The Shocks of 2020-2023 and the Business Cycle

[Чтобы прочитать русскую версию статьи, выберите русский в языковом меню сайта.]

“…the economists are at this moment called upon to say how to extricate the free world from the serious threat of accelerating inflation which, it must be admitted, has been brought about by policies which the majority of economists recommended and even urged governments to pursue. We have indeed at the moment little cause for pride: as a profession we have made a mess of things.”

“The Pretense of Knowledge,” Alfred Nobel Memorial Lecture, delivered on December 11, 1974, by Friedrich von Hayek

Leonid Grigoryev is academic supervisor and tenured professor at the School of World Economy, HSE University.

SPIN-RSCI: 8683-3549

ORCID: 0000-0003-3891-7060

ResearcherID: K-5517-2014

Scopus AuthorID: 56471831500

For citation: Grigoryev, Leonid, 2023. The Shocks of 2020–2023 and the Business Cycle, Contemporary World Economy, Vol. 1, No 1, January–March.

Keywords: business cycle, inflation, sanctions, lockdown, crisis

This research paper uses the results of the project “Assessment of the Consequences of Anti-Russian Sanctions on the World Economy,” carried out as part of the competition of project groups of the Faculty of World Economy and International Affairs of HSE University in 2022-2023.

This article was written in March 2023.

Abstract

The present research considers the impact of the four shocks of 2020–2022 on the world economy, with the main focus on cyclical processes. The first shock is considered to be the 2020 COVID-19 lockdowns, which were of non-economic origin and which interrupted the recovery phase, creating panic and a short-term liquidity squeeze. The second shock was created in 2020–2021 by the financial authorities of the world’s leading countries and the EU (as well as the IMF), which provided a unique financial stimulus for the economy in order to prevent a chain reaction of demand contraction. The third shock was related to the recovery in the commodity markets in 2021 and was expressed in an acceleration of inflation. Its consequence was, to a large extent, the turmoil in the U.S. and EU banking sector in March 2023. Finally, the shock of sanctions in 2022 perpetuated both the uncertainty for global capital accumulation in general and inflationary trends in particular.

Four shocks to the world economy accelerated the change of phases along with the number of their typical characteristics in the business cycle. At the beginning of 2023, the financial authorities of the U.S., EU, and other countries had to balance between curbing inflation and preventing recession using very cautious policy instruments.

Introduction: The world has been changing for a long time

The global business cycle school of thought goes back centuries and has been an integral part of economic growth theory in developed economies. Business cycle theories can be traced from Karl Marx and Clément Juglar in the 1860s to Ben Bernanke and Kenneth Rogoff in the 2010s. Business cycle theories involve a battle of approaches, assessments of established patterns between economic indicators, and patterns of transmission of fluctuations from country to country. In addition, they include expectations concerning the behavior of firms, private banks, workers, consumers, financial markets, governments and central banks. Understanding the patterns of fluctuations in economic activity on a path from A to B is much more difficult than assessing the prospects for medium-term growth over the same period between points A and B.

Global development parameters started to change significantly after the global crisis of 2008–2009, which originated in the financial sector and was sudden and deep. Up to 2019, changes in the nature of connections and the logic of fluctuations in economic activity were discussed (Romer 1999; Reinhart, Rogoff 2014). At the same time, the international community was concerned about sustainable development goals, mitigating the consequences of climate change, and the apparent crisis in global governance, which could influence the course of the business cycle.

The successes of growth and the resilience of many parameters in the early 2000s brought about two important phenomena not only in the world economy, but in its research field. These were the assumption of the normality of growth and development along with the gradual disappearance of large swings in economic activity. In that sense it is worth mentioning the 2004 Nobel Prize-winning real business cycle model by Edward Prescott and Finn Kydland, which denied the importance of financial shocks as triggers of crises (Prescott 2004).

Surprisingly, the theory survived unscathed for only four years before the devastating Great Recession was brought on by the financial shock of 2008 (on September 15, the investment bank Lehman Brothers went bankrupt). The fight against it dragged on for several years, using the “quantitative easing” approach, which recently earned Ben Bernanke a Nobel Prize, but this time for fighting banking crises (Bernanke et al. 2022). This study aims to make sense of shock distortions in previously established mechanisms of the cycle under the influence of external shocks. This immediately begs the question: what external shocks are we aware of and prepared to take into account? This paper aims to improve our understanding of and analyze the impact made by the four shocks as they appear in the 2020–2022 timeframe, namely:

a) The COVID-19 pandemic shock in the form of lockdowns and its impact on the healthcare sector

b) The shock of unique (in scale and time) anti-crisis responses by governments and central banks in 2020–2021, employing fiscal and monetary incentives

c) An early recovery in the commodity markets and rising raw material prices under (a) and (b) in 2021–2022

d) The sanctions shock in 2022 as a global economic issue and the EU energy collapse as a key component of it or as an individual shock.

The extraordinary feature of the current situation is that all four shocks—each in its own unique manner and in various contexts—disrupted the normal flow of the cycle. However, it raises the question of what constitutes a conventional cycle. Arguably, since Marx and Juglar, cycle theory has gradually drifted towards analysis of an alternation of “recessions” and “rebounds” with transitions into upturns and overheating. The real business cycle theory reassured us with its “end of cyclical history” of crises, but this did not materialize (Grigoryev, Ivashchenko 2010). In this regard the IMF working paper Collapse and Revival (Kose, Terrones 2015) should be mentioned, as well as the work of Reinhart-Rogoff (Reinhart, Rogoff 2014) which was also focused on alternating recessions and recoveries, but not on qualitatively different cycle phases (which could be useful at this time).

Modern approaches to the cycle theory have largely been shaped by neoclassical economists and monetarists (and, by default, by advocates of anti-inflation and fiscal moderation). The Great Recession of 2008–2010 provided a very challenging experience of the practical application of anti-crisis measures (Keynesian in fact, if not by intention) in the U.S., with a deficit of 10% of GDP in 2009 (Grigoryev 2013). Nevertheless, this crisis generally fitted the traditional pattern as long as we accept some specific reasons for its severity—a huge bubble, a mortgage crisis and excessive deregulation of the financial sector—as a fact, not as a mark of distinction. The quantitative easing and theoretical innovations in banking theory by Bernanke and his colleagues (Bernanke 1991 onwards), for which he was awarded the Nobel Prize in 2022, were in fact based on a rethinking of the experience of the Great Depression of 1929–1933.

As a result, the transition from crisis to recovery for developed economies in the second decade of the 21st century was rather peculiar: a long period of “credit squeeze” due to Basel 3, a relatively weak investment recovery, and an exit from the debt crisis instead of entrepreneurial expansion (Grigoryev, Podrugina 2016; Podrugina 2021). The global economy approached the fateful year of 2020 in an unusual state. Growth showed no signs of overheating, commodity prices were rather stable, interest rates were low, and debt was conventionally high but stable. It is important to mention that since 2015, two major international agreements were also in place (the Paris Agreement on climate change and the UN Sustainable Development Goals) which are aimed not only at ensuring energy transition but also at coordinating world development trajectories. However, global governance was clearly in decline and progress in these areas was limited (Bobylev, Grigoryev 2020; Grigoryev, Medzhidova 2020). Generally, there was not much overheating by 2020, frictions between countries were already significant, and coordination on climate and other issues was weak.

In his 1988 book, the author (Grigoryev 1988) attempted, for the sake of simplicity, to provide a seven-stage structure for the business cycle. It is presented here in a concise form:

- A: the acute phase of the crisis, the “liquidity squeeze”, is followed by a decline in private consumption, employment, and incomes, with a downturn in inflation and interest rates, and the start of a fall in commodity and energy prices;

- B: the “flat phase” of the crisis, personal consumption, is at its lowest point, investment falls, and there are bankruptcies, tax cuts, and deficits. The decline in housing construction (as in 2005-2008) drags on;

- C: a “depression” in Marxism, in fact a turn towards slow consumption growth while investment continues to fall;

- D: the start of recovery with low labor and commodity prices, with interest rates still low, to the point of the pre-crisis maximum, but sometimes followed by a “credit squeeze”;

- E: early recovery – rapid growth with low factors of production prices, credit expansion (in the 2010s Basel 3 squeezed it);

- F: the “broad back of upturn”: moderate growth rates, everything appears to be fine, but imbalances are building up, and prices gradually rising;

- G: “overheating and bust”: – rapid growth in income but not in production, incomplete investment projects, rising debt and imbalances, peak inventories – a “liquidity squeeze” (see phase A), and financial shock. This is where the trigger (explosive bankruptcy or something similar) usually appears.

In terms of the proposed scheme, the lockdown shock occurred during the “broad back of the recovery” (F) in 2020, although the issue of a possible downturn had been in discussion from 2018 onwards. This is a surprising occurrence—the massive lockdowns of Q2–Q3 2020 disrupted the logic of the recovery in several ways: the abruptness of the shock, the concentration of shutdowns in services (and especially for the wealthy strata), and this happened before the overheating of the economy, rising interest rates and similar things (as is typical for phase G). However, the key feature of the “services output” crisis itself was that it interrupted the upswing not only before the “liquidity squeeze” and another trigger, but also before a significant accumulation of imbalances and an excessive increase in debt. The long period of the credit squeeze, and the rather stringent Basel 3 measures in general, gave the impression that a normal recession could take the form of a “growth cycle”.

Bernanke’s work on understanding the experience of the Great Depression in the U.S. in 1929–1933 changed economic thought from the need for rigidity in the financial system to the easing of monetary policy (Bernanke 1983). And the global economy lived in this—somewhat artificial—environment of low interest rates under the control of Basel credit tightening until 2019 (Podrugina 2021; Grigoryev, Podrugina 2016). This created a regime of not only low inflation and interest rates, but also high debts and low deposit rates. Now interest rates are rising for other—anti-inflationary—reasons, creating the effect of a suddenly discovered bubble. In the face of high inflation and uncertainty for regulators and economists, one can turn to Friedrich von Hayek’s Nobel Lecture of 11 December 1974, “The Pretense of Knowledge.” At that time, in the midst of a crisis, he said something that is quite relevant to the current situation (see epigraph).

From ascent to the shock of lockdowns

The economic activity of industries and the dynamics of important parameters of markets and countries can remain within the established “norm,” defined by the average growth rate and the range of fluctuations over the relevant period. When sudden shocks occur, whether economic, natural or political, it is the parameters of the indicator’s decline (rarely, growth) that can change. Technical analysis immediately changes the average rate of increase over a long period, which naturally raises questions about the nature, stability, and duration of the changes: is it a new trend, a new type of fluctuation from an old trend, or a completely new trend and level of fluctuation? This is the problem that arises after every major—especially sudden—crisis: 1929, 1973, 2008, 2020 (starting years). Uncertainty about the future evolution of demand, prices and technological progress affect the actions of economic agents, investors, companies (their investments) and governments (fiscal authorities and economic policy). The most obvious signals are, of course, the depth of the decline in demand by sector and commodity, and the dynamics of prices and costs. However, economic policy signals can be hugely important, and geopolitical signals can play an important role at sensitive times in history.

In the past, it has been witnessed that periods of rapid economic growth have had their own drivers and beneficiaries (Grigoryev, Ivashchenko 2011). After World War II, there was rapid growth in the U.S., Europe and Japan in 1950–1960, then the consumer boom in oil-exporting countries after 1974, followed by the rise of the Asian Tigers. The Soviet Union and COMECON gradually slowed down until the late 1980s, while Japan stagnated. Growth slowed in the European Union, which tried to solve the problem by expanding as soon as the opportunity arose after the collapse of its neighbors’ planned economies. The 1990s saw the opening of markets in Russia and other former socialist countries, an influx of cheap skilled labor and raw materials from them, with production cut by 25% or more, favorable to exporters of manufactured goods. Immediately, a gigantic mechanism of growth and exports from China, then India, kicked in. Hence the composition of growth factors changed somewhat every decade and a half, but global growth generally maintained its parameters.

Figure 1. Global cycle dynamics: annual growth rate, 2007-2022, including forecasts for 2025.

World = GDP and Exports. GDP = China, Brazil, India, Russia, Germany, United Kingdom, United States, Eurozone.

Source: IMF

In this context, the conditions for the functioning of the global business cycle have changed. The process of fluctuations in economic activity has never ceased, although the two world wars and the Great Depression produced shocks that had far-reaching consequences for both structural shifts and fluctuations in activity, however we qualify them. Each crisis defines the depth of the decline in demand and output, the spread across firms and individuals, industries and sectors, and the degree of imbalance in performance.

It should be noted that the business cycle before World War I was largely based on the railway and banking sectors. After the war, Germany was in stagnation, but its industrial apparatus fell into Hitler’s hands intact—there had been no military operations in the country. The Great Depression, which took on a global dimension, set a certain rhythm, especially in the U.S., but World War II undermined the German economy and mobilized the economies of the U.S. and the UK. From 1949 onwards, a somehow unified world cycle with U.S.-centered crises can be identified. Given the experience of the Great Depression, we can say that, for half a century, the business cycle initially encompassed fluctuating demand, with the crisis spreading through trade channels from the U.S. via Keynesian anti-crisis methods. But in the 1970s, neoclassicism replaced Keynesianism, particularly in the fight against inflation, and anti-crisis methods changed. In the 1990s came the Great Moderation, which, in addition to the change in the type of regulation, had two more specific supporting factors. These were the disappearance of an isolated socialist unit and the global expansion of the market system, with the inclusion of Russia and China in world trade. And China, with its cheap labor costs, with its mass production and (supported by the devalued yuan) exports, also provided an acceleration of growth—some reduction in the inflationary parameters of its developed importers.

There was no high inflation in the 2000s, despite the severe Great Recession of 2008–2010, growing imbalances in the global economy and difficulties in global governance. However, in March 2020, the lockdown threatened to shut down the service sector, collapse employment and create an artificial “liquidity squeeze”. It should be mentioned that a sudden non-economic shock in the form of a shutdown of services, especially transport and leisure services, is the opposite of the usual entry into the crisis phase through liquidity squeeze and decline in the consumption of durable goods (see Figure 1).

Figure 2. Global cycle dynamics: industrial production 2019-2022, quarterly growth rates, seasonally adjusted

Source: Federal Reserve Economic Data

For the first time in the history of crises, the first shock of lockdown disabled a significant part of the services sector, in particular recreation, travel and leisure, which accounts for a large part of the consumption of the fourth and especially the fifth quintile of the population in developed countries. The global economy was fortunate that the pandemic did not occur during the regular “liquidity squeeze”, when the chain reaction of declining output, financial markets and bankruptcies would have been amplified by the contraction of economic activity due to lockdowns (Grigoryev 2020). The speed of the contraction of activity also played a rather positive role, as the resources of the financial authorities were not exhausted by prolonged attempts to prevent a recession. Although the recession spread rapidly to most sectors, from services to commodity markets, it did so to firms and households that were still “yesterday” in conditions of normal recovery (Figure 2). It was crisis management on the best possible terms in such a situation. The general high level of debt, especially government debt, could not be ignored, but the overall threatening situation called for a comprehensive anti-crisis experiment to prevent a severe crisis in an uncompleted recovery.

More specifically, the lockdowns led to a decline in employment and income in the services sector, in small and medium-sized enterprises, in private consumption (particularly among the wealthier portions of the population), in savings and in the production of goods. Thus, without a liquidity squeeze, there was a decrease in expenses, which was typical of the acute stage of the crisis. Sectors and areas of economic activity were affected very unevenly. In the area of capital investments, a significant decrease was noticeable in the areas of tourism (deferred projects) and hydrocarbon production (canceled projects).

The shock of the lockdown and the decline in economic activity immediately triggered the second shock of fiscal and financial stimulus to firms and households, designed as an “anti-shock”. The speed and radical nature of the lockdowns and the fiscal stimulus, which were introduced almost simultaneously (if the unit of time is one month) was quite extraordinary. Fiscal incentives of the financial authorities were aimed at supporting the poor—the unemployed and small businesses—but some went to the wealthy (who had to decide what to do with their forced savings). In the U.S. and the EU, the total savings rate of the population jumped from 10-12% of disposable income to 24–25% in the second quarter of 2020 (Grigoryev et al. 2021). These huge financial resources have been partly visible in financial markets, where stock indices have displayed a steadiness that is not typical of crises. Besides that, huge financial resources also manifested themselves in consumer markets: in the purchase of durable goods in the U.S. and in housing construction in a number of developed countries, which was supported by low mortgage rates. Thus, anti-crisis financial measures created prerequisites for an early recovery in the commodity sectors of the economy, as well as for an increase in demand for raw materials and even for energy resources (restoration of car trips, instead of more Covid-hazardous public transport).

Two related shocks: fiscal stimulus and soaring inflation

The second shock of 2020 was a huge fiscal and monetary stimulus through the injection of cheap money during lockdowns due to COVID-19 which created an imitation of financing a way out of the crisis during within one or two quarters of the same year. In 2020, without much academic debate, developed countries took the innovative approach of “flooding” the credit crunch with cheap money. And after a huge infusion of funds by the financial authorities, everything in this crisis became unusual: high stock prices, incentives for a housing boom, a decrease in firm bankruptcies - despite a significant drop in GDP.

The growth of forced savings among wealthier segments of the population due to deferred consumption of services was also fundamentally important. It was largely a crisis based on the contraction of demand for services from relatively rich strata and on unemployment among poor workers in the service sector (Grigoryev 2020; Grigoryev et al. 2021).

Figure 3. Volume and monthly changes in Fed and ECB assets, USD and EUR, March 2020 to March 2023

Source: European Central Bank, Board of Governors of the Federal Reserve System

Figure 3 quite clearly shows first the panic injections of liquidity into the economy by the Fed and the ECB in the first 5–8 months of the crisis in 2020, which took two and a half years in general, until June 2022. The Fed and the ECB managed to prevent the development of a liquidity squeeze and the transition to a financial crisis. Monetary policy then supported a recovery in production and consumption in commodity sectors and markets, with a relatively delayed recovery in the service industries. After a brief stabilization, the process of financial outflows and rising borrowing costs began, which lasted until March 2023. It can be noted that the Figures of both GDP and industrial production as well as the financial injections by the central banks describe a surprisingly short multiphase cycle: crisis — recovery — price and interest rate hikes, overheating — and deceleration of growth by the central banks. The external shock of the pandemic set in motion the “carousel” of the cycle, which, as it were, spun three times faster and completed a circle in three years instead of nine or more years.

Since the summer of 2022, observers have been waiting for a turn towards high central bank rates. At the beginning of March 2023, the banking crisis in the U.S., Switzerland and, possibly, other European countries put financial regulators in a difficult position: either strengthen the fight against inflation (raising interest rates) or repeat quantitative easing—at least on a much smaller scale. This is due to the need to respond quickly to inflation when the economy grows. Figure 4 shows the process of adaptation of the financial sector in 2019–2021, in particular the banking sector, to a relatively low level of interest rates on long-term government bonds, which are considered not subject to default and acceptable to the most cautious investors. This is, strictly speaking, a general rule, and is normal in a subdued environment. However, the sharp rise in central bank rates to 3.5% (ECB) and 5% (Fed) means that liabilities are becoming more expensive at a faster rate than the refinancing of “cheap” 10-year bonds in assets. Huge amounts of government bonds continue to generate “moderate” yields from quantitative easing issues, especially (in the eurozone) the period between Q3 2019 and Q4 2021. Now a lot of financial institutions are trying to close the gaps in the profitability of long-term assets and funding sources, which are rapidly becoming more expensive.

Figure 4. United States, EU, Germany: long-term interest rates on government bonds with a maturity of 10 years, % p.a., Q1 2012 – Q4 2022, January 2023, February 2023

Source: OECD

Recovery in commodity sectors and energy prices

The third shock—an early spike in commodity prices in late 2020—was related to three factors: a marked recovery in the commodity markets, a surplus of cheap money in the economy (the 2nd shock), and the effects of underinvestment in traditional energy sectors since 2012 and especially in 2020. The oil and gas industry experienced a shock that also sparked the coal and renewable energy industries and exacerbated the global food situation. This shock has been well documented in the literature (Grigoryev, Medzhidova 2020; Grigoryev, Kheifets 2022). In a nutshell, it can be said that the announced acceleration of the global energy transition (Mitrova, Melnikov 2022) is likely to be slower than expected before the shock discussions took place, not only because of technological constraints, but also because of a lack of global coordination, with diffusing objectives among the key players and the increased complexity of mobilizing financial resources for the mitigation of climate risks.

The high energy price shock was a relatively natural consequence of the rapid recovery in the commodity markets, with cheap credit and declining investment in hydrocarbon production. Something similar happened in 2003–2008, when economic growth outstripped energy supply. In the most recent case, the effect was amplified by four circumstances. First, the prolonged (premature) political pressure on the business from politicians and environmentalists in favor of renewables and against hydrocarbons. To use layman’s terms, the EU “overplayed its hand” in the fight for renewables, and global governance collapsed. Second, a liberalized market brings benefits to consumers in a buyer’s market. Third, 2021 saw the first natural supply crisis for renewables in Europe (and not just there). Finally, an early surge in Asia led to a withdrawal of U.S. and Qatari supply from the EU. In general, Gazprom was naturally named responsible for the rise in prices. It is difficult to recognize the existence of objective circumstances and consequences due to the action of regulatory mechanisms, so an external factor, as usual, was declared the source of difficulties. The return of gas prices (Figure 5) by March 2023 to the level of the summer of 2021 rather indicates that the sacrifice of part of the EU’s industrial production and the high overpayment of 2022 were of an extra-economic nature.

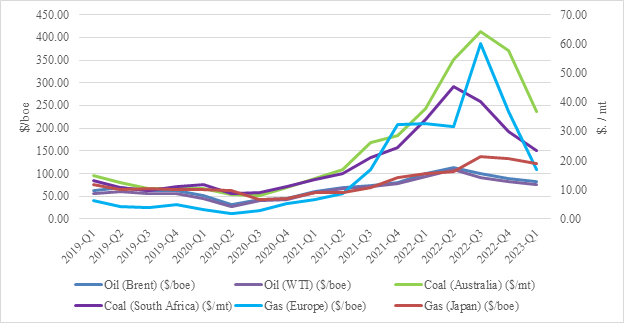

Figure 5. Prices: oil, gas in Europe and Asia ($/boe, left axis), coal ($/mt, right axis), 2019–2023, quarterly.

Source: World Bank

The energy transition as a means of supporting future growth and creating a new source of demand certainly holds promise, but the speed and intensity of its implementation has its own logic and limits. In its simplest form, reinvestment in mineral fuels will have to come first, which the U.S. is already doing (drilling for oil in Alaska) as it sets itself energy security goals. Consumption of oil, coal, and LNG therefore pushes up greenhouse gas emissions until the new turn to renewables. The lack of commercially viable technologies and production capacity is perhaps a major constraint on the rapid spread of the green transition. Proclamations about the rapid impact of the green transition on economic recovery tend to be very optimistic. However, the constraints on the immediate financing needed for crisis management, replacement of existing capacity in the energy sector, etc. are much more cautious. And humanity is running out of time to solve this problem.

Underinvestment in the oil and gas sectors has been going on for quite a long time (Grigoryev 2021). Goldman Sachs noted on the eve of the banking crisis that in the world of oil refining, “underinvestment is enduring” (Goldman Sachs 2023). The IEF report shows an increase in global oil and gas capital investment to $499 billion in 2022 (not adjusted for cost inflation). This is above the 2019 level (much lower than the $700bn in 2014) but insufficient in the medium term. Non-OPEC production could fall significantly by 2025 and 2030, so spending would have to rise to $597bn and $640bn respectively (IEF 2023: 6, 9). So the pressure on prices from the industry generally persists for objective reasons, in addition to political tension and uncertainty.

The reversal of energy prices with an upward vector has been going on since the spring of 2021, and the liberalized European market has been perceived as being in crisis, even though there have been no breaches of contract, falls in production or other events usually interpreted as crises. In any case, against a background of initially low inflation in industrial goods and services, energy (together with supply chain disruptions and the labor market) gradually “unwound” inflation in the US and the EU. A mild winter, reduced gas consumption in the EU as a result of austerity measures, and the closure of some industrial consumers caused gas prices to fall to around $500 per 1,000 cubic meters by March 2023. This suggests that a similar price reduction could have occurred in the spring of 2022 in the absence of sanctions.

The development of inflationary processes in 2021–2023 in the US and the EU occurred despite the increase in interest rates. It seems that the transition from low to high inflation follows its own pattern, which cannot be quickly closed by central banks’ “interest rate taps”. After two years of rising prices, indexation mechanisms are triggered that perpetuate the process (Podrugina 2023; forthcoming). Figure 6 shows how this worked in practice between 2021 and 2022, with two years of inflation looking very severe. The persistence of inflation puts monetary and political authorities in a difficult position, as the social aspects of the issue will have an impact at every election.

Figure 6. Consumer prices in the United States, EU, and Germany: growth rate, %, quarterly, 2018–2022

Source: OECD

As a result of a series of shocks and attempts at rapid regulatory responses, the pattern of the past three years has developed a recognizable (though forgotten) nature. Decision-making mechanisms in companies and even families are operating more slowly and rationally, as they form their own inflationary expectations.

They do not translate the intentions of the regulators into action as quickly as the regulators would like, but rather with lags and/or inertia, biding their time. The result is inertia on the inflation side and a drag on investment. The phase change of the cycle (especially the upturn) has moved faster, as if someone were manually turning the hands of an economic clock at three times the speed. Table 1 shows that there is a risk of a recession in March 2023, exactly three years after the lockdowns in 2020, even if the threat of a banking crisis does not materialize.

Table 1. Shocks and cycle phases, 2020–2023

|

Shocks |

Starting phases |

Intensity of the shock |

A new phase |

Consequences |

|

1) Lockdowns 2020 - Q2 |

Incomplete upturn = phase F |

Developed country GDP falls 4.9% |

Services crisis - general decline 2020 = phase A |

Innovative response by monetary authorities |

|

2) Financial stimulus 2020 |

Crisis of 2020 - threat of collapse - autumn 2020 - spring 2021 = phase A |

Trillions of dollars. Fed and ECB, Finance ministries, and forced savings |

Early recovery in commodity markets = phase E |

Stability of stock prices, rise in commodity prices |

|

3) Early rise in commodity prices

|

Recovery in commodity markets 2021 = phase E |

Transition from low to 5-7% inflation in the U.S. and EU |

Rising commodity prices, as in upswing = phase F |

Lower money supply, higher interest rates

|

|

4) Trade and energy sanctions in the face of inflation |

Growth slowdown with inflation - from March 2023 = phase F |

Logistical and export issues, uncertainty |

U-turn - stagflation or soft landing = phase B? |

Cumulative effect - threat of a banking crisis |

Source: compiled by the author

The global cycle was transformed by unexpected non-economic shocks. This has happened extremely quickly, with financial authorities and regulators finally pushing the global economy back to the laws of real investment following changes in demand, risk, and profitability in the financial markets. Of course, this will only happen if companies, banks, and families are left to make their own decisions. Legislators and regulators must allow them to make decisions within a common, modified framework. In addition to the welfare of EU citizens and those in other developed and especially developing countries, the “four shocks” have caused a shift in greenhouse gas emissions, bringing back coal and LNG instead of cleaner pipeline gas.

The EU’s costs and investments in reducing Russian hydrocarbon consumption are not equivalent to an effective fight against climate change. A recent UN Climate Synthesis Report (IPCC 2023: 23) suggests that drastic steps will still have to be taken in the 2020s to limit warming to 1.5oC by 2100, since all issues should be resolved by 2035. The document’s hope for temperature limitation is based on the assumption of radical reductions in current greenhouse gas emissions, starting in 2021. In reality, global coordination of emission reduction efforts will be postponed till 2025 at best. Calculations show that 2020–2022 were largely “lost” as emissions continued to rise above 2019 levels. It appears that the lack of global coordination and the intensification of conflicts will lead to a huge increase in the costs of adapting (rather than mitigating) the effects of climate change with a warming of 2°C or more. This is in part the result of the third and fourth shocks, the effects of which will be felt for a long time for three reasons: The “temporary” shift of projects around the world to conventional sources (including the U.S. and China); a focus on “energy security” (everyone has their own interpretation) in many parts of the world; and limited financial capacity in the case of worsening social and debt problems among countries.

The de facto shift from EU climate initiatives to energy security is a delayed slowdown in efforts (in terms of actual focus, spending and policy) to prevent global climate change. The decision to move away from “dependence” on Russian energy supplies has brought some commercial benefits to American, Norwegian, Arab, and African natural gas suppliers. However, switching to LNG means a 25% increase in greenhouse gas emissions compared to pipeline gas. The impact of all gas price developments and the switch in 2022 has increased the cost of EU gas imports from $80.5 billion in 2021 ($31 billion in 2020) to $290.5 billion; and the price of gas for domestic consumers has increased by 30% across the EU (Eurostat, 2023).

The shipwrecked global economy: sanctions and the cycle

Massive economic sanctions against the Russian economy constitute the fourth shock. They have had a noticeable impact on Russia, but the world economy is also experiencing significant difficulties associated with inflation, slowing economic growth, and trade.

Sanctions against the Russian economy were imposed in 2014 and intensified in March 2022. Leaving aside the political reasons and objectives of the sanctions, it should be noted that the choice of specific economic goals and methods was in the hands of the governments of the countries and groups of countries that imposed the sanctions. It should be noted that elements of the “world state plan” manifested themselves in the sanctions process through the reorientation of areas of cooperation and development. Since Russia plays an important role in the production of raw materials, semi-finished products, and individual goods, the investments made in technology in the 1990s were not lost. Thus, the global breakdown in the division of labor between the OECD and China, India (BRICS) and other leading developing countries led to an unexpected shift. Elements of negative “state supply” took the form of bans and controls on certain transfers and shipments. The emergence of ideas and the creation of the first mechanisms to limit energy export prices could generally be described as “state-set pricing”, part of a planned mechanism. The world community has failed to establish a coherent development coordination as part of the UN Sustainable Development Goals from 2015and has not shown impressive results in the fight to preserve the planet’s climate. Sanctions, on the other hand, are somewhat coordinated, at least within the G7 and the EU.

To analyze the economic impact of the sanctions, this work will focus on a few key areas, not for the Russian economy, but for the “global” economy. By this we mean the G7, EU, and OECD countries that imposed the sanctions, and the global economy as a whole in its capacity as the inevitable “recipient” of the consequences of the sanctions. The Russian economy, as important as it is to Russians, accounts for 1.5–2% of the world’s GDP. A 2% fall in Russian GDP means changes in global GDP measured in thousandths of a percent (this is even more true for the Ukrainian economy).

Given this approach, here we will briefly overview the changes in world GDP, inflation, energy consumption, and finance that can be attributed to the impact of sanctions as well as their impact on the phases of the global cycle.

A fourth shock in a row could not, of course, have been an isolated phenomenon. Regardless of the political reasons for the sanctions and the governments’ intentions regarding their results, it can be concluded that the decisions were made by government officials. The choice was made very quickly and within the limits of their perceptions of the nature of global economic relations, Russia’s place in them, and their sustainability. From the point of view of this work, this meant interfering with trade, financial flows, and the expectations of companies and investors, as well as the administrative impact on energy: trade flows, finance, investment, companies, and so on. Blocking Russian financial reserves and transactions by financial institutions, banning imports of goods and technologies, and restricting Russian energy exports to the G7 and the EU (fuel embargoes) as the target of sanctions also automatically meant an asymmetric and multifaceted impact on global economic processes. This would have been the case even if the Russian government had not imposed counter-sanctions and pursued a policy of obstruction and blocking. In this case, this research is an attempt to analyze the “net effect” of sanctions on the global process of cyclical fluctuations.

We note here the applicability of W. Ross Ashby’s theorem on the nature of the stability of large systems with a large number of subsystems and interconnections. In such systems, momentum is transferred between subsystems and is extinguished longer than in systems with weak connections (Ashby 1959: 345, 348). The scale of changes in the relations of the world economy with Russia and outside Russia between economic agents (with sanctions in mind) represents an enormous upheaval and entails a difficult-to-measure increase in risks and transaction costs. Taking into account the disrupted plans, the write-off of lost costs, profits and assets, the increased uncertainty, risks and insecurity, we are dealing with a shock of crisis proportions. The administratively driven redirection of oil exports from the Persian Gulf away from India and China to Europe, while Russia shifted oil exports from Europe to India and China, can be considered to be an example of the net cost of sanctions. This is a huge increase in transportation distances, risks, insurance and costs, all for the same world oil consumption of around 100 mb/d. The same applies to numerous other commodities, creating additional capital investment risks for companies (see Figure 7).

Figure 7. Gross capital investments, 2009–2022 (estimate), %

Source: IMF

The first category of sanctions was restrictions on exports of various manufactured goods to the Russian Federation. Econometricians will be able to calculate the effects of trade multipliers, but they do not look dramatic for exporting countries, although they are certainly painful for exporting companies. This blow of “institutional changes” fell on the world economy, which had just emerged from lockdowns with rising inflation, social complications, and tangled debt problems.

Table 2. Actual GDP growth rates and IMF projections for 2020–2021–2022–2023, 2024

|

|

actual, 2019 |

actual, 2020 |

actual, 2021 |

actual, 2022 |

forecast from January 2020 for 2020 |

forecast from January 2020 for 2021 |

forecast from January 2021 for 2021 |

forecast from January 2021 for 2022 |

forecast from January 2022 for 2022 |

forecast from January 2022 for 2023 |

forecast from April 2023 for 2023 |

forecast from April 2023 for 2024 |

|

World Output |

2,9 |

−3,5 |

5,9 |

3,4 |

3,5 |

3,3 |

5,5 |

4,2 |

4,4 |

3,8 |

2,8 |

3 |

|

Developed economies |

1,5 |

−4,9 |

5 |

2,7 |

1,9 |

1,4 |

4,3 |

3,1 |

3,9 |

2,6 |

1,3 |

1,4 |

|

United States |

2,3 |

−3,4 |

5,6 |

2,1 |

2 |

1,6 |

5,1 |

2,5 |

4 |

2,6 |

1,6 |

1,1 |

|

Eurozone |

1 |

−7,2 |

5,2 |

3,5 |

1,7 |

1,2 |

4,2 |

3,6 |

3,9 |

2,5 |

0,8 |

1,4 |

|

Germany |

0,3 |

−5,4 |

2,7 |

1,8 |

1,2 |

1,5 |

3,5 |

3,1 |

3,8 |

2,5 |

−0,1 |

1,1 |

|

France |

1,2 |

−9 |

6,7 |

2,6 |

1,3 |

1,4 |

5,5 |

4,1 |

3,5 |

1,8 |

0,7 |

1,3 |

|

United Kingdom |

0,9 |

−10 |

7,2 |

4 |

1,8 |

1,5 |

4,5 |

5 |

4,7 |

2,3 |

−0,3 |

1 |

|

Emerging and developing economies |

4 |

−2,4 |

6,5 |

4 |

4,8 |

4,8 |

6,3 |

5 |

4,8 |

4,7 |

3,9 |

4,2 |

|

China |

5,9 |

2,3 |

8,1 |

3 |

5,9 |

5,8 |

8,1 |

5,6 |

4,8 |

5,2 |

5,2 |

4,5 |

|

India |

4,3 |

−8 |

9 |

6,8 |

6,9 |

6,1 |

11,5 |

6,8 |

9 |

7,1 |

5,9 |

6,3 |

|

Russia |

1,5 |

−3,6 |

4,5 |

−2,1 |

1,6 |

2,4 |

3 |

3,9 |

2,8 |

2,1 |

0,7 |

1,3 |

|

Brazil |

1,8 |

−4,5 |

4,7 |

2,9 |

2 |

2,4 |

3,6 |

2,6 |

0,3 |

1,6 |

0,9 |

1,5 |

Source: IMF - relevant years, January, 2020–2022, April 2023

Table 2 enables us to make observations, with great caution, about a “loss of growth” resulting directly from the sanctions and the broader set of uncertainties. In spring 2023, it is still difficult to assess the slowdown of the world economy in the medium term. However, the loss of growth due to sanctions can be illustrated for developed countries using the example of 2022 and the decline in forecasts for 2023. For the eurozone, the IMF forecast from January 2022 promised a 3.9% GDP growth in the same year, and in fact it was 3.5%; for Germany, the forecast was 3.8%, and in fact it was 1.8%; for all developed countries, the projected and actual growth values were 3.9% and 2.7%, and for the U.S. it was 4% and 2.1%. As for 2023, we can compare two forecasts for it: from January 2022 and April 2023. They give the following figures: the world: 3.8% and 2.8%, respectively; U.S.: 2.6% and 1.6%; the eurozone: 2.5% and 0.8%; Germany: 2.5% and -0.1%.

With all the danger of harsh judgments on such an important issue, we can talk about the loss of one percentage point of global growth in 2022–2023, and much more for the eurozone and Germany, which accounted for the main costs and problems in the fields of inflation, energy and energy and gas-intensive industry. This is an unpleasant but largely obvious fact, the details of which we will leave to the economists of the future. The channels of deceleration are clear: uncertainty and decline in investment, high interest rates on long-term loans, and high energy prices. There will be PhD theses in the future examining how inflation, rising capital costs, and uncertainty have affected economic growth. At the same time, there is already a stream of papers (IMF 2022) on inflation and the emergence of a high-price regime in 2021-2023. The wage-price “inflation spiral” is at work (Podrugina 2023, forthcoming).

Apparently, autumn 2022–winter 2023 was the turning point in the reversal of the dynamics of capital investments. At Davos in January 2023, business leaders hoped for the best, although leading expert Kenneth Rogoff was much more cautious in his analysis, “Too Soon for Global Optimism” (Rogoff 2023). A few days later, the banking crisis began in Silicon Valley and then in Zurich. On 16 March, The Economist published a piece titled “Is the global investment boom turning to bust?” (The Economist 2023). There are already predictions that the world’s big tech companies will invest 7% less money in 2023 than they did the year before. Overall, The Economist’s graphs show a (real) investment boom of almost one year (2021) in 33 countries in the non-residential sector, with Q4 investment falling compared to Q3 2022. This is probably the shortest investment boom in the business cycle. It seems that the global economy has managed to jump through a full set of cycle phases, to a new investment downturn with high inflation and anti-inflationary measures by central banks since 2019.

Uncertainty is increasing, which observers say could potentially lead to deeper recessions (Kose, Terrones 2015: 128, Fig. 9.6). Earlier this year, a new World Bank report “Falling Long-Term Growth Prospects”, as its title suggests, expressed concern about the modest performance of global investment growth. It had already mentioned inflation and other factors discussed in this paper, but not banking issues (Kose, Ohnsorge 2023: 174), and expected a general decline in growth rates. The IMF’s annual Global Financial Stability Report (IMF 2023) largely directs central banks towards maintaining financial stability rather than fighting inflation.

This situation is associated with the secondary difficulties of the economic policy of many countries in terms of increasing interest rates to curb inflation. Overall global growth has of course slowed, at least between 2022 and 2024. Poor and developing countries, together with climate change initiatives, will be the hardest hit, becoming “innocent bystanders”. This circumstance requires separate consideration, as the situation looks very “progressive” at the declaratory level and in terms of the growth rate of renewable energy use. Without returning to the complexity of implementing major energy transition measures (not in the EU, but globally), let us refer to the AR6 Synthesis Report: Climate Change 2023 (IPCC 2023). Suffice it to say that, according to the report, limiting global warming to +1.5–2 degrees is based on radical emission reductions starting in 2021 (page 23 of the report). Unfortunately, nothing like this is happening: global coordination has been disrupted, and instead of a radical reduction in emissions, they are increasing beyond the level of 2019. The potential additional costs of adaptation are difficult to calculate, although the approximate global temperature increase should be calculated at least from 2025.

The logic of global business cycle phases suggests that 2023 could be seen as a “growth cycle” rather than a full recovery after the 2021–2022 rebound. Structural changes, especially in the energy sector, will have a positive impact in the medium term. The March banking crisis (2023) was a natural consequence of the first three shocks. It presented U.S. and EU financial regulators with a difficult dilemma: continue to raise interest rates to fight inflation or provide banks with cheap funding again.

In the short term, in March 2023, the Fed and the ECB opted for an increase in credit (5% and 3.5% respectively) and tried to manage banking problems manually, in particular by transferring banks to the management of more sustainable ones, such as Credit Suisse and UBS (the continuation of such moves is probably inevitable). The attempt to avoid panic and bank runs by depositors against weak banks is being carried out manually by the regulators through the distribution of deposit guarantees, and through reassurance by the media (such as the total exclusion of mentions of Lehman Brothers). The tightening of debt policy by the leading countries and the IMF is based on macroeconomic grounds, due to the inertia of the transition from a low interest rate regime to a higher, anti-inflationary one. Uncertainty in the financial sector will dampen global economic growth in 2023, raising the risk of stagflation. This factor will complicate attempts to contain banking shocks.

In terms of almost forgotten theories, we seem to be dealing with the equivalent of a Nordhausian “policy cycle” (Nordhaus 1975), in which the authorities take measures to achieve certain policy goals that have the side effect of increasing inflation. When some goal is achieved, or when the resources and capacity of these policies are exhausted, the authorities are forced to switch to “manual” inflation control, as we saw in the spring of 2023. The outcome of the policy battle between the twin objectives of inflation control and financial stability remains unclear.

Conclusion — the “carousel” is spinning three times faster

Economic shocks (bankruptcies, price rises, commodity price fluctuations, financial imbalances) are historically unpleasant, but they are a “normal”, well-known phenomenon that affects the established global business cycle, its parameters, and its nature. Cycle analysis differs from business cycle monitoring mainly in that the latter deals with short time periods and linkages within one or two phases (sub-phases) of the cycle. In a business cycle, fluctuations and trends in accumulation, shifts in the sectoral structure and price relationships are the underlying factors. Shocks turn out to be either indicators of shifts over time, including those in factor relationships, or simply temporary phenomena. Recognizing their characteristics (distinguishing “disturbances” as temporary and “changes” as permanent) is a complex exercise in itself. Known cyclical patterns help to analyze the business cycle. The impact of the economic policies of governments and monetary authorities—for whatever purpose—can distort the course of events. The nature of the outcome depends on the strength of the regulatory impact and its direction, whether pro- or counter-cyclical. There may be failures or non-economic actions with unclear or opposite results to those desired. It can be hypothesized that the cycle is a more resilient system of relationships than is usually assumed. It tends to revert over time, sometimes in spite of various influences.

The 2020–2022 shocks under review represent a surprising set of impacts that triggered responses that were largely unanticipated by regulators. The first and fourth shocks, COVID-19 and sanctions, were non-economic and unpredictable. The second and third shocks were a consequence of the first, but their nature was unexpected by economists. Their impact on growth and the evolution of the global cycle is not yet fully clear, although it is time to calculate the huge costs to the global economy. In particular, the “overhead” costs of redirecting oil and gas flows “in a direction contrary to logic and logistics” represent a net loss of wealth for the world economy.

Whether and in what proportions this set of shocks will become a means of slowing down the global economy for adjustment and structural change remains to be seen. In applied terms, the prospect of a transition to a “normal” global cycle seems rather simple: slowing growth to get out of a high inflation regime, removing (sooner or later) the uncertainties associated with sanctions, climate policies and the development of effective and efficient policies for poorer countries, which have not fully succeeded after the global financial crisis of 2008–2009 (Morozkina 2019). The threat is the continuation of a triple “twist”: slow growth, inadequate anti-inflationary policies, and continued uncertainty for businesses — “growth without a boom”. The problems of inequality and social discontent in developed countries may, of course, worsen in line with electoral cycles. Developing countries will struggle to return to the growth levels of 2010–2019, combined with the costs of climate protection that the developed world is so keen to achieve. And at the same time, debt problems will remain.

The shocks have set the carousel of shifts in global business cycle phases in motion three times faster. This raises the suspicion that the G7 and EU governments, as well as the economic and financial regulators, have overestimated their ability to manage cyclical and inflationary processes simultaneously with the dismantling of the established global division of labor.

Bibliography

Ashby, W.R., 1959. Vvedeniye v kibernetiku [Introduction to Cybernetics]. Moscow: Foreign Literature Publishing House, p. 432.

Bernanke B. S., 1983. Nonmonetary effects of the financial crisis in the propagation of the Great Depression. American Economic Review, Vol. 73, No 3, pp 257–276.

Bernanke, B.S., Diamond, D.W., Dybvig, H.P., 2022. For research on banks and financial crises. The Royal Swedish Academy of Science. Available at: < https://www.nobelprize.org/uploads/2022/10/popular-economicsciencesprize2022.pdf>

Board of Governors of the Federal Reserve System, 2023. Factors Affecting Reserve Balances - H.4.1. Available at: <https://www.federalreserve.gov/releases/h41/>

Bobylev, S.N., Grigoryev, L.M., 2021. V poiskakh novykh ramok dlya Tseley ustoychivogo razvitiya posle COVID-19: strany BRIKS [In Search of a New Framework for the Sustainable Development Goals after COVID-19: BRICS countries], translated from English by Beletskaya, M.Y., Faculty of Economics Research. Electronic journal, Vol. 13, No 1, pp 25-51. Available at: <https://archive.econ.msu.ru/journal/issues/2021/2021.volume_13.issue_1/Bobylev_Grigoryev/> (in Russian).

Colander, D., Howitt, P., Kirman, A., Leijonhufvud, A., Mehrilng, P., 2010. Beyond DSGE Models: Towards an Empirically-Based Macroeconomics. Presentation at 2010 AEA Meeting.

European Central Bank, 2023. Weekly financial statements. Available at: <https://www.ecb.europa.eu/press/pr/wfs/html/index.en.html>

Eurostat. EU trade since 1988 by HS2-4-6 and CN8 [DS-045409__custom_5744777] Available at: <https://ec.europa.eu/eurostat/databrowser/bookmark/06984c4b-c15c-4b71-9fb4-bce6ce0a9536?lang=en>

Federal Reserve Economic Data, 2023. Production: Total Industry Excluding. Construction. Available at: <https://fred.stlouisfed.org/series>

Goldman Sachs, 2022. 2023 Commodity Outlook: An underinvested supercycle. Available at: <https://www.goldmansachs.com/insights/pages/2023-commodity-outlook-an-underinvested-supercycle.html>

Grigoryev, L. M., Elkina, Z. S., Mednikova, P. A., Serova, D. A., Starodubtseva, M. F., Filippova, E. S., 2021. “Ideal’nyy shtorm” lichnogo potrebleniya [“The perfect storm” of personal consumption]. Voprosy ekonomiki, No 10, pp 27-50. Available at: <https://doi.org/10.32609/0042-8736-2021-10-27-50>

Grigoryev, L. M., Entov, R. M. Mekhanizm sovremennogo tsikla: vstupitel’naya kharakteristika [Mechanism of the modern cycle: an introductory characteristic]. In: Entov, R.M. (ed.), 1978. Mekhanizm ekonomicheskogo tsikla v SSHA [Mechanism of the modern cycle: an introductory characteristic]. M.: Nauka.

Grigoryev, L. M., Heifetz, E. A., 2022. Neftyanoy rynok: konflikt mezhdu pod’yemom i energeticheskim perekhodom [The Oil Market: A Conflict Between Recovery and Energy Transition]. Voprosy ekonomiki, No 9, pp 5-33. Available at: <https://doi.org/10.32609/0042-8736-2022-9-5-33>

Grigoryev, L. M., Kurdin, A. A., 2015. Disbalans na mirovom rynke nefti: tekhnologii, ekonomika, politika [World oil market disbalance: Technologies, economy, and politics]. Energy Policy, No 24, pp. 24–33.

Grigoryev, L. M., Podrugina, A. В., 2016. Osobennosti tsiklicheskikh kolebaniy posle Velikoy retsessii [Peculiarities of cyclical fluctuations after the Great Recession]. Problems of Management Theory and Practice, No 6, pp 57-65.

Grigoryev, L., Ivashchenko, A., 2010. Teoriya tsikla pod udarom krizisa [The Theory of the Cycle in Crisis]. Voprosy ekonomiki, No 10, pp 31-55.

Grigoryev, L., Ivashchenko, A., 2011. Global imbalances in savings and investment [Mirovyye disbalansy sberezheniy i investitsiy]. Voprosy ekonomiki, No 6, pp 4-19.

Grigoryev, L., Medzhidova, D., 2020. Global energy trilemma. Russian Journal of Economics, No 6, pp 437–462 < https://doi.org/10.32609/j.ruje.6.58683>

Grigoryev, L.M., 1988. Tsiklicheskoye nakopleniye kapitala (na primere nefinansovykh korporatsiy SSHA) [Cyclical Capital Accumulation (On the Example of Non-Financial Corporations in the U.S.)]. Moscow: Nauka.

Grigoryev, L.M., 2013. The United States: Three Socio-Economic Problems [SSHA: tri sotsial’no-ekonomicheskiye problemy], Voprosy ekonomiki, No 12, pp 48-73. Available at: <https://doi.org/10.32609/0042-8736-2013-12-48-73>

Grigoryev, L.M., 2020. Mirovaya sotsial’naya drama pandemii i retsessii [World Social Drama of Pandemics and Recession,] Population and Economy, Vol. 4, No 2, pp 18-25. Available at: <https://doi.org/10.3897/popecon.4.e53325>

Grigoryev, L.M., Kurdin, A.A., Makarov, I.A. (eds.), 2022. Mirovaya ekonomika v period bol’shikh potryaseniy [The World Economy in a Period of Big Shocks]. Moscow: INFRA.

Zamulin, O., 2005. The concept of real economic cycles and its role in the evolution of macroeconomic theory. Voprosy ekonomiki, No 1, pp. 144-153.

IEA, 2020. Global annual change in real gross domestic product(GDP), 1900–2020. Available at: <https://www.iea.org/data-and-statistics/charts/global-annual-changein-real-gross-domestic-product-gdp-1900-2020>

IEF, 2023. Comparative Analysis of Monthly Reports on the Oil Market. Available at: <https://www.ief.org/news/comparative-analysis-of-monthly-reports-on-the-oil-market-36>

IMF, 2020. World Economic Outlook: Tentative Stabilization, Sluggish Recovery. Washington, DC.

IMF, 2021. World Economic Outlook: Policy Support and Vaccines Expected to Lift Activity. Washington, DC.

IMF, 2022. World Economic Outlook: Rising Caseloads, A Disrupted Recovery, and Higher Inflation. Washington, DC.

IMF, 2022. World economic outlook: War sets back the global recovery. Washington, DC.

IMF, 2023. Global Financial Stability Report: Safeguarding Financial Support amid High inflation and Geopolitical Risks. Washington, DC.

IPCC, 2021. Climate change 2021: The physical science basis. Contribution of Working Group I to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change. Cambridge University Press. Available at: <https://doi.org/10.1017/9781009157896>

IPCC, 2023. AR6 Synthesis Report: Climate Change 2023. Available at: <https://www.ipcc.ch/report/sixth-assessment-report-cycle/>

Kilian, L., 2009. Not all oil price shocks are alike: Disentangling demand and supply shocks in the crude oil market. American Economic Review, No 99, pp. 1053–1069. Available at: <https://doi.org/10.1257/ aer.99.3.1053>

Kose, A., Ohnsorge, F., 2023. Falling Long-Term Growth Prospects: Trends, Expectations and Policies. World Bank Group. Available at: <https://www.worldbank.org/en/research/publication/long-term-growth-prospects>

Kose, A., Terrones, M., 2015. Collapse and Revival: Understanding Global Recessions and Recoveries. IMF. Available at: <https://www.imf.org/en/Publications/Books/Issues/2018/02/26/Collapse-and-Revival-Understanding-Global-Recessions-and-Recoveries-40897>

Makarov, A. A., Grigoryev, L. M., Mitrova, T. A., (eds.), 2015. Evolyutsiya mirovykh energeticheskikh rynkov i yeye posledstviya dlya Rossii [The evolution of global energy markets and its consequences for Russia]. Moscow: INEI RAS; Analytical Center for the Government of the Russian Federation, (in Russian).

Makarov, A. A., Mitrova, T. A., Kulagin, V. A., (eds.), 2019. Prognoz razvitiya energetiki mira i Rossii 2019 [World and Russian energy development forecast 2019]. Moscow: INEI RAS; Moscow School of Management Skolkovo.

Medzhidova, D., 2022. Izmeneniye roli prirodnogo gaza vsledstviye energeticheskogo perekhoda [Changing the role of natural gas due to the energy transition]. Problems of Economics and Management of the Oil and Gas Complex, No 207, pp 5–17. Available at: <https:// doi.org/10.33285/1999-6942-2022-3(207)-5-17>

Mitrova, T.A., Melnikov, Yu.V., 2022. Energeticheskiy perekhod i osobennosti mezhtoplivnoy konkurentsii v sovremennom mire [Energy transition and features of inter-fuel competition in the modern world]. In: Grigoryev, L.M., Kurdin, A.A., Makarov, I.A. (eds.), 2022. Mirovaya ekonomika v period bol’shikh potryaseniy [The World Economy in a Period of Big Shocks]. Moscow: INFRA.

Morozkina, A.K., 2019. Ofitsial’naya pomoshch’ razvitiyu: tendentsii poslednego desyatiletiya [Official development assistance: trends of the last decade], World Economy and International Relations, Vol. 63, No 9, pp 86-92. Available at: <https://ras.jes.su/meimo/s013122270006839-3-1>

Nordhaus, W. D., 1975. The Political Business Cycle. The Review of Economic Studies, Vol. 42, No 2, pp 169–190. Available at: <https://doi.org/10.2307/2296528>

OECD, 2023. Inflation. Available at: <https://data.oecd.org/price/inflation-cpi.htm>

OECD, 2023. Long-term interest rates. Available at: <https://data.oecd.org/interest/long-term-interest-rates.htm>

Podrugina, A.V., 2021. Dinamika kreditnoy aktivnosti stran YES posle Velikoy retsessii [Post-Great Recession Dynamics of Credit Activity in EU Countries]. Economic Policy, Vol. 16, No 4, pp 8-41. Available at: <https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3940210>.

Prescott, E.C., 2004. The Transformation of Macroeconomic Policy and Research. Nobel Prize Committee, pp 370-395. Available at: <https://www.nobelprize.org/uploads/2018/06/prescott-lecture.pdf>

Reinhart, C.M., Rogoff, K.S., 2014. Recovery from Financial Crises: Evidence from 100 Episodes. American Economic Review: Papers & Proceedings, Vol. 104, No. 5, pp 50–55.

Rogoff, K.S., 2023. Too Soon for Global Optimism. Harvard Kennedy School. Mossavar-Rahmani Center for Business and Government. Available at: <https://www.hks.harvard.edu/centers/mrcbg/programs/growthpolicy/too-soon-global-optimism>

Romer, C., 1999. Changes in Business Cycles: Evidence and Explanations. Journal of Economic Perspectives, Vol. 13, No. 2, pp 23-44.

Solow, R., 2010. Building a Science of Economics for the Real World. Statement for The House Committee on Science and Technology, No 111-106, pp 12-14

Stock, J., Watson, M., 2003. Has the business cycle changed? Proceedings. Federal Reserve Bank of Kansas City, pp 9-56

The Economist., 2023. Is the global investment boom turning to bust? Available at: <https://www.economist.com/finance-and-economics/2023/03/16/is-the-global-investment-boom-turning-to-bust>

1.jpg)