AuthorID: 55352304400

For citation: Ivanova, Natalya, 2023. The Evolution of Technological Globalization, Contemporary World Economy, vol. 1, no 1, January–March.

Keywords: technological globalization, R&D financing, technological sanctions, sectoral priorities, international comparisons

The article was prepared within the project “Post-Crisis World Order: Challenges and Technologies, Competition and Cooperation” supported by the grant from Ministry of Science and Higher Education of the Russian Federation program for research projects in priority areas of scientific and technological development (Agreement No 075-15-2020-783).

Abstract

This article presents an analysis of current trends in technological globalization, focusing on comparisons of the scale and dynamics of the development of the science and technology sectors in various countries. In particular, the article highlights the trends toward outstripping growth of the research and development sphere in non-Western countries, toward an increase in the share of the private sector in investment in research and development, to the transformation of China into one of the world’s technological leaders, and the expansion of its technology companies in other countries. The article compares the structure of research and development by country and industry measurements and provides information on the benefits and limitations of the current model for including China in technological globalization.

Introduction

Contemporary discussions of key trends in the development of the global economy include a widespread notion of deglobalization processes associated with the growing manifestations of protectionism, the formation of regional trade and economic blocs, the expansion of the arsenal of potential sanction pressures, and the challenges of overcoming the global Covid-19 pandemic, etc. This study examines the significance of the features of technological globalization to global economic growth. According to economic theory, the formation and efficient operation of research and development (R&D) is the basis of technological development as “creative destruction” (according to Joseph Schumpeter). The increasing number of nations that place their own R&D at the heart of their innovation systems is a solid foundation and driving force of globalization. By using trade and direct foreign investment mechanisms, catching-up nations can rapidly establish new industries by borrowing technologies. However, only the development of their own R&D sector guarantees a transition to a path of endogenous innovative growth. The rapid expansion of high-tech industries in major developing nations, particularly China and India, has improved their standing in global trade, value chains, and investments. Successes in establishing one’s own R&D base enhance international competition for innovation leadership and access to innovation resources such as new knowledge, qualified professionals, and intellectual property. The COVID-19 pandemic has, on the one hand, accelerated the development of a variety of technologically advanced industries; on the other hand, it has exacerbated processes that had been developing in recent years, such as the monopolization of certain markets, the fragmentation of the legal regime governing international trade and investment, protectionism, and sanctions regimes. Moreover, there is a growing realization that complex value chains pose additional security threats and necessitate the development of new methods to protect national interests in the face of pandemics, natural disasters, and military conflicts. The concepts of technological sovereignty, security, and critical technologies are currently dominating discussions regarding the long-term development priorities of many nations. These circumstances heighten the significance of relying on proprietary R&D and sectoral innovation systems operating within national regimes.

Economic science has demonstrated that dynamic technological development and the creation and constant updating of knowledge and technology are supported by both the national scientific potential, which is the state’s responsibility, and the private research base of businesses, which creates monopoly advantages in the markets and exclusive intellectual property rights. The renewal of productive forces is driven primarily by competition based on such advantages. Theoretically, this conforms to the tenets of the theory of innovative development which was developed by a number of economists, from Joseph Schumpeter to Paul Romer, who established the unique significance of business research and development. A group of researchers at the Massachusetts Institute of Technology concludes that Schumpeterian “creative destruction” may not be the best way to improve the efficiency of the invisible hand of the market, but it enhances capitalism, increases productivity, and ensures the overall growth of global prosperity (Aghion 2021).

This theoretical context defines the article’s two primary goals: first, to systematize the available statistical data on the global scale and structure of R&D by country and industry; and second, to illustrate the characteristics of the current limitations of R&D development in China, a potential leader in technological globalization. This study’s research methodology is distinguished by its international comparison of data on scientific research, with an emphasis on the role of the entrepreneurial sector, sectoral R&D priorities, and proportion of basic research.

Scale, dynamics, and organization of global R&D investments

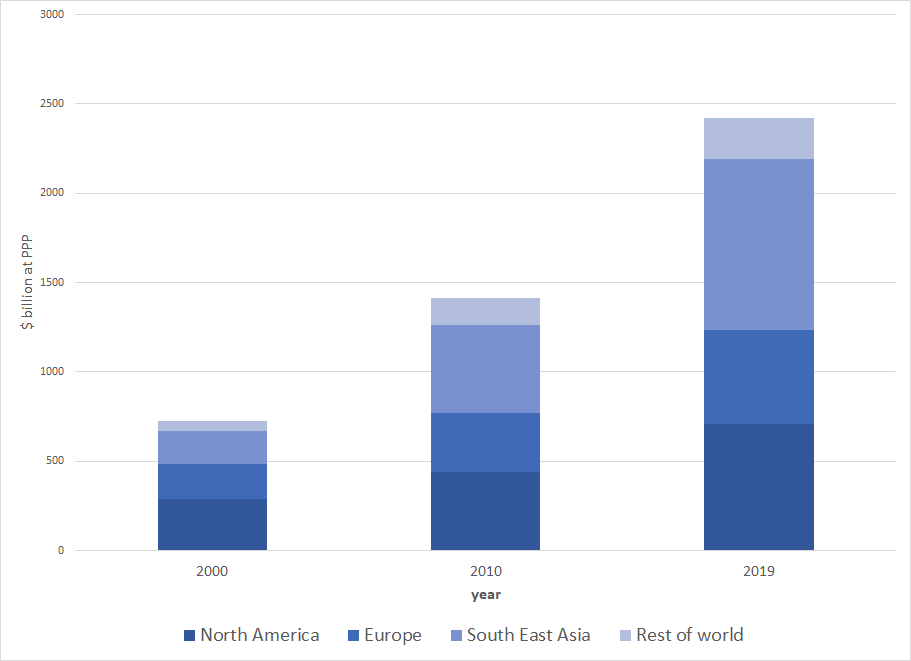

All global science and technology sector development indicators point to the 2000s as a time of successful, progressive technological globalization. Growth in all types of innovative activities, including research, patenting, ventures and startups, export and import of technologically sophisticated goods and services, and direct foreign investments in new businesses, resulted in adjustments to the global economy’s operation and an acceleration of key dynamics. This study focuses on R&D, considering it to be the most direct “proxy” for technological globalization, which is fully reflected in international statistics. As shown in Figure 1, all regions of the world have increased their R&D expenditure. Over the course of twenty years, global spending quadrupled, reaching nearly $2.5 trillion, or 2.5% of the global GDP. Southeast Asia has demonstrated the most impressive growth in the field; in 2000, its scope was inferior to that of the United States and Europe, but by 2019 it had surpassed the technological leaders of the 20th century. Latin America, Africa, and Australia represent a small, but rapidly expanding portion of the world’s total.

It is also important to note that neither the severe economic crisis of 2007–2008 nor Covid-19 and the recessions and crises it spawned had any effect on the support for R&D; governments and businesses, despite harsh conditions, declining budget revenues, and declining profits, continued to provide funding for scientific institutions, laboratories, and university research units. In contrast, the dynamics of foreign trade in high-tech goods, investments in ventures and startups, and direct investments were heavily influenced by external factors and subject to short-term fluctuations and long-term deviations from typical trends.

Figure 1: Global R&D expenditures, by region: 2000, 2010, and 2019

Source: Boroush, M., 2020. Cross-National Comparisons of R&D Performance. Research and Development: U.S. Trends and International Comparisons. Science and Engineering Indicators. January 2020. National Science Foundation. Available at: <https://ncses.nsf.gov/pubs/nsb20203/cross-national-comparisons-of-r-d-performance>

Source: Boroush, M., 2020. Cross-National Comparisons of R&D Performance. Research and Development: U.S. Trends and International Comparisons. Science and Engineering Indicators. January 2020. National Science Foundation. Available at: <https://ncses.nsf.gov/pubs/nsb20203/cross-national-comparisons-of-r-d-performance>

As shown in Table 1, the United States is the global leader in R&D investment, with China rapidly gaining ground. During the 2000s, China had a significant advantage in terms of the growth rate of this sector. The historically unprecedented double-digit average annual growth rates of expenditures on technological development enabled China to restructure and modernize its national economy, establish new highly competitive industries in cutting-edge fields, and pave the way for future breakthroughs. In the 1970s and the 1980s, Japan advanced rapidly toward new frontiers in the technological realm. However, in recent years, it has slightly slowed its pace. The relative knowledge-intensiveness of its economy still places it ahead of both the United States and China. The leader in this field is the Republic of Korea, which also exhibited high growth rates in the late 20th century and established a number of cutting-edge industries and major high-tech corporations with a global presence. India lags far behind developed nations and China in terms of the scale of R&D and relative indicators of knowledge intensity, but the country’s high rates of innovation indicate that it has chosen the path of innovation and is confidently moving in the right direction. In the 2000s, European Union nations increased their annual R&D expenditures by 5 to 5.5% on average. This expansion was primarily attributable to the largest nations, namely, Germany, France, and the United Kingdom.

Table 1. International Comparison of the Scale and Dynamics in R&D Financing by Leading Countries, 2000-2019.

|

|

R&D expenditures, total, 2019, $ billion at PPP |

R&D expenditures to GDP - knowledge intensity, % |

Average annual growth rate of expenditures on R&D, %

2000-2010 2010-2019 2000-2019 |

||

|

United States |

668 |

3.13 |

4.3 |

5.6 |

4.8 |

|

China |

526 |

2.23 |

20.5 |

10.6 |

14.1 |

|

Japan |

173 |

3.20 |

3.6 |

2.4 |

3.3 |

|

Germany |

148 |

3.19 |

4.9 |

6.1 |

5.2 |

|

South Korea |

102 |

4.64 |

10.9 |

7.8 |

8.9 |

|

India |

59 |

0.65 |

9.4 |

4.4 |

7.2 |

Based on: Boroush, M., Guci, L., 2022. Cross-National Comparisons of R&D Performance. Research and Development: U.S. Trends and International Comparisons. Science and Engineering Indicators. April 2022. National Science Foundation. Available at: <https://ncses.nsf.gov/pubs/nsb20225/cross-national-comparisons-of-r-d-performance>

Russia and the post-Soviet states (CEE and CIS) are currently on the periphery of global trends of high dynamics of resource support for research and development relative to the size of the economy. In some countries, this level has increased slightly, whereas in others, it has decreased. There has been no significant increase in state budgets or business expenditures. Even the most developed countries of Central and Eastern Europe—the Czech Republic, Slovakia, Slovenia, Latvia, Lithuania, and Estonia—lag behind the global average in terms of science intensity (1.4%-1.5% of GDP) and are two to three times behind the global leaders in technological development (Sherstnev 2022). During this period, the Russian Federation experienced a modest increase in internal expenditures on R&D but it lagged behind in GDP growth, resulting in a stabilization of the R&D-to-GDP ratio between 1.0 and 1.1%. In some years, the science intensity of the Russian economy decreased. Russia is currently ranked ninth in the world by R&D spending (PPP), trailing China by 12 times and the United States by 13 times (ISS RAS, 2021: 64).

Active technology import in the 2000s led to an increase in indicators of so-called “imputed knowledge intensity” (taking into account R&D costs incurred by foreign suppliers of high-tech products) in a number of sectors of the Russian economy, thereby bringing the country’s technical level to global averages. This resolved the competitiveness issues of energy, agriculture, metallurgy, machinery manufacturing, and the financial sector, but led to critical levels— 90–100%—of import dependence of certain industries. In the context of sanctions imposed by developed nations in response to the events in Ukraine, the production of automobiles, aircraft, and offshore oil and gas, among others, has ceased. The government took steps to increase “parallel imports” (the importation of technically complex products through third countries without licenses or other permits) as well as imports from China and other friendly nations. This situation highlighted the importance of technological sovereignty, which requires a nation to rely on indigenous scientific and technological capacity.

The data on business R&D expenditures organized by industry (Table 2) most accurately reflect the principal directions of the technological race in the global economy.

Table 2. Global business spending on R&D, by country and industry, 2020, billions of euros

|

|

United States |

EU |

China |

Total* |

|

ICT goods |

83 |

26 |

38 |

143 |

|

ICT services |

111 |

14 |

23 |

146 |

|

ICT total |

194 |

40 |

61 |

289 |

|

Health |

94 |

37 |

8 |

139 |

|

Automotive and other transport |

19 |

62 |

15 |

97 |

|

Industrial equipment |

9 |

11 |

17 |

37 |

|

Construction |

1 |

2 |

18 |

21 |

|

Chemistry |

5 |

6 |

2 |

13 |

|

Financial industry |

5 |

6 |

6 |

19 |

|

Energy |

3 |

5 |

7 |

17 |

|

Aviation, space, defense |

5 |

5 |

6 |

16 |

|

Other |

9 |

6 |

7 |

28 |

|

Total |

344 |

184 |

148 |

676 |

*the sum of expenditures for these nations; the total expenditures of 2,500 companies in this database are €908,6 billion in 2020, a 6% increase over 2019.

Based on European Commission, 2021.The 2021 EU RD Investment Scoreboard. JRC/DG RTD.

The three consolidated industries—ICT, healthcare, and automobile manufacturing—are the current leaders in technological advancement in terms of funding and global economic significance. ICT is a leader in the United States and China, while the automotive industry is a frontrunner in the European Union. In general, U.S. businesses outperform European and Chinese firms, but Chinese firms have outperformed European firms in the field of ICT; these proportions confirm the current pattern of global competition, as recognized by specialists. Less obvious are the relatively modest funding levels for the defense and aerospace industries (tens of times less than ICT and healthcare). Evidently, these areas are primarily financed by state budgets and not by businesses. However, even in the United States, where federal defense spending on R&D is the largest, it is still less than the funding for innovative developments in digitalization and healthcare.

Numerous small- and medium-sized supplier companies provide system integration of their scientific and technological activities to automotive industry titans in the European Union. In addition, Siemens and Robert Bosch in the field of electronics; ASML Holding, Infineon, STMicroelectronics, and NXP in the semiconductor industry; SAP in software development; Medtronic (Ireland) and Philips Healthcare (Netherlands) in medical equipment manufacturing, as well as other companies, hold strong positions in the global innovation and technology industries. At the beginning of the twenty-first century, the technological achievements of Nokia and Ericsson in telecommunications inspired the optimism that European companies would occupy a prominent position in the global ICT industry. However, leading telecommunications companies Vodafone, Orange, and Deutsche Telekom have not become global leaders because they are primarily European market players (Konina 2021). Experts list the primary reasons for the relatively weak competition from Europeans in the ICT sector: market mistakes by corporations themselves, insufficient domestic demand, lack of long-term support and funding at the EU level in the late 1990s and the early 2000s, and insufficient innovation efficiency have slowed the growth of European information companies.

The ICT situation in Russia is ambiguous. In terms of microelectronics production and information and communication technologies, the nation is at least a decade behind world leaders (there are no domestic current-generation microchip manufacturers or microchip production equipment) and is fully reliant on imports. Russian companies are up-to-date in software development and providing of a vast array of information services. Examples include Russian developers of transportation services, unmanned land vehicles (Yandex, NAMI, Cognitive Technologies, and others), and facial recognition devices (NtechLab).

Global competition has intensified in terms of the technological growth of the global economy. In geopolitical battlefields, the United States and other Western nations view the retention of advanced scientific and technological achievements as a central strategy. Currently, the United States and China are engaged in an uncompromising struggle for technological leadership. Among their top priorities is the creation of tools for resolving institutional problems and dilemmas related to globalization, with a focus on achieving a balance between national and international aspects of innovation policy. It can be argued that the United States continues to lead the world in innovation, as its national innovation system possesses a number of significant advantages, such as flexibility and agility, strong corporate scientific and technological culture, and a stock market that responds appropriately to industry innovations.

According to the Special Competitive Studies Project, which was published in September 2022 by a research team led by Eric Schmidt, a co-founder and former executive at Google, there are substantial differences between industry leaders. China already dominates certain subindustries, including the production of 5G communication systems and lithium batteries (80% of the global market). Biotechnology (including genomic research and new pharmaceuticals), cloud computing, and artificial intelligence systems are dominated by the United States (Chauhan 2021). This position of preeminence has resulted in globally significant innovations such as the Covid vaccine based on Crispr technologies (gene editing) and a new computing architecture for artificial intelligence that has enabled the transition to large models. It is a known fact that China has not yet created a vaccine using gene editing technologies, despite the political urgency of the Covid issue in the country.

The development of digital technologies implemented primarily by private knowledge-intensive businesses in developed nations has resulted in the formation of large monopolies that dictate many current directions of scientific and technological advancement. Data characterizing the comparative scale of modern business research activity by country and industry indicate that research on all types of businesses is increasingly related to the advancement of information technology, both directly and indirectly.

In terms of both volume and growth dynamics, the research potential of the largest companies in the information and communication sector surpasses that of other high-tech industries. In the ten years since 2010, spending on research and development (R&D) by the five largest U.S. and three largest Chinese corporations, known colloquially as FAMGA (Facebook-Meta, Apple, Microsoft, Google-Alphabet, Amazon) and BAT (Baidu, Alibaba, Tencent), has increased more than sevenfold and reached $121.3 billion by 2020. Comparatively, this represents approximately 10% of the R&D expenditure of the 2,500 largest companies in the world. As of 2019, FAMGA’s share of innovation and technological spending across all types of national R&D spending, including business spending in the United States, was 15.4% and 22.1%, respectively.1 The figures for China and the BAT Group were significantly lower. However, Chinese companies began the transition to innovation much later than their American counterparts did.

The digital business sector emerged as a major beneficiary of the COVID pandemic, as evidenced by stock market performance. The market capitalization of Apple, a digital technology and stock market leader, surpassed $3 trillion at the beginning of 2022, allowing the company to raise additional funds for innovation and development. Simultaneously, the Chinese government enacted restrictions on the presence of the country’s largest digital corporations on U.S. stock exchanges. Between 2021 and 2022, this has limited borrowing opportunities in the rapidly expanding U.S. high-tech market.

The digital sector’s long-term bet on new knowledge, technology, and global innovation has created a dominant segment of innovation systems, which has attained heightened political significance. Digital businesses pursue technological and innovation policies that increasingly conflict with state interests by using their own resources. In addition, their activities in the field of mass communication generate new political challenges and give rise to new forms of regulation, such as the emergence of technological protectionism and new legislative strategies to combat digital globalization.

The pandemic has become a catalyst for accelerating the development and use of digital technologies across all industries and social spheres. Digital companies have accelerated the evolution of medical services, creating new business opportunities in the healthcare industry. Apple is increasing its number of iPhone applications for medical monitoring, Microsoft is offering healthcare cloud services, and Alphabet is investing heavily in biopharmaceutical research. Amazon intends to make significant technological advancements in healthcare. Amazon launched a network of clinics that were legal in 32 U.S. states on November 15, 2022. The clinics provide online consultations and treatments for twenty distinct medical conditions, ranging from acne to allergies. Amazon's historical background for this project includes the acquisition of One Medical (790 thousand customers) for $3.9 billion, the establishment of their own online pharmacy, and experience in providing digital health care for its employees. Insurance companies, which have been heavily criticized in the United States, do not participate in the provision of these services. Amazon’s CEO believes that the healthcare industry is ripe for technological disruption (The Economist 2022a).

In the context of technological shifts, “creative destruction” has also begun in the financial sector. New financial technologies include online payment systems, artificial intelligence (AI) advisors for credit transactions, crowdfunding technologies, cryptocurrencies, and other blockchain-based financial systems. According to experts, these innovations are upending established business practices, blurring the lines between industries, and reshaping the structure of financial markets (Podrugina and Tabakh 2022). Consumers of financial services value these innovations’ benefits (e.g. speed, accessibility, anonymity), whereas banks and other financial institutions see a potential competitive advantage. The new fintech sector has proven to be significantly more effective than traditional institutions, but it has posed a number of risks and resulted in the partial prohibition of certain transactions. Serious concerns among national and international regulators will not result in a total ban on these technologies, but rather in the development of new regulatory methods and tools as well as innovative solutions at all levels of management in this field (Ivanova 2022).

These and other examples suggest that the value of digitalization processes and, consequently, the attitudes of the market, society, and state have undergone a transitional phase. A new economic and sociopolitical phenomenon is the development of digital technologies and transformation of a number of digital platforms into global monopolists. This indicates that innovation policy issues have transcended purely economic debates, acquired a unique political urgency, and revealed not only the vulnerability of theoretical perceptions of the public good, but also profound global differences in values that can serve as the basis for new global regulation and long-term state strategies governing technological supremacy.

Technology globalization in China: characteristics and challenges

China’s model of technological globalization during the 1990s and the 2000s was characterized by the large-scale attraction of foreign direct investment to build manufacturing and service enterprises, establishment of advanced economic sectors on that foundation, accession into the WTO to increase technological imports (primarily high-tech components, but also know-how and other forms of intellectual property), export of finished products, copying of advanced technologies, rapid increase in R&D funding, and the establishment of economic incentives to form a national innovation system.

According to estimates by both Russian and foreign researchers, the rapid development of the Chinese economy and the re-equipping of the majority of industries with modern technical and technological bases were made possible by investments from the United States, Japan, Germany, the United Kingdom, and the Republic of Korea. “They brought to China new goods, production means (tools, machinery, equipment), technology, know-how, patents, inventions, engineering, and managerial skills” (Varnavskiy 2022).

It should be emphasized that the fundamental basis for long-term scientific and technological success, ensuring the development of a country, is its own science, or more generally, a research and development field. In this regard, China has achieved remarkable success. As shown in Table 1, total R&D expenditure increased by double digits. According to data from 2021, China has invested 2.8 trillion yuan ($386 billion), or 2.4% of its GDP in science, indicating a slight increase in the knowledge intensity of the economy over the past two to three years. Significant advancements were made in fields such as manned space navigation, lunar and Martian exploration, subsurface and deep-sea exploration, supercomputers, satellite navigation, quantum computing, nuclear power technologies, new energy technologies, large aircraft production, biomedicine, and biopharmaceuticals. China has joined the ranks of innovative nations (according to the report of the Central Committee of the Chinese Communist Party to the 20th Congress).

Owing to the government’s constant support and promotion of innovative activities, Chinese scientists have achieved great success in applied research and development related to the development of new industries and knowledge-intensive private and public sector companies. China surpasses both Japan and the European Union in total R&D funding for this sector, approaching parity with the United States.

In terms of funding (Table 3), China is more than three times behind the United States, and in terms of quality results (Nobel Prizes and other prestigious awards, highly cited journals and articles in advanced fields, and university rankings), it also lags behind European countries. Quantitative and qualitative gaps in basic science are extensive and difficult to close, as demonstrated by the experience of other nations.

Table 3. Scale and structure of R&D funding, by stage, $ billion at PPP, 2019

|

|

Total costs |

Basic research |

Applied research |

Development |

|

United States |

668.4 |

102.9 |

132.9 |

432.6 |

|

China |

525.7 |

32.7 |

59.3 |

434.7 |

|

Japan |

173.3 |

21.7 |

32.2 |

112.3 |

|

India |

55.1 |

7.9 |

12.2 |

10.8 |

|

|

As a percentage of total costs |

|||

|

United States |

100 |

15.4 |

19.8 |

64.6 |

|

China |

100 |

6.0 |

11.3 |

82.7 |

|

Japan |

100 |

12.5 |

18.6 |

64.8 |

|

India |

100 |

14.4 |

22.2 |

63.4 |

Sources: National Center for Science and Engineering Statistics, National Patterns of R&D Resources (2019–20 edition); Organization for Economic Cooperation and Development, Main Science and Technology Indicators (September 2021 edition).

Moreover, over the past three years, in the midst of political controversies, trade war, and the Covid-19 pandemic, cooperation between Chinese and foreign scientists, particularly American scientists, has slowed significantly. This was evidenced by the sharp decline in all types of collaborative publications. Collaboration between Chinese and American scientists has been a relatively recent phenomenon. Prior to 2000, there was almost no publication by dual-affiliated (U.S.-China) scientists, and the 18 years that followed saw a rapid increase in collaborations that outpaced the dynamics of U.S. scientists collaborating with scientists from other countries. By 2021, the number of such articles in refereed databases dropped to 12,000 from the 2018 peak of 15,000. Notably, the collaboration and publication of U.S. and Chinese scientists with colleagues from other nations continues along the same trajectory as in the past and has been historically stable. However, the scope of the interactions with other nations is many times smaller. Under the new conditions, it is possible that the previous level of Chinese-American interaction is no longer attainable (Van Noorden 2022). The decisions of the 20th Chinese Communist Party Congress reaffirm that science and technology are the most important methods and tools for addressing long-term modernization challenges, but China’s reliance on its own resources is becoming increasingly pronounced (The Economist 2022b).

High business activity is an important advantage of China’s research and development. Three-quarters of China’s national R&D expenditures are carried out and financed by the private sector, reflecting the predominant orientation of research toward the market and profit generation for innovative companies. Such indicators are typical of the most technologically advanced nations, including the United States, Japan, and the Republic of Korea (see Table 4). In European nations, business participation in overall R&D activities is somewhat lower. In India, only 37% of R&D funding comes from the private sector, which is comparable to the R&D structure of the Russian Federation (33% in 2020). International comparisons reveal that the lower the share of business investment in R&D and the higher the share of public investment in R&D as a proportion of the total national R&D budget, the less efficient the spending, the slower the development in advanced high-risk areas, and the less state developments are transferred to industries and services.

Table 4. Structure of funding and implementation of R&D, by country, 2019, %.

|

|

R&D funding |

R&D implementation |

||||

|

Business |

Government |

Universities and NGOs |

Business |

Government |

Universities and NGOs |

|

|

Unites States |

74.5 |

9.7 |

15.7 |

65.0 |

21.0 |

14.0 |

|

China |

76.4 |

15.5 |

9.1 |

76.3 |

20.5 |

3.2 |

|

Japan |

79.2 |

7.8 |

13.0 |

78.9 |

14.7 |

6.4 |

|

R. of Korea |

80.3 |

10.0 |

9.7 |

76.9 |

20.7 |

2.4 |

|

France |

65.8 |

12.4 |

21.8 |

56.7 |

32.5 |

10.8 |

|

India |

36.8 |

56.1 |

7.1 |

36.8 |

63.2 |

0.0 |

Based on: Boroush, M., Guci, L., 2022. Cross-National Comparisons of R&D Performance. Research and Development: U.S. Trends and International Comparisons. Science and Engineering Indicators. April 2022. National Science Foundation. Available at: <https://ncses.nsf.gov/pubs/nsb20225/cross-national-comparisons-of-r-d-performance> (table RD-7).

China’s 2020-2025 five-year plan projects an average annual growth rate of 7% for scientific expenditures. A predicted slowdown in economic growth may make it harder to achieve this goal, since in a context of increased politicization of economic regulation it may be difficult for businesses to raise funds for innovative projects. The Chinese Communist Party’s long-term objective is to reach the average science intensity of the GDP of OECD countries by 2035, which currently stands at 2.7%. Specialists have questioned the feasibility of this objective. This objective is further complicated by the CPC’s declared policy of strengthening and enhancing the significance of state-owned enterprises, which could reduce incentives for small and medium science-intensive businesses and foreign investors. The declared priorities of development, such as the military complex, agriculture, and green energy, are not always commercially attractive to modern knowledge-intensive businesses (The Economist 2022b).

The country’s innovative potential is hampered by conflict with the United States, also known as the trade war. However, the disagreements between the nations extend beyond trade disputes; this is a new phase in the competition for technological advantage as the basis for geopolitical leadership. As Chinese manufacturers approached the forefront of technological advancement and transitioned from playing catch-up to pursuing their own strategies, in 2018, the United States began imposing various sanctions against Chinese companies, primarily high-tech companies (Danilin 2020). The stated reasons for the sanctions pressure include the prevention of leaks of dual-use technologies, accusations of unauthorized access to defense technology secrets, cyberattacks against government agencies, etc. Numerous Russian and Chinese experts believe that with the rapid development of Chinese high-tech, claims and contradictions have assumed a critical nature, posing threats to U.S. global leadership and hegemony.

The first effort to resolve the U.S.-China trade dispute was a large bilateral trade agreement (signed on January 15, 2020 by Donald Trump and Chinese Vice Premier Liu He). The eight-part document addresses trade issues, including the trade volume of food and agricultural products, financial issues, terms of dispute settlement, and, most importantly, technological development and technology transfer issues. The agreement begins with a section on intellectual property, as China's spotty record regarding this area is of great concern to the United States. When both parties signed the agreement, it meant that China acknowledged the issue and accepted the proposed solutions. This topic was translated into practical terms in the second section of the agreement, which addressed the technology transfer and localization conditions. It is known that the Chinese government required foreign companies entering the Chinese market to agree to localize production, train Chinese specialists, and transfer technology to Chinese companies. This occurred, for instance, with the manufacturing of wind turbines and solar panels; as a result of the transfer of foreign technology, as U.S. experts assert, China has become one of the largest manufacturers of wind turbines and the undisputed leader in the manufacturing of solar panels.

In the new trade agreement, the parties “confirm the priority of technology transfer on voluntary, market conditions,” and China pledges not to require foreign companies to transfer technology. Building on these commitments, China adopted the Foreign Investment Law in 2020, which established an institutional framework for attracting, protecting, and regulating foreign investment. All laws and regulations that do not comply with this law will be abolished over the following three years. Chinese experts argue that this development has increased the country’s openness to the outside world, and that this openness will continue to increase in the future.

In spite of these steps and a series of other reciprocal steps made by China, the “technological war” between the U.S. and China continues, becoming more acute in 2022. In June, the U.S. passed the so-called Chips and Science Act, which aims to limit the supply of state-of-the-art microelectronics production technologies to China and provides for an increase in scientific and technological capacity in the United States. The total amount of direct and indirect subsidies provided to the U.S. microelectronics sector and the national science fund will exceed $300 billion over several years. Beijing links the law on microchips to a new U.S. initiative to establish the Chip-4 group (U.S., Japan, South Korea, and Taiwan), an alliance of four leading chip manufacturers. The goal of the group is declared to be “blocking the development of the Chinese microchip industry and monopolizing the industry of high-quality microchips.”

In August 2022, the U.S. Department of Commerce imposed a ban on the export of electronic design automation software to China. In October, the Administration introduced new restrictions on exports to China, this one regarding advanced semiconductors and equipment for their production, as well as bans on the employment of U.S. specialists in Chinese companies that are subject to sanctions. Experts believe that these sanctions against Chinese microelectronics, in terms of their impact, will prove to be as serious as those previously adopted against the telecommunications company Huawei (its market position has deteriorated significantly).

The situation in the Chinese high-tech sector is also compounded by the increasing intensification of internal CCP politics, which is increasingly limiting the presence of its major companies, especially digital businesses, in global capital markets (especially on U.S. stock exchanges), instead orienting big business toward CCP political and ideological priorities, increasing pressure on social networks, the video game industry, e-commerce, and artificial intelligence. Priorities for national security and technological sovereignty are increasingly coming to the forefront in China.

The aforementioned trends of decreasing international interaction, limiting the powerful forces behind the global division of labor and scientific cooperation, and shifting national development priorities toward state enterprises and central government-controlled R&D programs may pose unforeseen challenges and threats to the CCP's stated goal of becoming a world superpower with a developed economy in the foreseeable future (Institute of World Economics and Politics, CASS Research Center for Hongqiao International Economic Forum 2022: 182).

***

Thus, in the 2000s and the 2010s, technological globalization was marked by new and important trends that distinguished the era from earlier global economic processes, as the above statistical and empirical data suggest.

First, there was accelerated growth in the research and development field beyond the leading group (the USA, EU, and Japan), in countries that were previously passive in this area, especially in Asia. The developed R&D sector qualitatively changes the foundations of economic growth, creates human and intellectual-creative potential for new solutions, patents, startups, and new industries and services. There has been an increase in the knowledge intensity of the global economy and the formation of stable bases of technological development in regions that have recently joined the new stage of the global division of labor, with a special role of fast-growing high-tech industries. The Covid-19 pandemic accelerated the development of R&D as a critical source of solutions for emerging problems. At the same time, the economic growth slowdown, fragmentation of global value-added chains, and increased priorities of security and technological sovereignty led to the fragmentation and individualization of many previously open global processes, slowing down the development of a number of R&D areas.

Second, a structural transformation of the R&D sphere was noted, owing to an increase in the share of the entrepreneurial sector, which surpassed the importance and role of state investment in R&D. This shift was most striking in the field of information technology. The cross-cutting, breakthrough nature of these technologies, the high economic return of the transformation of all types of business, and the special social and political significance of digitalization are the sources of growth of capitalization and the high investment activity of digital corporations. The mastery of advanced frontiers of information technology, especially in the field of microelectronics, is considered a major strategic advantage in geopolitical competition and has led to new disputes between the U.S., China, and Taiwan.

Third, during the 2000s, China exhibited unprecedented double-digit growth rates in R&D, which accompanied the industrialization of its economy and its integration into global value chains through increasingly sophisticated products and services. On account of these factors, the People’s Republic of China has become the leader of the developing world, with Chinese corporations successfully pursuing global expansion in all regions and countries, provoking opposition from the U.S. and European regulators. The 20th CPC Congress proclaimed a policy of long-term strengthening of the foundations of scientific and technological development and attainment of leadership in this field. China continues to seek its own path to modernization while overcoming structural imbalances in the innovation system, competitors’ resistance, and difficulties in transitioning from catch-up development to mastery of new areas of science and technology.

Bibliography

Acemoglu, D., 2021. Remaking the Post-COVID World. Finance and Development. IMF. Available at: <https://thedocs.worldbank.org/en/doc/596451600877651127-0080022020>

Aghion, P., Antonin, C., Bunel, S., 2021. The Power of Creative Destruction: Economic Upheaval and the Wealth of Nations. Cambridge, MA: Belknap Press.

Boroush, M., 2020. Cross-National Comparisons of R&D Performance. Research and Development: U.S. Trends and International Comparisons. Science and Engineering Indicators. January 2020. National Science Foundation. Available at: <https://ncses.nsf.gov/pubs/nsb20203/cross-national-comparisons-of-r-d-performance>

Boroush, M., Guci, L., 2022. Cross-National Comparisons of R&D Performance. Research and Development: U.S. Trends and International Comparisons. Science and Engineering Indicators. April 2022. National Science Foundation. Available at: <https://ncses.nsf.gov/pubs/nsb20225/cross-national-comparisons-of-r-d-performance>

Chauhan, M., 2021. Dr. Eric Schmidt Launches Special Competitive Studies Project. TFIR. Oct. 6 Available at: <https://www.tfir.io/dr-eric-schmidt-launches-special-competitive-studies-project>

Congressional Research Service, 2022. Semiconductors: U.S. Industry, Global Competition, and Federal Policy. CRS Report Prepared for the Members and Committees of Congress. R46581. Available at: <https://crsreports.congress.gov/product/pdf/R/R46581?__cf_chl_jschl_tk__=pmd_wPiTeLsN2DtpWGLMmBvhH03fBS5jx0SkUVfqt2ksWXg-1634515534-0-gqNtZGzNAlCjcnBszRU9>

Danilin, I.V., 2020. Amerikano-kitayskaya tekhnologicheskaya voyna: riski i vozmozhnosti dlya KNR i global’nogo tekhnologicheskogo sektora [The U.S.-China Technology War: Risks and Opportunities for China and the Global Technology Sector]. Sravnitel’naya politika [Comparative Politics], vol. 11, no 4, pp. 160–176. Available at: <https://doi.org/10.24411/2221-3279-2020-10056>

European Commission, 2021.The 2021 EU RD Investment Scoreboard. JRC/DG RTD.

Grigoryev, L.M., Kurdin, A.A., Makarov, I.A. (eds.), 2022. Mirovaya ekonomika v period bol’shikh potryaseniy [The World Economy in a Period of Big Shocks]. Moscow: INFRA.

Institute of World Economics and Politics, CASS Research Center for Hongqiao International Economic Forum, 2022. World Openness Report 2022. November.

ISS RAS, 2021. Nauka, tekhnologii i innovatsii Rossii — 2021: kratkiy stat. sbornik [Science, Technology and Innovation in Russia - 2021: Brief Statistical Digest]. Moscow.

Ivanova, N., 2020. Innovatsionnaya konkurentsiya [Innovative competition]. Moscow: Ves’ Mir.

Ivanova, N.I., 2022. Razvitiye tsifrovykh tekhnologiy i novyye zadachi gosudarstvennoy antimonopol’noy politiki. Polis, no 1, pp 53–66. Available at <https://doi. org/10.17976/jpps/2022.01.06>

Konina, N.Yu., 2022. Osobennosti rynochnogo polozheniya yevropeyskikh TNK v sovremennykh usloviyakh [Peculiarities of the market position of European MNCs in modern conditions]. Sovremennaya Yevropa [Modern Europe], no 5, p. 84.

Liu Zhen, 2022. US will lose China tech war if 5G, AI, microchip ‘core’ fronts are not fortified, report warns. South China Morning Post. Sept. 14. Available at: <https://www.scmp.com/news/china/science/article/3192386/us-will-lose-china-tech-war-if-5g-ai-microchip-core-fronts-are>

Mallapaty, S, 2022. What Xi Jinping’s third term means for science. Nature. Oct. 27 Available at: <https://www.nature.com/articles/d41586-022-03414-z>

Mikheyev, V., Lukonin, S., 2022. Bolevyye tochki Pekina — 3 (Smena ekonomicheskoy modeli i vneshnepoliticheskiye riski) [Beijing’s Pain Points - 3 (Economic Model Change and Foreign Policy Risks)]. Mirovaya ekonomika i mezhdunarodnyye otnosheniya [World Economy and International Relations], no 1.

National Center for Science and Engineering Statistics, 2020. National Patterns of R&D Resources (2019–20 edition).

OECD, 2020. Digital Economy Outlook 2020. Paris: OECD Publishing.

OECD, 2021. Main Science and Technology Indicators. September 2021.

The Economist, 2022a. Amazon Makes a New Push Into Health Care. Nov. 21 Available at: <https://www.economist.com/business/2022/11/20/amazon-makes-a-new-push-into-health-care> (accessed on November 21, 2022)

The Economist, 2022b. An obsession with control is making China weaker but more dangerous (China’s next chapter). Oct. 15. Available at:<https://www.economist.com/leaders/2022/10/13/an-obsession-with-control-is-making-china-weaker-but-more-dangerous>

Van Noorden, R., 2022. The number of researchers with dual US–China affiliations is falling. Nature. Available at: < https://www.nature.com/articles/d41586-022-01492-7> (accessed October 30, 2022.)

Varnavskiy, V.G., 2022. Kitayskiy fenomen ekonomicheskogo rosta [Chinese Phenomenon of Economic Growth]. Mirovaya ekonomika i mezhdunarodnyye otnosheniya [World Economy and International Relations], no 1, p. 12.

Wang, H., 2022. ‘China’s Evolving Role in Trade and Investment.’ In: Wang, H., 2022. The Ebb and Flow of Globalization. China and Globalization. Singapore: Springer. Available at: <https://doi.org/10.1007/978-981-16-9253-6_1>

Wang, H., Michie, A. (eds.)., 2021. Consensus or Conflict? China and Globalization in the 21st Century. Springer. Available at: <https://doi.org/10.1007/978-981-16-5391-9>

Notes

1 U.S. R&D estimates for 2019 from: Boroush, M., 2020.

1.jpg)