Bricks for the Pyramids: Foreign Participation in Egyptian Megaprojects

[Чтобы прочитать русскую версию статьи, выберите русский в языковом меню сайта.]

Ilia Orlov — junior researcher, Institute of Oriental Studies RAS; visiting lecturer, HSE University

ORCID: 0000-0002-6645-2179

Researcher ID: HGD-1513-2022

Andrey Ufimtsev — junior researcher, Research Center for African strategy in BRICS at the Institute for African Studies RAS; intern researcher, Center for Stability and Risks Analysis, HSE University.

ORCID: 0000-0002-4870-4360

Researcher ID: HLP-7821-2023

For citation: Orlov, I., Ufimtsev, A., 2024. Bricks for the Pyramids: Foreign Participation in Egyptian Megaprojects. Contemporary World Economy, Vol. 2, No 2.

Keywords: Egypt, megaprojects, external debt, budget deficit, BRICS.

Abstract

This is not the first time Egypt has resorted to implementing large-scale projects and attracting foreign funds in order to solve the problems of economic development. In the 19th century, the Suez Canal became such a project, and in the 20th century, the Aswan Dam. Each time, Egypt had to pay a high price for these initiatives. In the 21st century Egypt faces many economic problems: overpopulation, food shortages, unemployment, overload of the energy system, inflation and devaluation of the national currency, budget deficit, etc. The centralized governing model again led Egypt to the idea of megaprojects and again forced it to turn to the resources of other countries. However, this time Egypt is being cautious and trying to diversify foreign investment. In a sense, joining BRICS is a manifestation of this caution. The work identifies three groups of countries and examines their contribution to the megaprojects being implemented in modern Egypt. Based on this analysis, it is concluded that the OECD and BRICS-5 countries participate both as investors and as contractors, while the GCC countries almost always act as investors. At the same time, the BRICS-5 and GCC countries are usually represented by state corporations and sovereign funds, while the OECD countries are more often represented by private companies. This fact emphasizes the importance of BRICS as a platform for interstate negotiations that can expand cooperation between Egypt and other member countries of this organization. However, when choosing partners, Egypt is guided more by economic rather than political considerations, wanting to maintain neutrality in world politics and not become dependent on any of the political blocs. The country’s economic future is uncertain, so maintaining financial and political independence in the future is a challenge for Egypt.

Introduction

On January 1, 2024, Egypt, along with Ethiopia, the United Arab Emirates and Iran, became a member of the BRICS group of countries. By joining the international organization, Egypt expects BRICS to assist the country in overcoming some of its economic, social and demographic challenges. These expectations are articulated by the country’s senior officials. Prime Minister Mustafa Madbouly has discussed the potential for Egypt to receive preferential loans from the New Development Bank, which was established by BRICS member countries. Finance Minister Mohamed Maait has indicated his expectation that Egypt’s accession to this organization will result in increased investment and new export opportunities, facilitated by deeper economic cooperation between Egypt and the member states [Abdelaziz 2023]. Today, Egypt is particularly in need of external financing, as President Abd al-Fattah as-Sisi has led the country down the path of implementing megaprojects, and many traditional creditors refuse to encourage large-scale budget spending. Consequently, the International Monetary Fund has pledged to extend greater assistance to Egypt if the country reduces its expenditure on infrastructure projects [IMF 2024a].

The concept of addressing social and economic challenges through large-scale infrastructure initiatives is not a novel one in Egypt. The term “megaproject” is a widely used designation for a country’s largest construction projects. Nevertheless, it is evident that Egypt’s rulers employed comparable strategies during the 19th and 20th centuries, albeit without using the term “megaproject” to describe them. Throughout modern history, the state has played a pivotal role in the country’s economy. The realization of significant economic breakthroughs has necessitated not only the determination to pursue specific “megaprojects,” but also the availability of unrestricted funds, which have always had to be sought abroad. The aforementioned tasks have proven to be challenging for Egypt. Therefore, in light of their historical experience, the country must exercise caution when selecting external creditors and contractors, in order to avoid becoming politically or economically reliant on other countries.

This article will examine the role of “megaprojects” and external debt in the history of modern Egypt, the country’s current economic situation and the problems that modern megaprojects are designed to solve, as well as the participation of foreign actors in the implementation of these megaprojects in the context of Egypt’s accession to BRICS and the perennial budget deficit. The objective of this study is to identify the principal external investors and contractors involved in the implementation of megaprojects in Egypt.

“Megaprojects” and foreign debt in the history of modern Egypt

The Suez Canal – the “megaproject” of the 19th century

Egypt embarked on the path of modernization in the early 19th century, when Muhammad Ali, the viceroy of the Ottoman sultan, decided to use the country’s potential to strengthen his own power. He initiated the recruitment of European specialists and the dispatch of Egyptian nationals to Europe for study, thereby establishing an army and an administrative system that were at the vanguard of their time [Fahmy 2012. P. 65, 99, 106]. Despite the considerable advancements, Egypt’s development was, and to a considerable extent remains, a process of catching up with more developed countries. In order to continue Muhammad Ali’s modernization policy, his successors were compelled to seek external financing, a strategy that Egypt has employed on numerous occasions throughout its history and continues to do so. The initial attempt was particularly careless.

Muhammad Ali’s own son, Said, was the first who attempted to secure external financial assistance. He came to power in 1854 and, in the same year, under the influence of his friend and former French consul Ferdinand de Lesseps, initiated the planning of the first “megaproject” of modern Egypt: The Suez Canal [Lebedev and Mirsky 1964. P. 7]. However, the implementation of this plan, as well as the launch of other modernization projects, necessitated the availability of financial resources, which were not readily accessible within the country. The construction of the Suez Canal was completed between 1859 and 1869. To initiate the construction, Said had to purchase shares at a cost of 88 million francs (equivalent to over 3.5 million pounds), a sum that was considerably higher than the 16 million francs (approximately 640 thousand pounds) that had originally been budgeted for. Furthermore, Egypt was obliged to pay an additional 44 million francs (approximately 1.75 million pounds) to the Suez Canal Company in 1863, in the form of penalties, due to the fact that the Ottoman Sultan, under pressure from Britain, ordered Said’s heir Ismail, who had already succeeded Said, to take back some of the lands that had been transferred to the company and to prohibit the forced labor of Egyptian peasants at the construction site [Lebedev and Mirsky 1956. P. 9–11].

The Egyptian leadership initially resorted to the utilization of debt instruments in the period preceding the commencement of the construction of the Suez Canal. In 1858, Said attempted to issue treasury bonds, and in 1860, he borrowed in excess of one million pounds (equivalent to 28 million francs) from the French banking house on his personal account. Two years later, he secured a government loan for 3.3 million pounds with the approval of the Ottoman Sultan. Khedive Ismail, who assumed power following Said’s demise in 1863, pursued a similar policy of attracting foreign capital. The initial years of his tenure coincided with the American Civil War, which precipitated a significant surge in global cotton prices. Ismail was of the opinion that the influx of funds would facilitate the repayment of all outstanding debts with relative ease. From 1862 to 1867, the Egyptian leadership issued government bonds on five occasions in the financial houses of Paris and London, for a total of 18 million pounds. However, following the conclusion of the American Civil War, there was a decline in the price of cotton, which meant that Ismail was forced to consider taking out further loans in order to repay his existing debts. In 1868, the Khedive procured an additional 11.9 million pounds from the Imperial Ottoman Bank, Société Générale and Oppenheim, stipulating a five-year moratorium on further debt accumulation. Nevertheless, this strategy was not effective enough in resolving Ismail’s financial challenges. In 1872, he sought new loans from the Franco-Egyptian Bank, and in 1873, he secured the largest loan in the country’s history, amounting to 32 million pounds, from multiple financial institutions. By that time, the total of all debt repayments equaled the total of all revenues received by the Egyptian state budget [Tunçer 2021. P. 76–77].

It is evident that the court of the Khedive did not always utilize the funds for the benefit of the country. Corruption and waste were hallmarks of the state apparatus at the time. Furthermore, Ismail himself utilized the available funds to offer bribes to his relatives with the intention of securing their consent for his son to succeed him as ruler, rather than the eldest descendant of Muhammad Ali [Dawkins 1901. P. 492]. Nevertheless, the policy of foreign lending had a positive impact on the country’s economic growth. The funds were invested in a number of infrastructure projects, including the construction of irrigation canals, dams, railroads, repair shops, weaving workshops, and sugar and paper mills [Hunter 1999. P. 40].

By 1875, despite persistent efforts to increase taxation and other strategies employed to mobilize domestic resources, Egypt was bankrupt [Hunter 1999. P. 40, 180–181]. The Khedive attempted to sell his 44% stake in the Suez Canal initially to the French and subsequently to Britain, which agreed to purchase it for 4 million pounds [Tunçer 2021. P. 77]. This deal was one of the most successful in British history, with the value of these shares reaching 24 million pounds in 1901 and approximately 32 million pounds in 1910 [Dawkins 1901. P. 495; Lebedev and Mirsky 1956. P. 12]. In 1876, Egypt ceased all payments on outstanding bonds. The Khedive was compelled to consent to the establishment of the Public Debt Fund, which was to be managed by foreign commissioners, and which commenced the collection of funds directly from local governments. The fund received a variety of taxes, including those levied in Cairo, Alexandria and numerous other provinces, as well as salt and tobacco taxes, trade duties and revenues from railroads and the port of Alexandria. Egypt pledged to refrain from reducing these taxes or incurring new debts. In order to restore its financial sovereignty, Egypt was required to repay the total debt of 91 million pounds [Tunçer 2021. P. 82]. Nevertheless, the loss of financial sovereignty was followed by the loss of political sovereignty. The suppression of the Urabi Pasha uprising against foreigners in 1882 resulted in the occupation of Egypt by Great Britain.

The Aswan Dam – the “megaproject” of the 20th century

The subsequent effort to steer Egypt towards a trajectory of catching-up development was undertaken by Gamal Nasser. It is also noteworthy that his economic policy was characterized by a search for foreign funds to implement a new “megaproject”—the construction of the Aswan High Dam (AHD). Concurrently, whereas a century earlier Egyptian rulers had been reliant solely on European capital, Nasser was compelled to navigate the more competitive landscape of the emerging bipolar world.

The concept of an AHD was first proposed during the British occupation by an Egyptian agronomist of Greek origin, Adrian Daninos. His plan, which did not attract the attention of the British at the time, was received favorably by the new leadership of the “free officers” [Shokr 2009. P. 12]. The discussion of construction commenced a few months after the revolution in 1952, but the decision to commence exploration work was made after Nasser finally established himself in power in 1954. A budget of 17 million dollars was allocated for preliminary work, which was conducted with the assistance of German experts and a French company [Joesten 1960. P. 57]. In addition to experts from Germany, consultations were held with leading specialists from around the world, primarily Americans. Germany demonstrated particular interest and commitment to allocating resources for the planning of the dam, motivated by a desire to avoid compromising its relations with the Arab world, particularly given the necessity of providing compensation to the Jews of Israel. The German experts estimated that the construction of the dam would cost Egypt 210 million Egyptian pounds, with the total cost of the entire project reaching approximately 400 million (or approximately $600 million and $1.15 billion, respectively) [Tayie 2018. P. 425–426]. Other estimates, presumably utilized by the Egyptian leadership in subsequent deliberations, suggest that the cost of the dam itself was to be at least $1.3 billion, with the project’s overall cost reaching $2.2 billion, including the construction of hydroelectric power plants at the dam and the development of infrastructure around Aswan to accommodate workers and foreign specialists [Joesten 1960. P. 58].

Nasser lacked the financial resources to fund the construction of the dam independently. Consequently, he sought assistance from the World Bank, with the objective of securing the necessary funds to advance his country’s economic development. Egypt was prepared to raise $900 million of its own funds over the course of the 10-year construction period. However, at least an additional $400 million had to be sourced from external sources. Initially, the World Bank indicated its willingness to provide $100 million, subsequently increasing this to $200 million, contingent upon the Bank’s rigorous monitoring of expenditure. However, this was still insufficient, and concerns began to emerge regarding Egypt’s capacity to repay the debt. At that time, the World Bank engaged representatives of the United States and the United Kingdom to discuss the initiative. These representatives expressed their willingness to provide funds in the format of grants, subject to certain conditions. One of the conditions attached to the loan was that Egypt was to refrain from seeking any further external loans during the construction of the dam. The situation was further complicated by the fact that, towards the end of 1955, following the Israeli attack on Egyptian forces in the Gaza Strip, Egypt began to purchase Soviet weapons through Czechoslovakia. This development caused concern in the United States and Great Britain, yet together with the World Bank, these countries offered Nasser financing in the amount of 270 million dollars. The Egyptian president consented to the proposed conditions, despite the evident inadequacy of the promised funds, the curtailment of his sovereignty, and the USSR’s concurrent interest in participating in the construction of the AHD. On February 9, 1956, a preliminary agreement was concluded with the President of the World Bank. However, on July 19, 1956, perhaps as a result of increased diplomatic contact between Egypt and the USSR, the Egyptian ambassador to the United States was informed that, following discussions with Congress, the American president had decided not to provide financial support for the AHD. On July 20, the US State Department made a public announcement that the AHD project would result in Egypt experiencing 12–15 years of economic hardship. In the subsequent week, Nasser proceeded to announce the nationalization of the Suez Canal, which was to be finally taken over by Egypt in ten years’ time, in 1966 [Tayie 2018. P. 426–428; Joesten 1960. P. 59–60].

The unleashed Suez crisis ended successfully for Egypt and led to closer relations with the Soviet Union. Revenues generated by the Suez Canal were approximately $140 million annually, while revenues derived from the nationalization of the assets of British and French banking institutions could potentially exceed $1 billion [Mirsky 1965. P. 40]. In the autumn of 1958, negotiations on the construction of the AHD with the Soviet side commenced, and on December 27, an agreement on the first phase of construction was concluded. The USSR allocated 400 million rubles (approximately $100 million) for this purpose. The agreement stipulated that Egypt would repay the funds in 12 annual instalments, commencing in 1964, at a rate of 2.5% per annum. Despite a temporary cooling of relations in the spring of 1959, due to the anti-communist campaign in Egypt, cooperation continued, with construction commencing in the summer. During this same period, an agreement was concluded with Sudan, which permitted the flooding of its territories in exchange for compensation amounting to approximately $43 million. On August 27, 1960, an agreement was concluded whereby the USSR undertook to provide the necessary finance for the completion of the dam. The loan of 900 million rubles (equivalent to approximately $225 million) was intended to cover the costs associated with additional studies, the development of the final design, the installation of the sluice and hydroelectric power plant, and the provision of technical equipment for irrigation projects [Tayie 2018. P. 431–432; Joesten 1960. P. 61]. The construction of the dam also had negative consequences, including the flooding of areas, water losses due to evaporation from the reservoir formed in the middle of the desert, and a reduction in silt inflow with water. Nevertheless, the positive effects were found to outweigh the negative ones. It was anticipated that the dam would generate sufficient revenue to offset its costs in a relatively short timeframe [Tayie 2018. P. 434–435].

This period in Nasser’s rule is characterized by a shift in orientation towards the socialist bloc. Despite his aversion to definitive alignment with either superpower in the Cold War, Nasser’s trajectory towards Arab socialism and the comprehensive nationalization policy of 1961 offers compelling evidence of Soviet influence. In consequence, nationalization enabled Nasser to appropriate approximately one billion Egyptian pounds (equivalent to almost three billion US dollars) in assets. Over the period between 1953 and 1963, there was a significant increase in state investment in industry, with a nearly 30-fold increase in the value of investment. By 1962, 96% of the economy was under state ownership. Approximately one hundred industrial facilities were constructed with the assistance of the Soviet Union [Mirsky 1965. P. 45–46, 55]. It is argued that, in addition to financial assistance, the USSR exerted considerable influence over Egypt with remarkable rapidity, to the extent that the country’s sovereignty was significantly constrained. This may be identified as one of the factors contributing to the shift in the country’s political trajectory following the ascendance of Anwar Sadat to power [Fahim 2013. P. 26].

Egypt’s economic problems

Demographic problem

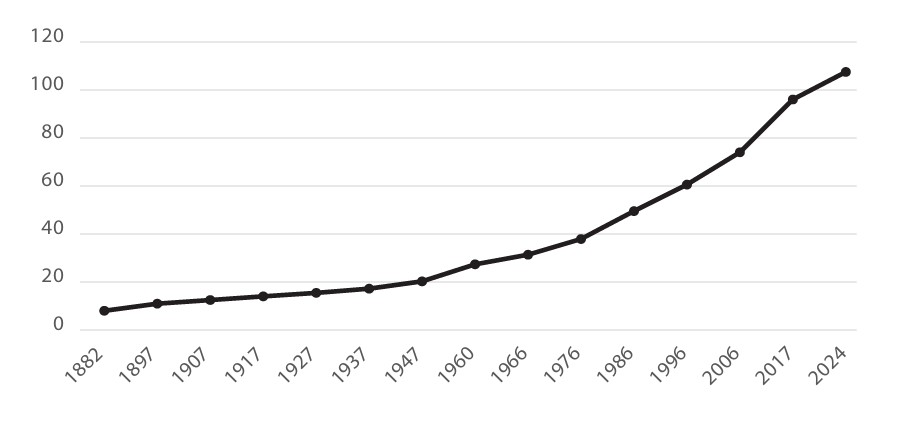

One of the problems to be solved by the construction of the Aswan Dam was the lack of land suitable for farming. Controlling the flow of the Nile River made it possible to better plan irrigation works and supply more areas with water. Even then, the solution to this problem was related to the threat of overpopulation in Egypt, which began to be actively discussed in the 1930s [Shokr 2009. P. 16–17]. Since the construction of the AHD, the population of Egypt has quadrupled. In 2024, the country’s population exceeded 106 million people [CAPMAS 2023] (see Figure 1).

Figure 1. Population of Egypt (million people)

Source: CAPMAS – Central Agency for Public Mobilization and Statistics. Egypt in Numbers.

Food problem

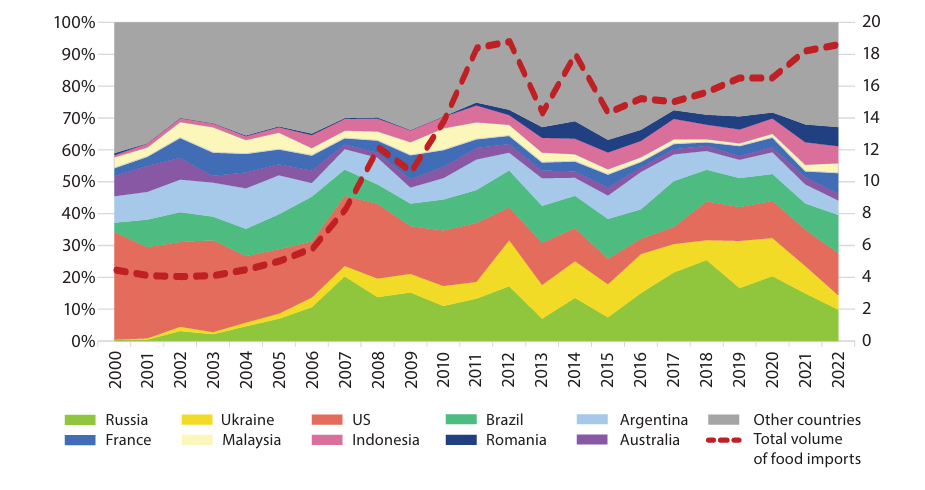

Although Egypt’s total territory is large, only a small part of it—the Nile Valley and the coast—is habitable. The increase in the number of people in the 20th and early 21st centuries has led to a dramatic increase in population density, which has had a negative impact on the environment, the deterioration of infrastructure and the overall quality of life. In addition, high population density has meant that what was once an agricultural powerhouse is now completely dependent on food imports: the available land is not enough to meet the national demand for staple foods such as wheat and oilseeds [Chansiri 2023. P. 44]. Egypt buys about half of the wheat it consumes abroad [Barnes 2022. P. 6]. Growth in food imports was particularly rapid between 2006 and 2011 (see Figure 2).

Figure 2. Distribution of Egypt’s food imports by country (left axis) and Egypt’s total food imports (right axis) ($ million)

Source: Observatory of Economic Complexity.

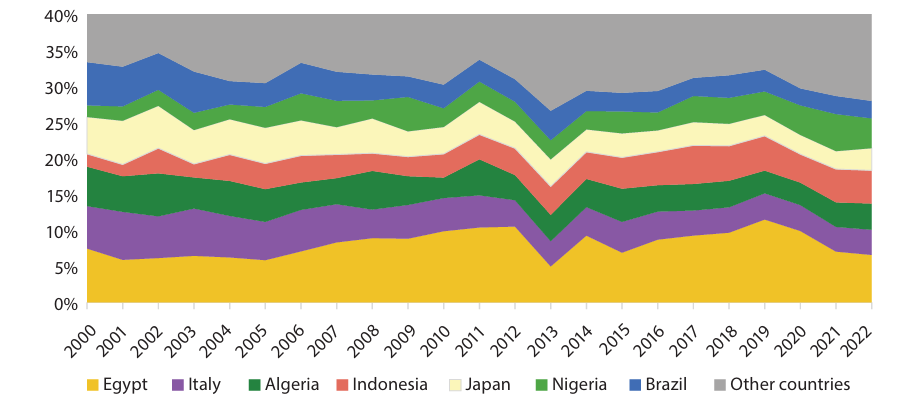

The consumer basket in Egypt differs from the European one: it is not so expensive, as it contains less meat, fish, vegetables and fruits, but more wheat. Flatbreads, couscous, bulgur, pasta (for example, as part of the Egyptian national dish koshari) form the basis of the Egyptian diet. Wheat consumption per person in Egypt, as in many other countries of the Arab World, is twice as high as the world average [World Population Review 2024]. Egypt, the largest Arab country, has been the largest importer of wheat for many years (see Figure 3).

Figure 3. Share of major importers in world wheat imports

Source: Observatory of Economic Complexity.

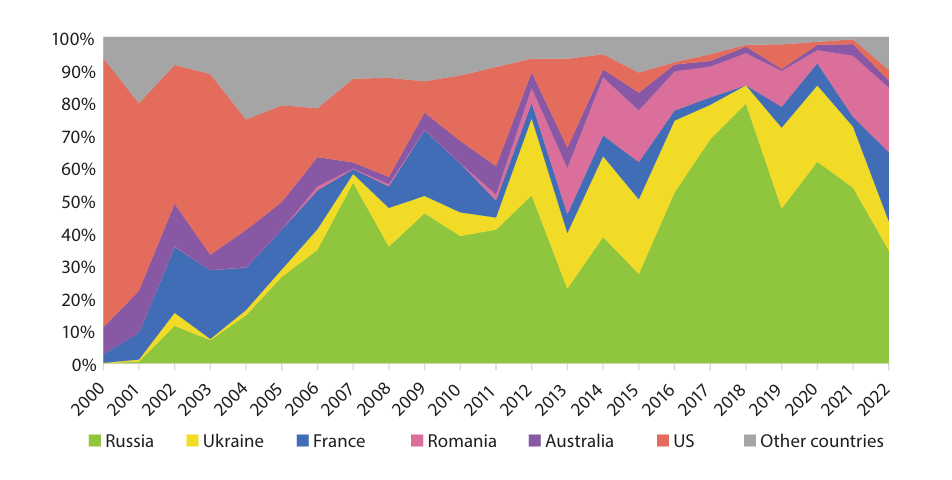

Figure 4 shows that in the early 2000s, Egypt bought almost all the wheat it needed from the United States, but gradually reoriented toward Russia and, to a lesser extent, Ukraine. By 2022, the import basket for this commodity was not sufficiently diversified. The armed conflict in Ukraine reduced the share of combined Russian and Ukrainian wheat imports to the 2006 level and forced Egypt to start looking for new suppliers.

Figure 4. Distribution of wheat imports to Egypt by country ($ million)

Source: Observatory of Economic Complexity.

It is important to acknowledge that in Egypt, the prices of essential commodities, including bread, are maintained at relatively low levels through the implementation of subsidies. Prior to the ascendance of the current President, Abd al-Fattah as-Sisi, the subsidy system was subject to relatively lax regulation. The state provided bakeries with flour and the requisite means to sell bread at a low price. However, this policy resulted in the exploitation of loopholes, with individuals purchasing quantities of bread exceeding their actual requirements. In some instances, bread was even used as animal feed. The purchasing of bread was subject to lengthy queues, with shortages occurring on occasion. In 2014, a reform was implemented, whereby special plastic cards were introduced, allowing citizens to receive a limited quantity of bread at a significantly reduced price of five flatbreads per person per day. Abuses of this system are also present in Egyptian society. For example, employees of public bakeries have been known to cheat citizens by recording larger purchases on their cards in order to save flour for other products. On occasion, citizens have been observed to provide their cards to bakers in collusion with them, allowing the bakers to charge the full amount permitted by the state. Nevertheless, the new system has demonstrated its efficacy, reducing the number of queues and making bread more affordable [Barnes 2022. P. 159–167]. However, the provision of these subsidies represents a significant financial burden for the state. Subsidies for bread, as well as for a number of other essential goods, account for approximately 4% of total state expenditure [Breisinger 2024. P. 112]. The government is currently attempting to reduce the proportion of the population receiving subsidies from 70–80% to 50–60%. However, it is unable to restrict access to subsidized bread, even for the middle class, who, as a result of this measure, are able to maintain their standard of living and avoid falling into poverty [Barnes 2022. P. 167].

Consequently, the level of state expenditure in Egypt is significantly influenced by global wheat prices, as these determine the amount of funding that must be allocated to subsidize the domestic price of bread, which the government is obliged to maintain at a low level. For example, the sharp increase in wheat prices resulting from the Russian–Ukrainian conflict has caused significant concern among the country’s leaders (see Figure 5). The Egyptian government has prohibited the export of select commodities, including pasta, flour, and various cereal grains, such as wheat, which it previously sold to neighboring countries on a periodic basis [Al-Ahram 2022]. The country’s leadership is acutely aware that a shortage of bread or an increase in bread prices could incite mass protests, as evidenced by historical precedents in 1977, 2008, and 2011 [Barnes 2022. P. 3].

Figure 5. Prices in the world wheat market ($/bushel)

Source: Trading Economics.

Problems of low living standards and unemployment

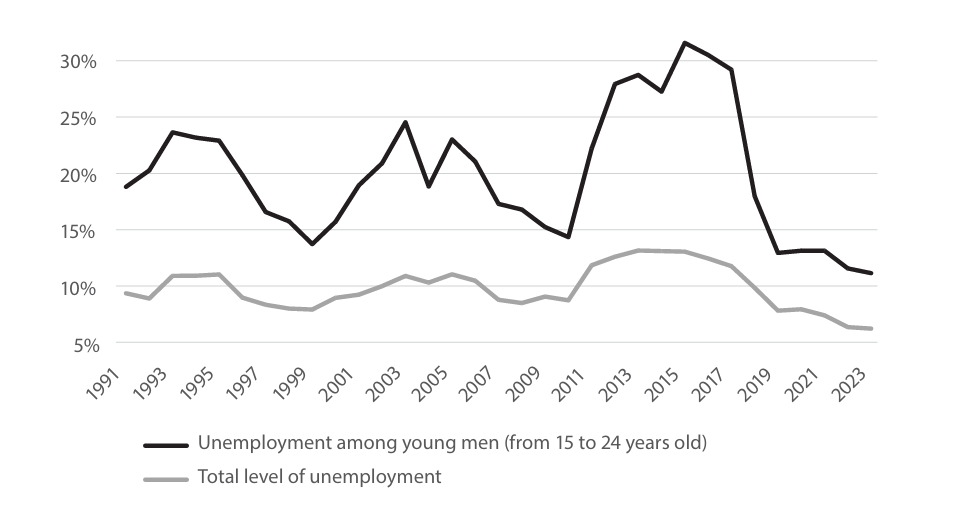

Another important socio-economic factor that affects the level of discontent of the Egyptian population is unemployment. A significant part of the protesters in Egypt during the Arab Spring was represented by young people who could not find a job even after receiving higher education [Korotayev and Zinkina 2011. P. 23]. However, after the arrival of Abd al-Fattah as-Sisi, the situation began to improve. In recent years, both general unemployment and youth unemployment have shown record low rates for Egypt (see Figure 6).

Figure 6. Unemployment in Egypt

Source: World Bank.

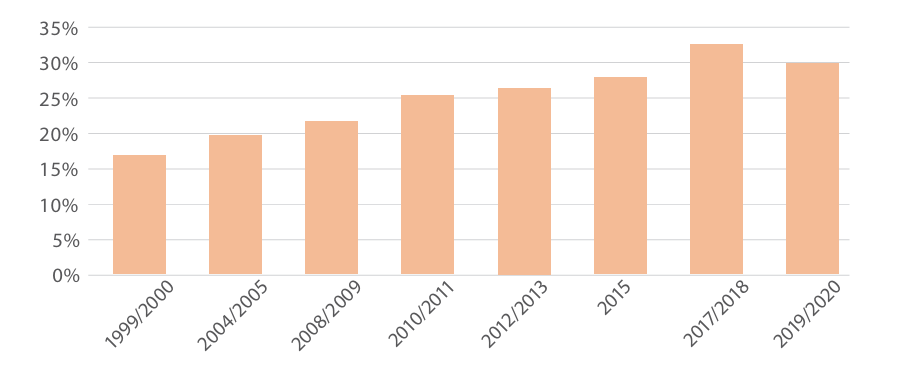

Although Egypt has a very low poverty rate (the proportion of people living on less than one dollar a day), poverty is a big problem for the country. For example, in 2019, more than 40% of the population spent less than five dollars per day [PIP 2019]. Due to the inflation of the national currency, the government has changed the thresholds for defining poverty several times in recent years. However, according to government statistics, poverty has steadily increased in recent decades, at least until recently (see Figure 7). While in some muhafazahs poverty is around 5%, in others it exceeds 50%. This is especially true in the Upper Egypt muhafazahs, where more than half of the rural population cannot meet basic needs [Elshahawany and Elazhary 2024. P. 112, 116–117].

Figure 7. Proportion of Egypt’s population living below the nationally defined poverty line

Source: CAPMAS.

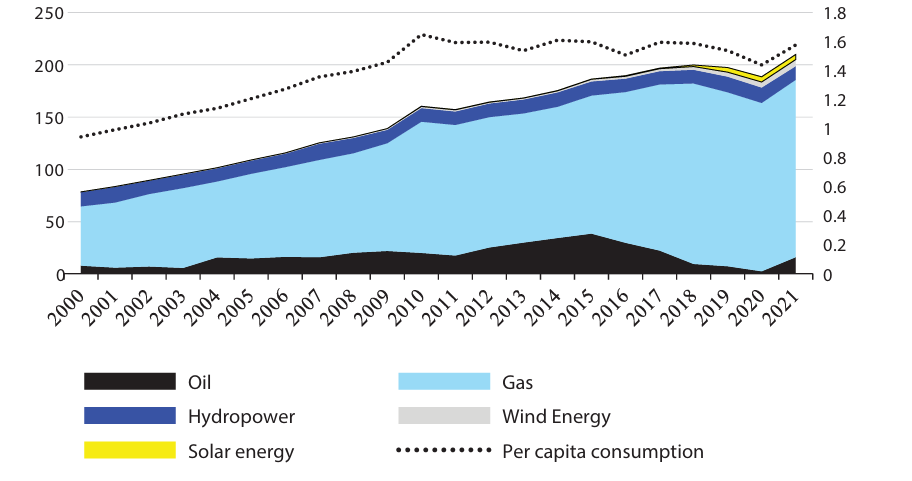

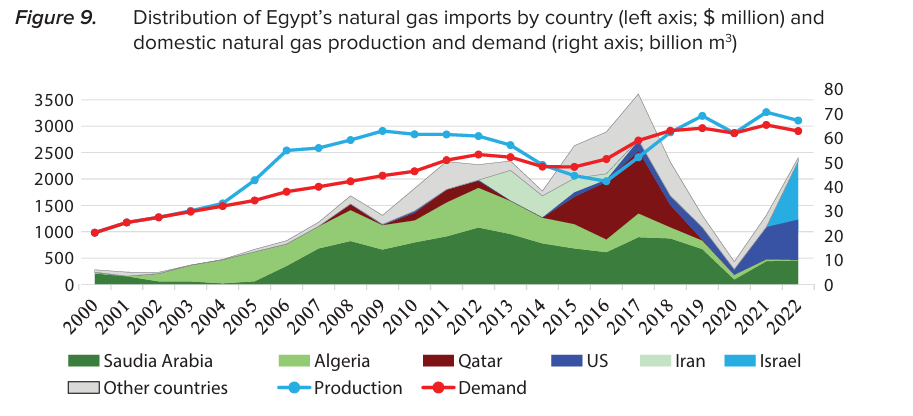

Energy problem

The construction of the Aswan Dam had a profound impact on Egypt’s energy potential. In the late 1960s and 1970s, the Aswan HPP was responsible for the production of over 50% of the country’s total electricity consumption [Tayie, 2018. P. 434]. Nevertheless, by the beginning of the 21st century, the contribution of hydropower plants to the country’s total electricity production had declined to 20%, and by the early 2020s, it had further diminished to 6%. Currently, the majority of the country’s electricity is generated through the combustion of gas. Concurrently, the growth of electricity consumption per capita has ceased since 2010 (see Figure 8). The majority of gas used for electricity generation is produced domestically, with only a minor proportion imported (while at the same time there is gas export from the country). Consequently, between 2015 and 2017, when domestic gas production was insufficient to meet demand, Egypt increased its imports. In 2018, the commencement of gas production at the Zohr field resulted in a decline in imports. Furthermore, in 2020, when energy consumption declined due to the pandemic, Egypt temporarily ceased importing gas [Rana and Khanna 2020. P. 9–10]. This is illustrated in Figure 9.

Figure 8. Distribution of electricity production in Egypt by energy source (left axis; TW⋅h) and electricity consumption per capita in Egypt (right axis; mW⋅h/person)

Source: IEA.

Figure 9. Distribution of Egypt’s natural gas imports by country (left axis; $ million) and domestic natural gas production and demand (right axis; billion m3)

Source: OEC, OPEC.

It is notable that by 2007, 99% of Egyptian households had already gained access to electricity. Despite this fact, the energy sector was still experiencing internal problems. The primary issue is that electricity in Egypt is subsidized and sold at a price that is significantly below the cost of production, resulting in considerable budgetary expenditure. In 2013, energy subsidies constituted 22% of government expenditure, representing approximately 6% of GDP. The low price of electricity prevented private energy companies from entering the market without government support. Concurrently, amidst political turbulence and a dearth of administrative resources, the country endured a series of recurrent disruptions in its energy supply between 2012 and 2014. The government has demonstrated considerable concern about the situation, implementing annual reductions in subsidies and raising electricity tariffs in response. From 2014 to 2019, the price of electricity in Egypt increased three and a half times [Rana and Khanna 2020. P. 10–15, 25–29]. Nevertheless, the resolution of the power outage problem represented a notable achievement of Abd al-Fattah as-Sisi’s tenure. However, since August 2023, due to the lack of production capacity to meet the growing demand, outages resumed [Ayoub 2024] and the problem persists to this day [Morsy 2024].

Macroeconomic challenges

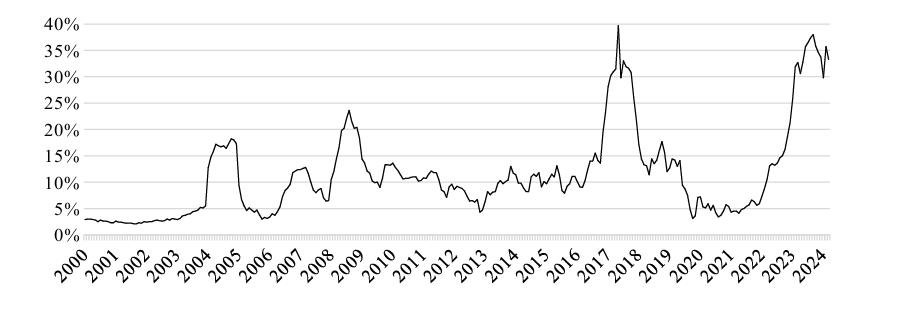

It is not only electricity prices that are rising in Egypt. While most of the time the Central Bank of Egypt has managed to keep inflation at 10–15%, in 2017 and from 2022 to today, inflation can be characterized as galloping (see Figure 10).

Figure 10. Consumer price index in Egypt

Source: Trading Economics.

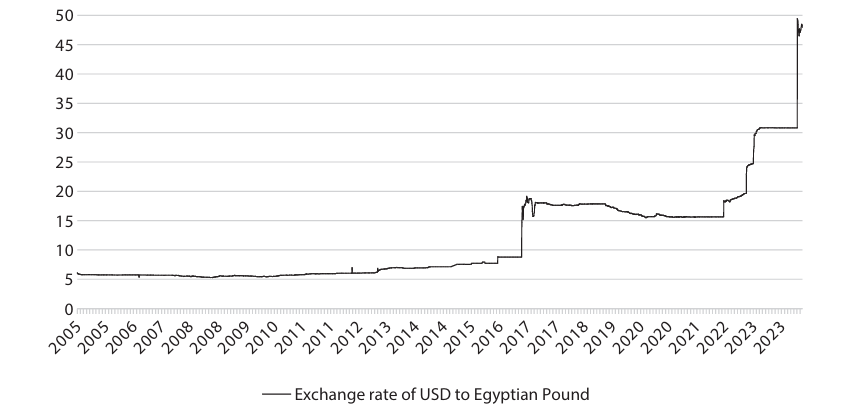

At the same time, there was also a significant devaluation of the Egyptian pound against the dollar. Recent years have been particularly difficult for the Egyptian national currency (see Figure 11).

Figure 11. Value of the US dollar in Egyptian pounds at the official exchange rate

Source: Central Bank of Egypt.

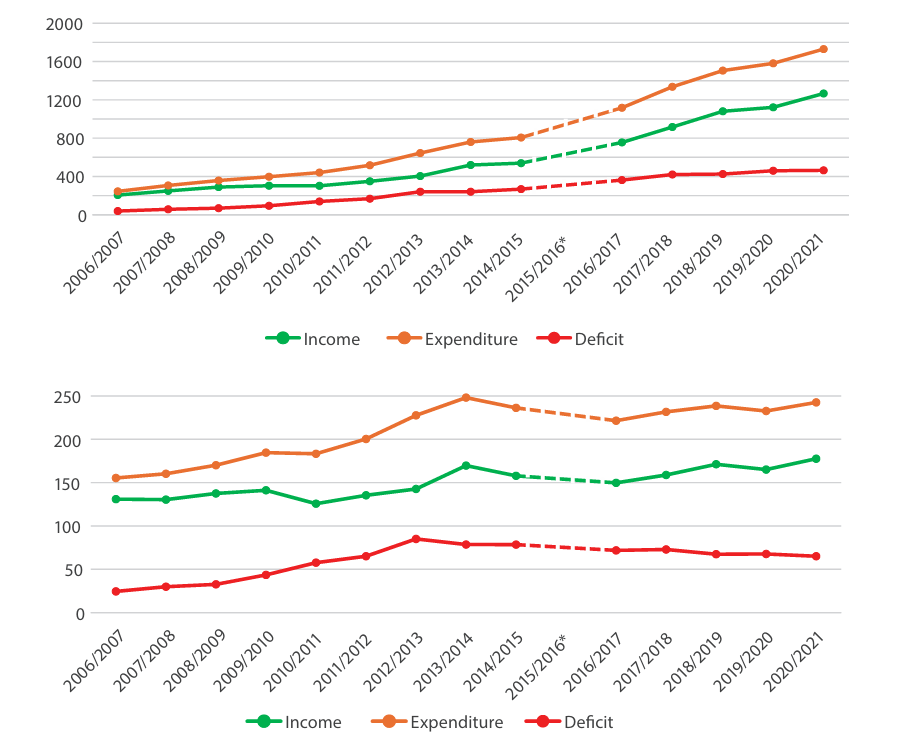

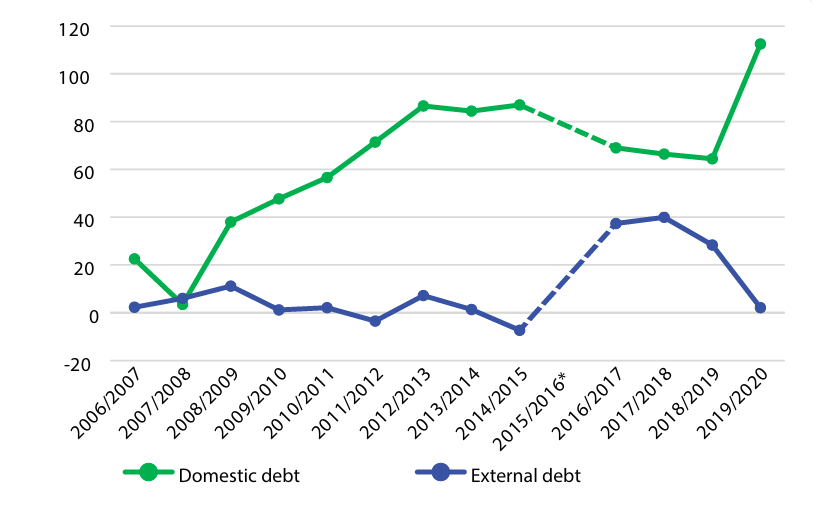

Inflation has resulted in a persistent expansion of the budget deficit in nominal terms. However, when adjusting for inflation, it appears that since Abd al-Fattah as-Sisi came to power in 2014, the budget deficit has even started to decline, although it still remains high (see Figure 12). The Egyptian government has historically addressed its budget deficit through the issuance of domestic debt, which has increased significantly since the mid-2000s. However, Abd al-Fattah as-Sisi has adopted a markedly more external-financing-oriented approach to deficit financing. In the initial phase of the pandemic, when the deficit declined, he was once again compelled to resort to increasing domestic debt in order to meet the deficit (see Figure 13). Furthermore, the outbreak of the Russia–Ukraine conflict contributed to inflation and the subsequent collapse of the exchange rate. During the tenure of the current president, the country’s external debt has increased significantly, largely due to the attraction of funds from China and GCC countries, as well as international organizations [Roll 2022. P. 8, 15, 19].

Figure 12. Egyptian government budget in current prices (top; billion Egyptian pounds) and inflation-adjusted in 2000 prices (bottom; billion Egyptian pounds 2000)

* No data available for fiscal year 2015/2016.

Source: Central Bank of Egypt.

Figure 13. Egypt’s inflation-adjusted domestic and external debt in 2000 prices (billion Egyptian pounds 2000)

* No data available for fiscal year 2015/2016.

Source: Central Bank of Egypt.

Megaprojects are the problem solution

Egypt is currently facing a challenging situation in which it must select between two unfavorable policy options. The first option entails a reduction in public expenditure, thereby curbing the budget deficit and net imports. Nevertheless, the result of such austerity measures will be a decline in GDP, a reduction in living standards and an increase in unemployment, as a decrease in public spending will lead to a decrease in economic activity. Macroeconomic stabilization at such a cost could weaken the position of Egypt’s current elites and reduce a popular support. The second strategy is to maintain or increase spending, which would serve to maintain the level of economic activity and employment. Nevertheless, the consequence of augmented government expenditure is an expansion of the budget deficit and net imports.

Although both strategies entail significant costs, the Egyptian government has, as might have been anticipated, opted for the second. Egypt persists in pursuing a stimulative fiscal policy, maintaining a high level of expenditure [IMF 2024b. P. 7]. One of the reasons for this choice is that austerity is politically costly. Those who have lost their jobs and been deprived of part of social assistance may begin to express their discontent publicly. Such a scenario is to be avoided.

Consequently, the Egyptian leadership is pursuing a strategy of megaprojects. There is no official set of criteria defining what constitutes a megaproject. The term is used in the media and official documents in relation to large infrastructure projects, for example, as in the Egyptian strategic plan, “Egypt Vision 2030” [Egypt Vision 2030. P. 17]. Accordingly, in the following text, the term “megaproject” will be used to refer to those large projects that have been so labelled in other sources, primarily in the media.

The implementation of megaprojects serves to address the following issues currently facing the country:

- The issue of overpopulation and the deterioration of infrastructure can be addressed through the implementation of transportation and urban development megaprojects.

- Land reclamation projects for agricultural and fish farming purposes are designed to address the food security challenge.

- The involvement of the population in the execution of megaprojects, coupled with the creation of new employment opportunities at the facilities, can help to alleviate socio-economic issues.

- The construction of numerous power plants based on both fossil and renewable sources, as well as the large Ad Dabaa nuclear power plant, is intended to address the issue of energy scarcity.

- Finally, the creation of a positive image of megaprojects and the attraction of funds from abroad can help to mitigate macroeconomic problems.

Furthermore, megaprojects have the potential to exert a significant influence on the political landscape. In contrast to the mere enhancement of macroeconomic indicators, megaprojects can serve as a demonstration of development and prosperity, thereby securing support in favor of the government. The political effect of megaprojects is further enhanced by the fact that “great construction projects” are distributed across different regions, thereby demonstrating the economic power of the country to the population.

The government is effectively subsidizing the political benefits at the expense of the country’s budgetary constraints, as evidenced by the IMF’s [IMF 2024a] observation that infrastructure projects place a significant burden on the country’s finances. Furthermore, the profitability of these projects, including the largest ones such as the New Administrative Capital and the expansion of the Suez Canal, is often subject to scrutiny [Roll 2022. P. 27–28]. In order to mitigate this burden, the Egyptian leadership endeavors to attract foreign investment and seeks external contractors (see Appendices 1–5). In many cases, the volume of investment is considerable. For instance, on February 23, 2024, the UAE pledged to invest $35 billion in the Ras al-Hekma construction project in return for a 65% stake in the project [NewArab 2024].

Foreign involvement in modern Egyptian megaprojects

Methodology

Since there is no single up-to-date list of megaprojects, the authors compiled this list independently for the purposes of the study. For this purpose, they analyzed materials from the following media outlets: Al-Qahira Al-Ikhbariya (Arabic. القاهرة الإخبارية), Al-Ain Al-Ikhbariya (Arabic. العين الإخبارية), Oxford Business Group, CSR Egypt, SkyNews Arabiya, al-Ahram, Reuters, CNN, al-Arabiya, The Impossible Build, Indian Construction Info, Ventures Onsite, Construction Review, The New Africa Channel, MEED, Vlaanderen. Examination of media data from different countries and profiles yielded a fairly broad list of 44 megaprojects. Of these 44 megaprojects, two have not been implemented (King Salman Bridge and Hamrawein coal power plant) and ten have not been identified as relating to foreign involvement. This does not mean that foreign companies were not involved in these projects, as it is possible that such involvement was not publicized or covered by the media.

In order to identify the countries from which the investors in the megaprojects under consideration originated, the Google News aggregator was used to systematically search for mentions of the specific megaprojects and their investors in news reports. In the initial stage of the process, the names of the megaprojects were provided in English, accompanied by the relevant forms of participation. To illustrate, the following example is provided:

“New Administrative Capital + Foreign Investment”

The above search term was employed to search for references related to foreign investments in the New Administrative Capital. Furthermore, the name of the megaproject was entered in conjunction with the names of countries. At the outset of the investigation, the search was conducted using a list of Egypt’s ten principal import trading partners for the period between 2012 and 2022 (PRC, US, Russia, Saudi Arabia, Germany, Turkey, Italy, Ukraine, India, and UAE) [OEC n.d.]. To illustrate:

“New Administrative Capital + Saudi Arabia”

In the future, when a new country was mentioned, it was incorporated into the list of countries to be searched. As a result, it was possible to identify the notable involvement of the Republic of Korea, Japan, United Kingdom, and other countries in Egyptian megaprojects. Such a comprehensive and meticulous search ensured the identification of crucial information and the avoidance of erroneous inferences.

It is possible that the authors may have collected incomplete information, as the names of countries were absent from the articles and the presence of foreign entities was identified through the names of foreign companies. Nevertheless, this potential issue does not appear to be significant. As a general rule, the frequency of new references to the megaproject declined with the number of queries.

Once the search had been concluded, the list of countries was divided into three distinct groups. The OECD, BRICS-5 and GCC countries. Despite the UAE’s ascension to full BRICS membership on January 1, 2024 and Saudi Arabia’s active involvement in numerous BRICS activities, it was determined that the Gulf monarchies should be grouped separately. It is typical for Saudi Arabia, the UAE, Kuwait and Qatar to participate in megaprojects in a particular manner, namely through the utilization of financing provided by sovereign wealth funds. To illustrate, the Abu Dhabi Development Holding Company (ADQ), a sovereign wealth fund owned by the United Arab Emirates (UAE), is involved in the construction of Ras al-Hukma city [The New Times 2024]. Additionally, the Benban Power Plant is managed through Masdar, a company owned by the UAE sovereign fund Mubadala Investment Company [Casey 2023]. The OECD is included in the analysis because it comprises the majority of developed countries, which allows for a comparison of the influence of BRICS countries and developed countries on the development of Egyptian megaprojects.

For each country, the format of participation in the project was indicated in parentheses: G indicates the involvement of the state, sovereign fund or public corporation; P denotes the participation of the country through private companies; NS denotes a form of participation that is not specified (for further details, please refer to Appendices 1–4).

Findings

Analysis of the data shows that OECD countries are involved in most of the megaprojects in Egypt, both as investors and as contractors. Their active participation is explained by the positive relationship between a country’s GDP per capita and the volume of its foreign investment, due to the higher capital intensity of developed countries and the resulting lower return on domestic investment, which makes companies from developed countries more willing to invest in developing countries [Bano and Tabbada 2015]. This also explains why the GCC countries are more often investors than contractors, as the Gulf monarchies, in an effort to save oil revenues, channel them into sovereign wealth funds that can invest in, among other things, Egyptian megaprojects (see Figure 14).

Figure 14. Number of megaprojects involving foreign investors and contractors belonging to different country groups, by type of participation

Source: compiled by the authors on the basis of media data.

The active participation of OECD countries in Egyptian megaprojects as contractors is linked to their overall level of technological and economic development, which ensures leadership in the production of transport and energy equipment. The contribution of the BRICS countries, led by China, is much higher than that of the Gulf monarchies, where high-tech manufacturing is less developed.

The participation of different groups of countries in megaprojects reflects Egypt’s neutral status and shows that the country favors one foreign partner or another based on the quality of its services rather than geopolitical considerations. Rosatom is the leading company in the field of nuclear energy, which is why it was chosen to build the Ad Dabaa nuclear power plant. China is the leader in housing construction and therefore plays a crucial role in the construction of the New Administrative Capital and New Alamein. And the German company Siemens is one of the leaders in the field of energy equipment manufacturing, which is why Egypt favored its services in the construction of the Beni Sueif and Burullus thermal power plants [Egypt Independent 2024; Ngugi 2023; Power Online 2016; Power Technology 2019].

Foreign participation in Egyptian megaprojects varies considerably. OECD countries are much more likely to be represented by private companies, while BRICS and GCC countries are represented by state-owned enterprises and sovereign wealth funds. This is due to the structure of the economies of the investor and contractor countries—the role of state-owned enterprises is much higher in the BRICS and GCC countries.

The level of foreign participation in Egypt’s megaprojects is also uneven. It is impossible to make an accurate assessment because little of the information is public and the forms of foreign participation vary. According to S. Roll’s estimates, the largest amount of foreign direct investment comes from the GCC countries, mainly Saudi Arabia and the UAE. Their cooperation with the BRICS countries has significantly strengthened the organization’s position in Egypt. Although the number of megaprojects involving BRICS countries still lags behind the number of megaprojects involving OECD countries, BRICS is likely to overtake the largest Western economies in terms of direct financing, largely due to the crucial contribution of Arab sovereign wealth funds [Roll 2022].

Conclusions and discussion of findings

The study demonstrates that foreign participants are frequently engaged in the execution of Egyptian megaprojects in the capacity of contractors (28 megaprojects) rather than solely as investors (26 megaprojects). This can be attributed to the fact that megaprojects are financed not only by private investors, but also by government funds. The rapid growth of the Egyptian population is forcing the country to address the issue of unemployment, as well as the lack of energy and the poor quality of its infrastructure, through the implementation of megaprojects. Nevertheless, the implementation of these projects places a considerable burden on the state budget, thereby increasing the risk to the Egyptian economy.

It is hypothesized that Egypt’s accession to the BRICS may have a beneficial impact on the country’s economy, given the enhanced opportunities for interaction with the organization’s members, which could facilitate the conclusion of new contracts. It is also noteworthy that OECD countries are involved in the financing and implementation of megaprojects indirectly. Typically, the Egyptian government enters into contracts with companies from these countries, rather than with their governments. In contrast, the situation with the BRICS countries, which will include the UAE from 2024 onwards, is characterized by the presence of state-owned corporations and sovereign wealth funds, which represent the main actors in the Egyptian economy. Consequently, in order to utilize the services of a state corporation or a sovereign fund from a BRICS country, a contract must be concluded at the state level. Furthermore, whereas Egypt is only able to offer financial assistance to a private firm, an agreement between the two states is more likely to encompass a significant non-financial political component.

The question of whether international cooperation can provide a solution to Egypt’s economic challenges remains unanswered. While the significance of the Suez Canal and the Aswan Dam, which continue to exert a considerable influence on Egypt’s economy, was once unquestionable, the extent to which modern megaprojects can facilitate economic recovery remains uncertain. In this context, it is of paramount importance for the country, while seeking external assistance, to avoid becoming overly reliant on any particular political bloc and to refrain from becoming a victim of the growing global contradictions.

Bibliography

Abdelaziz, M., 2023. Egyptian Media Reflections on Egypt’s Accession to BRICS. Fikra Forum. Available at: https://www.washingtoninstitute.org/policy-analysis/egyptian-media-reflections-egypts-accession-brics (accessed April 25, 2024).

Al-Ahram, 2022. At-tijara tuqifu tasdir 6 sala’i ghiza’iyti li-muddati thalahtati ashhurin [Al-Ahram. Stops exports of six food items for three months]. Available at: https://gate.ahram.org.eg/News/3436685.aspx (accessed April 20, 2024).

Ayoub, M., 2024. Egypt’s Energy Blackouts: A Growing Crisis Amid War. The Tahrir Institute for Middle East Policy. Available at: https://timep.org/2024/02/12/egypts-energy-blackouts-a-growing-crisis-amid-war/ (accessed April 25, 2024).

Bano, S., Tabbada, J., 2015. Foreign direct investment outflows: Asian developing countries. Journal of Economic Integration, Vol. 30, No 2. P. 359–398.

Barnes, J., 2022. Staple Security. Bread and Wheat in Egypt. Duke University Press.

Breisinger, C. et al., 2024. From Food Subsidies to Cash Transfers: Assessing Economy-Wide Benefits and Trade-Offs in Egypt. Journal of African Economies, Vol. 33, No 2. P. 109–129.

CAPMAS – Central Agency for Public Mobilization and Statistics, 2023. Egypt in Numbers. Available at: https://www.capmas.gov.eg/Pages/StaticPages.aspx?page_id=5035 (accessed April 20, 2024).

Casey, J. P., 2023. UAE to develop 10GW of renewable capacity in Africa, including 300MW of solar. PV Tech. Available at: https://www.pv-tech.org/uae-to-develop-10gw-of-renewable-capacity-in-africa-including-300mw-of-solar/ (accessed April 25, 2024).

Central Bank of Egypt. Available at: https://www.cbe.org.eg/en/economic-research/statistics/ (accessed April 20, 2024).

Chansiri, A., 2023. An Investigation of the Effects of Globalization and Trade Liberalization on Food Consumption and Food Security in Egypt. International Journal of Humanities and Social Science, No 4. P. 42–50.

Dawkins, C. E., 1901. The Egyptian Public Debt. The North American Review, Vol. 173, No 539. P. 487–507.

Egypt Independent, 2024. El Dabaa Nuclear Project is the largest cooperation project between Egypt and Russia. Available at: https://www.egyptindependent.com/el-dabaa-nuclear-project-is-the-largest-cooperation-project-between-egypt-and-russia/ (accessed April 20, 2024).

Egypt Vision 2030. Available at: https://arabdevelopmentportal.com/sites/default/files/publication/sds_egypt_vision_2030.pdf (accessed April 20, 2024).

Elshahawany, D. N., Elazhary, R. H., 2024. Government Spending and Regional Poverty Alleviation: Evidence from Egypt. Asia-Pacific Journal of Regional Science, Vol. 8, No 1. P. 111–135.

Fahim, H. M., 2013. Dams, People and Development: The Aswan High Dam Case. Pergamon Press.

Fahmy, K., 2012. Mehmed Ali: from Ottoman governor to ruler of Egypt. Simon and Schuster.

Hunter, F. R., 1999. Egypt under the Khedives, 1805-1879: from Household Government to Modern Bureaucracy. American University in Cairo Press.

IEA – International Energy Agency. Countries. Electricity. Egypt. Available at: https://www.iea.org/countries/Egypt/electricity (accessed April 20, 2024).

IMF, 2024a. IMF Staff and the Egyptian Authorities Reach Staff Level Agreement on the First and Second Reviews under the EFF Arrangement. Available at: https://www.imf.org/en/News/Articles/2024/03/06/pr-2459-egypt-staff-and-authorities-reach-agreement-on-reviews-under-the-eff-arrangement (accessed April 25, 2024).

IMF, 2024b. Country Report No. 2024/098: Arab Republic of Egypt. Available at: https://www.imf.org/en/Publications/CR/Issues/2024/04/26/Arab-Republic-of-Egypt-First-and-Second-Reviews-Under-the-Extended-Arrangement-Under-the-548335 (accessed May 20, 2024).

Joesten, J., 1960. Nasser’s Daring Dream: The Aswan High Dam. The World Today, Vol. 16, No 2. P. 55–63.

Korotayev, A. V., Zinkina, Yu. V., 2011. Egyptian revolution of 2011: sociodemographic analysis. Historical Psychology and Sociology, Vol. 4, No 2. P. 5–29 (in Russian).

Lebedev, E. A., Mirsky, G. I., 1956. Materials for a lecture on the topic: The Suez Canal. All-Union Society for the Dissemination of Political and Scientific Knowledge (in Russian).

Mirsky, G. I., 1965. Arab Peoples Continue to Fight. Moscow: International Relations Publisher (in Russian).

Morsy, A., 2024. Blackouts are Back. Ahram Online. Available at: https://english.ahram.org.eg/NewsContent/50/1201/522457/AlAhram-Weekly/Egypt/Blackouts-are-back.aspx (accessed April 25, 2024).

NewArab, 2024. Egypt economic crisis: What is Ras al-Hekma and why is Cairo “selling it” to UAE? Available at: https://www.newarab.com/news/egypt-economy-what-ras-al-hekma-cairo-selling-uae (accessed May 20, 2024).

Ngugi, M., 2023. The New Administrative Capital Project in Egypt. Constructionreview, Aug. 16. Available at: https://constructionreviewonline.com/construction-projects/the-new-administrative-capital-project-in-egypt/ (accessed April 20, 2024).

OEC – Observatory of Economic Complexity. Available at: https://oec.world/en/ (accessed April 20, 2024).

OPEC. Data. Available at: https://asb.opec.org/data/ASB_Data.php (accessed April 20, 2024).

PIP – Poverty and Inequality Program, 2019. Country Profiles. Egypt. World Bank. Available at: https://pip.worldbank.org/country-profiles/EGY (accessed April 20, 2024).

Power Online, 2016. First Siemens Gas Turbines Begin Their Journey to Egypt. Available at: https://www.poweronline.com/doc/first-siemens-gas-turbines-begin-their-journey-to-egypt-0001 (accessed April 20, 2024).

Power Technology, 2019. El Burullus Power Plant. Available at: https://www.power-technology.com/projects/el-burullus-power-plant/?cf-view (accessed April 20, 2024).

Rana, A., Khanna, A., 2020. Learning from Power Sector Reform: The Case of the Arab Republic of Egypt. World Bank Policy Research Working Paper, No 9162.

Roll, S., 2022. Loans for the President: External Debt and Power Consolidation in Egypt. SWP Research Paper.

Rudenko, L. N., 2017. Current economic problems of Egypt. Russian Foreign Economic Journal, No 6. P. 25–35 (in Russian).

Shokr, A., 2009. Hydropolitics, economy, and the Aswan High Dam in mid-century Egypt. The Arab Studies Journal, Vol. 17, No 1. P. 9–31.

Tayie, M. S., 2018. Impact of the International Context on the Political and Legal Dimensions of the Aswan High Dam (1952-1960). In: Grand Ethiopian Renaissance Dam Versus Aswan High Dam / A.M. Negm, S. Abdel-Fattah (eds.). Springer. P. 419–450.

The New Times, 2024. Egypt, UAE sign deal to develop new city on Egypt’s northern coast. Available at: https://www.newtimes.co.rw/article/14790/news/international/egypt-uae-sign-deal-to-develop-new-city-on-egypts-northern-coast (accessed April 25, 2024).

Trading Economics. Available at: https://tradingeconomics.com (accessed April 20, 2024).

Tunçer, A. C., 2021. Foreign Debt and Colonization in Egypt and Tunisia (1862–82). In: Sovereign Debt Diplomacies: Rethinking Sovereign Debt from Colonial Empires to hegemony / P. Penet, J.F. Zendejas (eds.). Oxford University Press. P. 73–93.

World Bank. Available at: https://data.worldbank.org/ (accessed April 20, 2024).

World Population Review, 2024. Wheat Consumption by Country 2024. Available at: https://worldpopulationreview.com/country-rankings/wheat-consumption-by-country (accessed April 20, 2024).

Appendices

Appendix 1. Investor countries in Egypt’s megaprojects

|

Project name |

Type of project |

OECD |

BRICS-5 |

GCC |

|

The new administrative capital |

Town planning |

|

China (G), South Africa (NS) |

UAE (NS) |

|

Line 3 of the Cairo Metro |

Transport |

South Korea (G) |

|

|

|

Line 4 of the Cairo Metro |

Transport |

Japan (G), South Korea (G) |

|

|

|

Tahrir Petrochemical Complex |

Industry |

USA (G), South Korea (G), Italy (G) |

|

|

|

Benban SPP |

Energy |

United Kingdom (G) |

|

UAE (G) |

|

Burullus TPP |

Energy |

Germany (P) |

|

|

|

Beni Suef TPP |

Energy |

Germany (P) |

|

|

|

Construction of new roads |

Transport |

|

|

Kuwait (G) |

|

City Gate |

Town planning |

|

|

Qatar (G) |

|

Golden Triangle |

Other |

Australia (P) |

|

Kuwait (G) |

|

Planting palm trees |

Other |

|

|

UAE (P) |

|

The new Assiut Dam |

Energy |

Japan (G), Germany (G) |

|

|

|

Zaafarana WPP |

Energy |

Denmark (P), Japan (P), Switzerland (P) |

|

|

|

The city of the 10th of Ramadan |

Town planning |

Turkey (NS), Italy (P), France (P) |

India (P), China (NS) |

Saudi Arabia (NS) |

|

Gabal az-Zeit WPP |

Energy |

United Kingdom (P) |

|

|

|

Suez Canal Economic Zone |

Industry |

Japan (P), Germany (NS) |

Russia (G), China (NS) |

Qatar (G), Kuwait (G), UAE (G) |

|

Port of Ain Sokhna |

Transport |

British Virgin Islands/Hong Kong (P) |

|

|

|

Cairo Metro Line 6 |

Transport |

South Korea (G) |

|

|

|

Ras al Hekma |

Town planning |

|

|

UAE (G), Qatar (G) |

Source: compiled by the authors on the basis of media data.

Appendix 2. Contracting and supply of equipment for Egypt’s megaprojects

|

Project name |

Type of project |

OECD |

BRICS-5 |

GCC |

|

The new administrative capital |

Town planning |

Germany (P) |

China (G) |

Saudi Arabia (G) |

|

Ain Sukhna – Marsa Matrouh railway |

Transport |

Germany (P) |

China (G) |

|

|

El Dabaa NPP |

Energy |

South Korea (G) |

Russia (G) |

|

|

Line 3 of the Cairo Metro |

Transport |

South Korea (G) |

|

|

|

Line 4 of the Cairo Metro |

Transport |

South Korea (G), France (P) |

|

|

|

Tahrir Petrochemical Complex |

Industry |

South Korea (P), Germany (P) |

|

|

|

New Alamein |

Town planning |

|

China (G) |

|

|

Monorail to the New Administrative Capital |

Transport |

United Kingdom (P), Spain (P), Canada (P) |

China (G) |

|

|

Benban SPP |

Energy |

Germany (P) |

|

|

|

Burullus TPP |

Energy |

Germany (P) |

|

|

|

Beni Suef TPP |

Energy |

Germany (P) |

|

|

|

Golden Triangle |

Other |

Italy (P) |

|

|

|

The new Assiut Dam |

Energy |

Japan (P), Austria (P), Germany (P) |

|

|

|

Zaafarana WPP |

Energy |

Norway (P) |

|

|

|

West Delta gas project |

Energy |

Italy (P) |

|

|

|

Salamat gas field |

Energy |

Denmark (P) |

|

UAE (G) |

|

The city of the 10th of Ramadan |

Town planning |

|

China (G) |

|

|

Cairo Metro Line 6 |

Transport |

France (G), Canada (P) |

|

|

Source: compiled by the authors on the basis of media data.

Appendix 3. Development of gas fields in Egypt

|

Project name |

OECD |

BRICS-5 |

GCC |

|

Development of the Zohr gas field |

Italy (P), United Kingdom (P) |

Russia (G) |

UAE (G) |

|

West Delta gas project |

United Kingdom (P) |

|

|

|

Salamat gas field |

United Kingdom (P) |

|

|

Source: compiled by the authors on the basis of media data.

Appendix 4. Other cooperation

|

Project name |

Type of project |

OECD |

Other countries |

|

The new administrative capital |

Town planning |

Canada (G) |

|

|

Al Galala |

Town planning |

United States (G) |

|

|

Airport expansion |

Transport |

|

Singapore (G) |

Source: compiled by the authors based on media data.

Appendix 5. Egypt’s megaprojects in which the authors were unable to identify the participation of foreign countries

|

Project name |

Type of project |

|

Expansion of the Suez Canal |

Transport |

|

Fish farming areas |

Other |

|

Medical Capital |

Town planning |

|

Rod El Farag Axis Bridge |

Transport |

|

Agricultural Reclamation |

Other |

|

October Oasis |

Town planning |

|

Berenice military base |

Other |

|

Cairo airport terminal 4 |

Transport |

|

Damietta Furniture City |

Industry |

|

The Grand Egyptian Museum |

Other |

Source: compiled by the authors on the basis of media data.

1.jpg)